I have repeatedly admonished readers to subscribe to Matt Levine’s daily market write up. His conversation on VIX manipulation is just the latest in a long series of examples as to why you should! -Barry

~~~

VIX manipulation!?

The CBOE Volatility Index — the VIX — is a measure of expected volatility in the S&P 500 index. People pay more for options when they expect prices to be volatile, and you can compute implied volatility from option prices. So the VIX looks at the trading prices of a bunch of out-of-the-money put and call options on the S&P 500 and computes a sort of average implied volatility from them. The methodology is in this white paper.

In addition to being an index that is much quoted in articles about market complacency, the VIX is used as a reference price for derivatives: If you want to bet that stock-market volatility will go up, or down, you can buy or sell futures or options on the VIX. These products are cash settled: The VIX is not a thing you can own, so if your option ends up in the money you just get paid cash for the value of the VIX at settlement. CBOE gets an official settlement level of the VIX based on a special monthly settlement auction of S&P 500 options. The auction runs from 7:30 a.m to 8:30 a.m., Chicago time. Traders submit bids and offers for S&P 500 options, the auction matches buyers and sellers to find clearing prices, and the prices of those S&P 500 options are used to compute the official settlement level of the VIX.

At the settlement time of the VIX Volatility Index, volume spikes on S&P 500 Index (SPX) options, but only in out-of-the-money options that are used to calculate the VIX, and more so for options with a higher and discontinuous influence on VIX. We investigate alternative explanations of hedging and coordinated liquidity trading. Tests including those utilizing differences in put and call options, open interest around the settlement, and a similar volatility contract with an entirely different settlement procedure in Europe are inconsistent with these explanations but consistent with market manipulation.

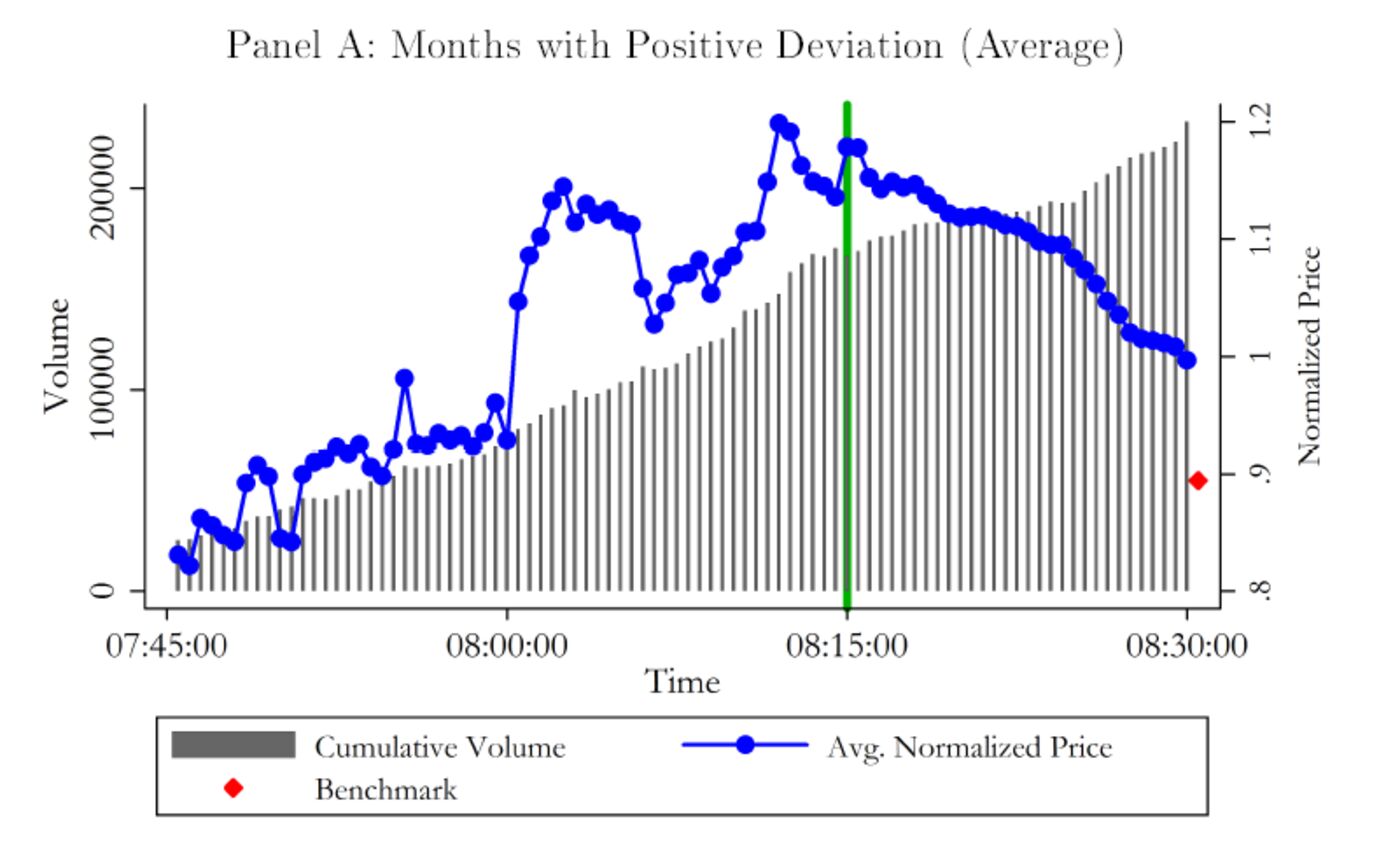

That’s from this paper by John Griffin and Amin Shams of the University of Texas, who find a lot of trading in the S&P 500 options underlying the VIX during these settlement auctions, trading that pushes the settlement price of the VIX up or down. So for instance in months where the trading pushes the VIX up, the prevailing price of the VIX-influencing options will jump during the auction, peak at around 8:15 a.m. (the deadline for VIX-related bids in the auction), and then drop seconds after the auction ends when the options start trading normally:

The blue line there is a measure of the indicative prices of VIX-influencing options, spiking at 8:00 a.m. and peaking near 8:15. (If you ignore the numbers on the axis, you can almost think of it as being a chart of the VIX price.) The red dot is the trading price of those options about 25 seconds after the auction finishes. The average effect is something like 0.31 VIX points, sometimes up and sometimes down, depending on the month.

What is going on? Usually when you see patterns like this, the innocent explanation is hedging. But Griffin and Shams consider and reject that notion here, noting for instance that traders don’t seem to be closing out existing hedge positions but instead adding new ones. They argue that it’s more likely to be explained by attempts to move the VIX: If you are a dealer who is long (short) VIX futures, you can push up (down) the VIX at settlement by buying (selling) some deep-out-of-the-money S&P 500 options.

That is generically true in any derivatives market: If you are long a derivative, you can buy the underlying and push up the derivative price. But Griffin and Shams give a list of reasons why you’d almost expect the VIX to be manipulated:

First, the upper-level VIX market is large and liquid, enabling a trader to invest a sizeable position in VIX derivatives. In contrast, many of the lower-level SPX options, where the VIX values are derived from, are illiquid.

Griffin and Shams calculate that “the size of VIX futures with open interest at settlement is on average 5.7 times the size SPX options traded at settlement, and it is 7.3 times for VIX options that are in-the-money at settlement.” So if you are a trader who owns a lot of the market in VIX futures, you could push around a large dollar value of futures by trading a small dollar value in options. This is particularly true because the S&P option volume is divided among many strikes, and the illiquid deep out-of-the-money S&P 500 options have a big influence on the VIX: You can move the price of those options a lot with relatively small trades, and those price changes have a disproportionate effect on the VIX.

Second, the VIX derivatives are cash settled. Therefore, if the VIX settlement value deviates from its true value, the VIX position will automatically be cashed out at the deviated price.

If cattle are trading at the wrong price when your cattle futures settle, that doesn’t matter so much, because you just get the cattle. But you can’t just get the VIX: You get cash, so if the VIX is at the wrong price at settlement, that’s the price you get.

Third, the settlement occurs within a short period of time based on the SPX options pre-open auction.

You don’t have to intervene over some long period to keep options prices up; you can just submit bids in the pre-opening auction once a month and move the settlement price for that month.

There is a sort of hierarchy of manipulability in markets. At the top is Libor manipulation: Trillions of dollars of derivatives settled based on Libor, but Libor was calculated by essentially asking banks “what should Libor be?” The banks didn’t even have to do any trading in order to push the number around; manipulation was, in effect, costless. (Later, with the fines, it was costly.)

At the bottom is, like, manipulating the price of a stock by trading that stock. There are cases of it! It’s a thing. But it is a dumb thing; it really shouldn’t work. If you buy a stock, you will push the price up, sure. But to make any money you then have to sell the stock, which should push the price right back down.

But if you are going to manipulate a tradable market — as opposed to a made-up one like Libor — then VIX looks pretty tempting. The product that you trade (S&P 500 options) is different from the product where you make your money (VIX futures and options), and the trading market is in the relevant sense smaller than the derivative market: You can move a lot of value in VIX products by trading a small amount of value, in a confined period of time, in the underlying market. So you can cheerfully lose money executing the manipulation — trading the S&P options — and make back more in the derivative.

If Griffin and Shams are right that there’s manipulation, there’s no particular pattern to it: Sometimes VIX gets anomalously pushed up during the settlement, sometimes down. That’s consistent with, for instance, a story of big dealers adding up their positions before each monthly settlement, realizing that they’re net long (short), and trying to push VIX up (down) to help out their positions. It would be like the kind of Libor manipulation that banks did to help out their trading books (which was up or down depending on their positions) — not the kind of Libor manipulation that banks also did to disguise their funding costs (which moved Libor systematically down). VIX manipulation, if it exists, probably doesn’t add to or subtract from the market’s sense of complacency. It just makes someone money.