@TBPInvictus here:

Zane Tankel, franchisee of some 38 Applebee’s casual dining restaurants in NYC, Westchester, and Rockland, appeared recently with Stuart Varney to wail on the minimum wage:

Herewith an excerpt:

TANKEL: We start ’17 (2017) 500 people skinnier than we started ’16 (2016) because…

VARNEY: You dropped 500 people?

TANKEL: Yes, sir. Yes, sir. About 15 percent of our total labor force.

VARNEY: Is that directly because of minimum wage?

TANKEL: 100 percent. 100 percent. Obama had a little bit of it, but 100 percent minimum wage.

And on it goes. You catch his drift – you raise the price of something and you must get less of it…yadda, yadda, Econ101, blah, blah, blah. And damn people who insist they should be paid what is still barely a poverty-level wage.

Taking Tankel’s claim at face value – that he’s shed 15% of his labor force – might we consider the possibility that there are factors at play other than minimum wage – like perhaps the possibility that the casual dining industry is in a period of tremendous upheaval and that Applebee’s has not navigated that upheaval well at all? A bit of Googling and a deep dive into SEC.gov filings are quite revelatory.

Interestingly, Business Insider has run a couple of stories on casual dining and has, in fact, even mentioned Applebee’s by name.

June 3: Millennials are killing chains like Buffalo Wild Wings and Applebee’s (BWLD)

Casual dining is in danger — and millennials are to blame.

Brands such as TGI Fridays, Ruby Tuesday, and Applebee’s have faced sales slumps and dozens of restaurant closures, as casual-dining chains have struggled to attract customers and increase sales.

March 7: Applebee’s, TGI Fridays, and Chili’s are trying to claw their way out of a restaurant death trap

Applebee’s provides a prime example in how a brand reboot can fall flat. Last May, the brand announced it was launching a “comprehensive business transformation,” installing wood-fired grills in all 2,000-plus locations across the US — a $40 million investment by the chain’s franchisees. The grills were supposed to usher in a new era for Applebee’s, in which the chain transcended the industry slump and attracted customers with its higher quality items.

Instead, as of mid-February, restaurants were still not seeing return on the investment, with Applebee’s comparable sales dropping 5% in the US 2016 — 7.2% in the fourth quarter. Now, parent company DineEquity is on the hunt for a new CEO, as Julia Steward announced she was stepping down when the company reported earnings.

As it happens, DineEquity is a publicly traded company (DIN). Perhaps their 10K can shed some light on what’s going on. Let’s have a look (emphasis added).

Applebee’s domestic same-restaurant sales declined 5.0% in 2016. While this performance should be assessed in the context that 2016 was the worst year in terms of sales growth for both the overall restaurant industry and the casual dining segment of the restaurant industry since 2009, Applebee’s 2016 performance with respect to domestic same-restaurant sales and customer traffic was differentially worse than that of the overall casual dining segment, based on data from Black Box Intelligence, a restaurant sales reporting firm (“Black Box”). The decline in Applebee’s domestic same-restaurant sales had an adverse impact on our 2016 franchise revenues, gross profit and net income.

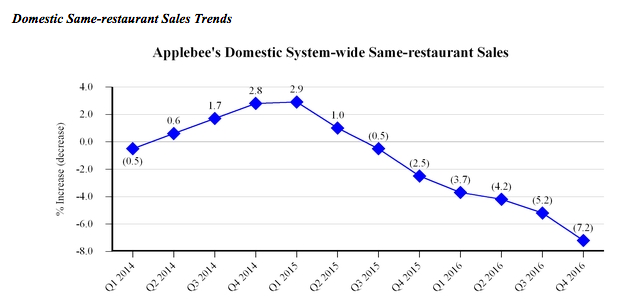

They are even kind enough to provide some interesting charts:

Caption: Applebee’s domestic system-wide same-restaurant sales decreased 7.2% for the three months ended December 31, 2016 from the same period in 2015. […] We believe the continued decline of guest traffic in 2016 was due in part to changes in consumer preferences that have adversely impacted the overall casual dining segment of the restaurant industry and due in part to initiatives we implemented during 2016 that did not drive repeat traffic as expected.

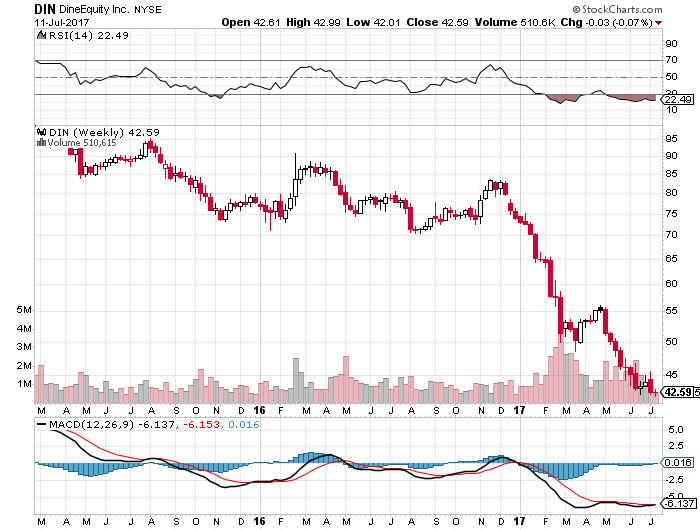

The ultimate arbiter of worth is, of course, the stock market, and here’s what she has to say:

DIN, which was over $100/share a scant 2 1/2 years ago, has puked up most of its value, trading now at around $42/share. You gonna blame *that* on your min wage workers, Zane? Shame on you for using the minimum wage as a pretext for letting workers go when the real culprits are a drastically changing landscape and apparent mismanagement.

More on Mr. Tankel can be found here, more on Applebee’s mismanagement here. And Stuart Varney continues to be one of the biggest financial journalism hacks extant.