“This is the conclusion on which I base my facts.” -Adlai Stevenson

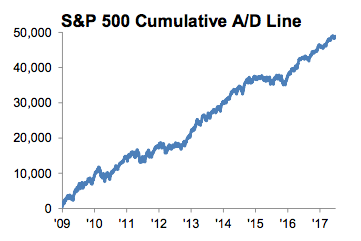

The folks at Birinyi Research point out that despite all of the angst and hand wringing, the market breadth — the measure of how broad or narrow equity participation is — has been fine. Even thought the S&P advance/decline line is flirting with new highs, the bearish sentiment they track is rampant:

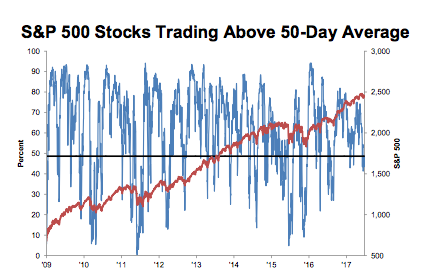

Unfortunately, that does not coincide with the bearish thesis so they find an indicator that does. We have seen more than one commentator note that the num- ber of stocks trading above their 50-day average is declining and at or near ’17 lows. The graph at above right goes back to 2009 and suggests other- wise.

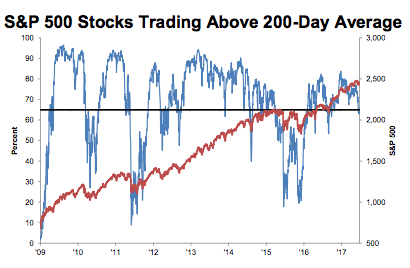

Another strategist concludes that the 200-day aver- age in that regard will lead to a 4 or 5% decline. Here too the evidence does not endorse that conclusion.

Sentiment is what people say; A/D reflects what they do.

I cannot hear what you are saying because what you are doing is speaking so loudly:

Source: Birinyi Research