Michael Batnick is the Director of Research at RWM. He is also a Chartered Financial Analyst and is a member of the firm’s investment committee. Michael writes at The Irrelevant Investor blog, where he aims to educate people about investing.

I got an email from a reader which touches on so many interesting points that I wanted to share and answer him here.

I have a 401(k) through my employer and invest mostly in a passive strategy indexed to the S&P. I have a friend who like me has a 401(k) through his employer. Where we differ, is that he allocates his “side” portfolio to one asset – Facebook.

I try to highlight the dangers of being as concentrated in one asset as he is.

His counter-argument is quite consistent – he’s beating me. Consistently, and by a lot.

While I would never consider being so concentrated with my own portfolio, I do often think about a strategy adjustment to significantly overweight Facebook, Apple, Google, Amazon, Netflix. Even if one of them crashes, the gains that the remaining 4 have been producing would still have a better yield than S&P

First I’ll comment on your friend. Reading this reminded me of something Mark Twain once said, “It is strange the way the ignorant and inexperienced so often and so undeservedly succeed when the informed and the experienced fail.” This perfectly describes the stock market. The experience your friend is having in Facebook is the reason why millions of people show up to play this game every day. The potential exists for somebody without any skill or knowledge to make a lot of money, which entices the amateur and frustrates the professional.

There is nothing you can say to convince your friend that having 100% of his account in Facebook is a bad idea. Everyone learns at their own speed and through their own experience. Some of this stuff just can’t be taught, so trying to change somebody’s mind is largely a waste of time.

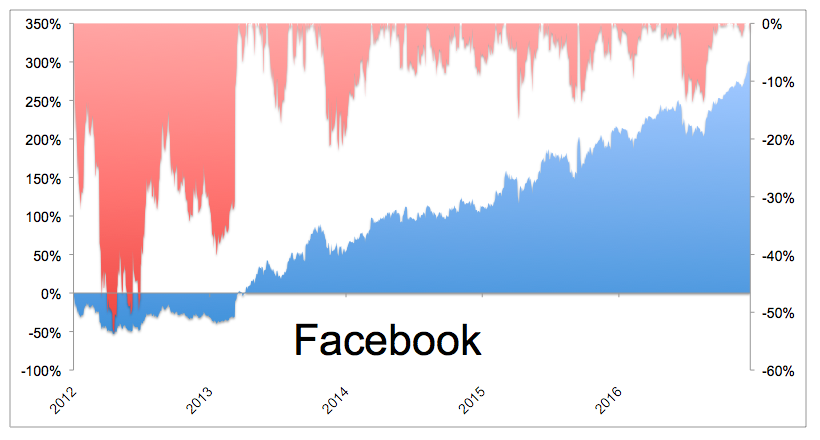

Arguing about the right way to invest is like arguing about politics, but worse, because in this case we’re not talking ideas, he’s got actual results. And the fact is, Facebook is up 145% over the last three years while the S&P 500 is up 35% and a 60/40 portfolio is up 22%. So yes, his results have been better than yours and the luck versus skill argument is irrelevant ex-post. Places still accept money that was made by chance.

Next, let’s address your question on overweighting Facebook, Apple, Google, Amazon and Netflix.

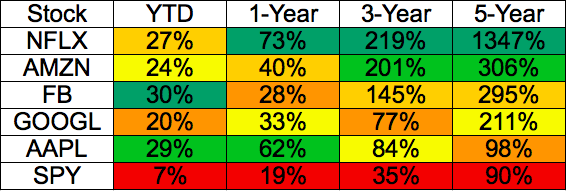

The best stocks provide an illusion of safety, which is why performance chasing is one of the few things in finance that will never, ever disappear. If you believe in risk and reward, then it makes sense to acknowledge that the stocks that have reaped the biggest rewards over the last few years are also the ones that carry the highest risk going forward. Below is the recent performance for the group.

These are among the finest companies on earth and it’s hard to argue that this fact is not reflected in their performance, which has greatly accelerated in the first 86 days of 2017; Facebook and Apple have each made 22 new all-time closing highs, Netflix and Google 18, and Amazon 13.

I won’t comment on the valuation of these companies, they can still be cheap for all I know, but the idea that you should put 10% of your money in these stocks and the rest in an index seems redundant. These 5 companies are 10% of the index, so you already have plenty of exposure to them.

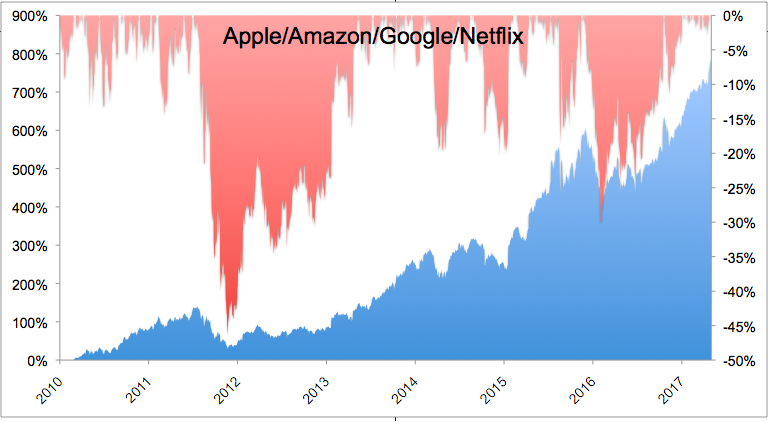

It’s easy to look back and wish we owned these stocks without asking ourselves honestly whether we would have had the temerity to stick with them. Let’s look at the experience an investor in these stocks would have had. I’m going back to 2010 and assuming a portfolio that invested $1,000 into each of Apple, Amazon, Google and Netflix, and never rebalanced. That $4,000 would be worth over $35,000 today, a 784% gain, compared with the S&P 500 (total return) which gained 149% over the same time.

There was a very real cost associated with the outperformance that we choose to ignore when looking at a chart. Sticking with this portfolio would have been mentally exhausting and unrealistic for those of us who have feelings.

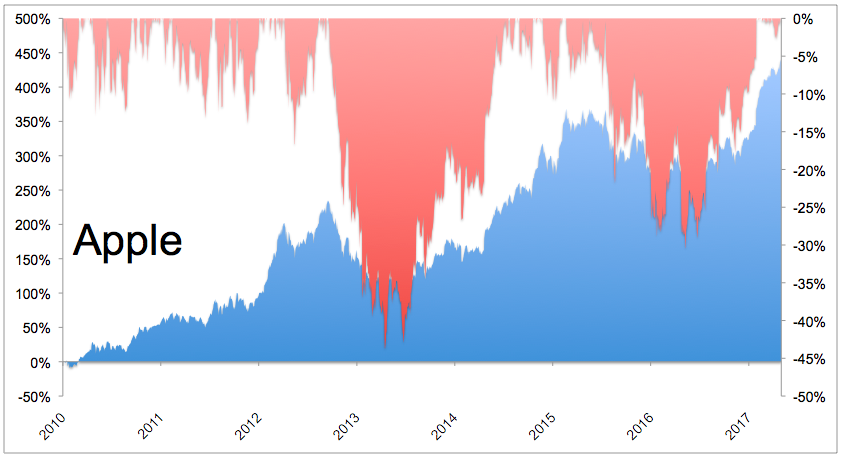

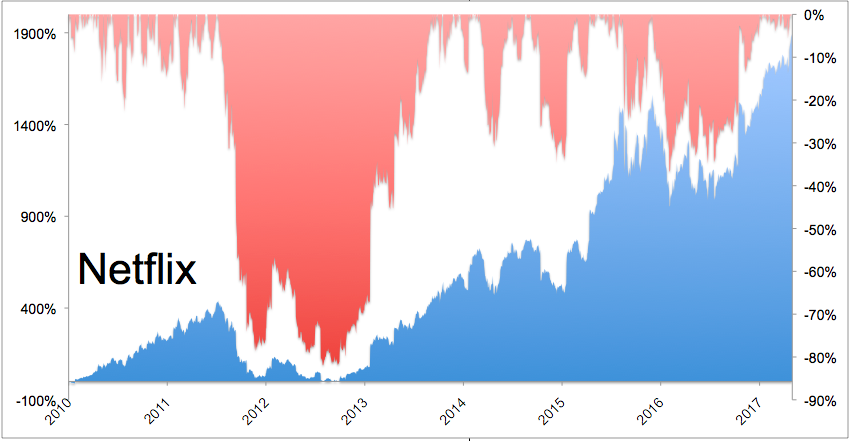

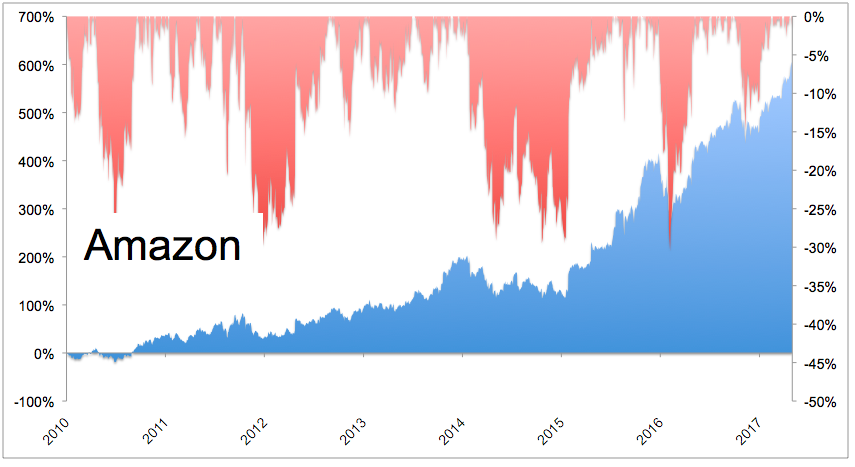

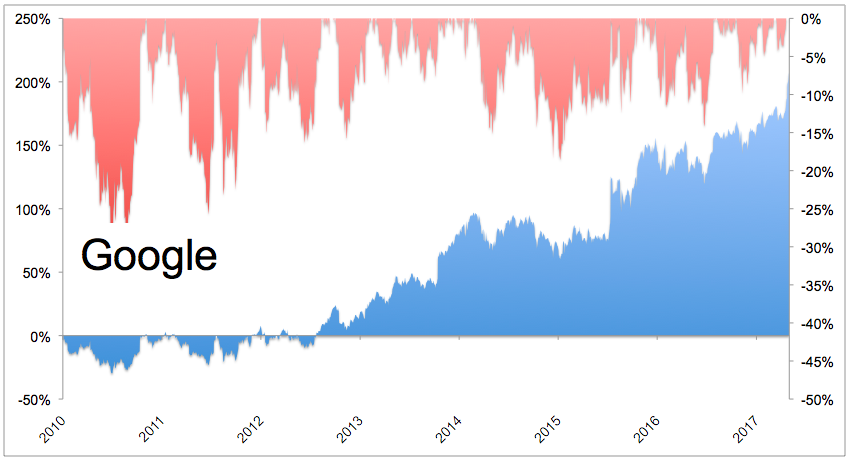

The chart below shows the gains (blue, left axis) and drawdowns (red, right axis).

To give a better visual of how the drawdowns actually felt, I like to show them in dollar terms. From December 2015 to February 2016, in just 42 days, the value of this portfolio fell $8,500, twice as much as the initial investment, and the 610% gain shrunk to a 397%. Even if you sold there, it would have been a magnificent run, but getting there is so difficult because we’re wired to “protect the nest.” The fear that our winners will turn into losers is why it’s so hard to “let them run.” So again, the idea that we could have extracted these gains is probably far fetched for most of us. And not to mention, these companies attract all the news, and each of these stocks was bombarded with scary headlines at some point.

It sounds easy, but having the self-control to not chase performance is really, really hard. And it’s hardly amateurs that engage in these unforced errors, many money managers almost behave as if it’s in their mandate. Before you buy something solely on the basis of how it’s done relative to an index, remember that you’re not the only one playing this game. If you’re thinking this, so are a lot of other people. Howard Marks diagnoses this behavior perfectly.

First-level thinking says, “It’s a good company, let’s buy the stock.” Second-level thinking says, “It’s a good company, but everyone thinks it’s a great company, an it’s not. So the stock’s overrated and overpriced; Let’s sell.”

First-level thinkers see what’s on the surface, react to it simplistically, and buy or sell on the basis of their reactions. They don’t understand their setting as a marketplace where asset prices reflect and depend on the expectation of the participants. They ignore part that others play in how prices change. And they fail to understand the implications of all this for the route to success.

Good luck and thank you for reading.

Below are the gains and drawdowns for each of the four stocks, as well as Facebook.

Source: Irrelevant Investor

What's been said:

Discussions found on the web: