Peter is the CIO of Bookmark Advisors, an asset management firm and the Editor of The Boock Report, a macro economic and market newsletter.

My thoughts on tax bill and again, all else not equal

I’ll make my position clear that lowering the corporate tax rate is a big long term positive in making the US a more attractive place to do business. Also, allowing immediate expensing of capital spending will hopefully lead to an immediate rise in investment. Conversely, getting rid of the SALT deduction is a big negative for many households that do a large amount of consumer spending and will be hit hard. Philosophically, it is blatant double taxation and wishful thinking that politicians will respond in kind to lessen the impact. Breaking this last point down further, California is the 6th largest economy in the world with GDP of $2.6T. The New York economy is about $1.5T, Illinois comes in at $800b, New Jersey at $575b and Connecticut at $260b. Adding these 5 states up and one gets $5.7T of total output which is about 1/3 of the US economy.

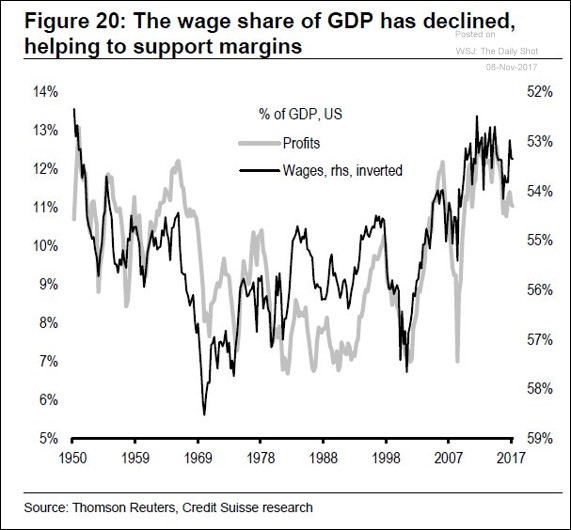

I make these points because I’ve also stated that any full analysis of the impact on corporate profits from the tax bill should assume all else is NOT equal and not every penny falls to the bottom line. What we saw last night from AT&T (I won’t get political on this one), Comcast, Wells Fargo and Fifth Third Bank should be a reminder. Raising wages for its employees is great for employees and increasing capital expenditures will fill a missing link hopefully of the slowdown in productivity. But, for the former it shows that there will be an offsetting rise in labor costs to lower taxes and for the latter, it takes time to reap the benefits in terms of profitability. This chart (the right side is inversed) I took from the WSJ last month and it shows how much lower labor costs have helped corporate profit margins in this recovery. For labor, hopefully we are on the cusp of this reversing. For corporate profit margins, they have likely peaked if the case.

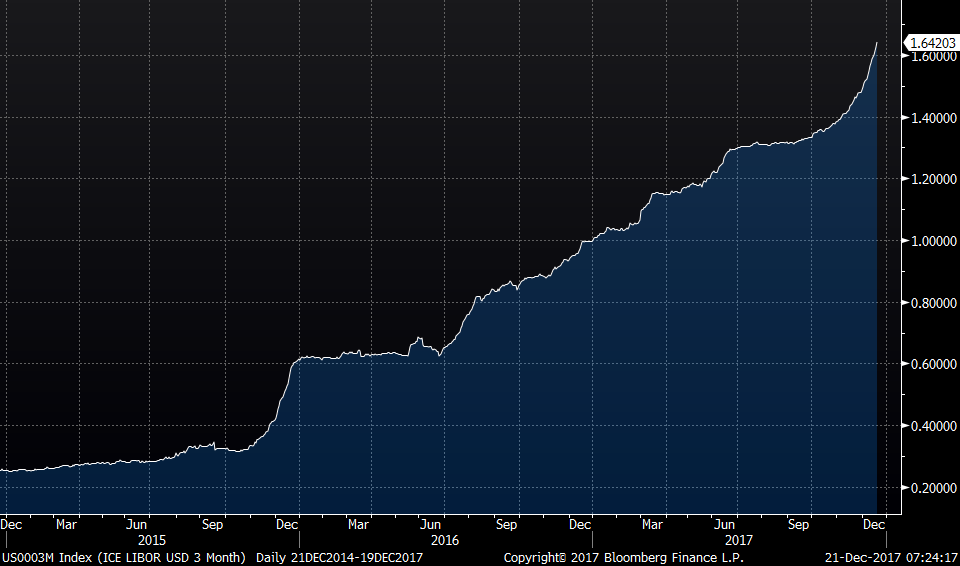

Another point here and its impact on profits, we of course have seen a quick rise in interest rates on the long end but continue to see a persistent rise in US LIBOR where many billions of floating rate loans are priced off. A higher cost of capital should also thus be included in any analysis of the impact of tax reform. If one is a corporate treasurer/CFO that has not termed out their debt in a fixed fashion at this point, they should be fired.

US 3 MONTH LIBOR

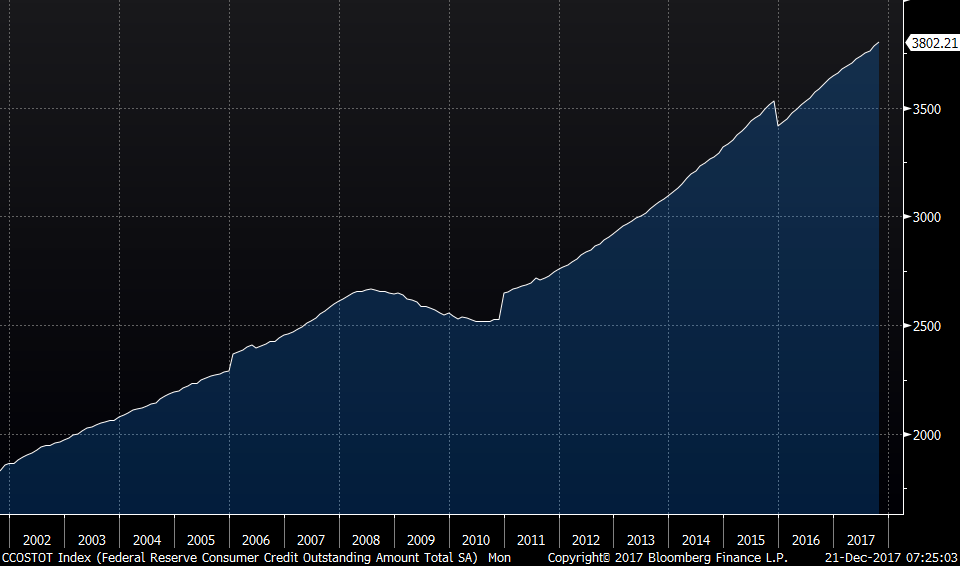

Lastly, on the tax cuts for the middle class, likely some of the benefit will go to improving their balance sheets as non mortgage total consumer credit is up 43% from the 2008 peak.

TOTAL CONSUMER CREDIT OUTSTANDING not including mortgages

We saw a rise in bullish sentiment in yesterday’s II data and that was repeated today on the individual investor side. AAII said Bulls rose 5.5 pts to 50.5 and is up 14 pts in just the past 2 weeks. This is the highest level since January 1st, 2015. Bears fell 2.5 pts to 25.6, the least in 6 weeks with Neutral making up the balance. I take the AAII data with a grain of salt and only mention it when it gets stretched which it did today with Bulls, relatively speaking.

The BoJ did nothing as expected and Kuroda gave no hints as to when things might change. They remain addicted to easing and their 2% inflation target and it takes a while for a junky to change its ways. Kuroda stoked speculation last month that they were going to let the yield curve steepen when he brought up the saying ‘reversal rate’ but today he said “Just because I brought up this academic analysis, reversal rate, doesn’t mean at all that we need to review or change the yield curve control we’ve adopted since September last year.” JGB yields are unchanged as is the yen and the Nikkei. This in turn disappointed bank investors as the Topix bank index gave back 1.1% after rising by 1.9% yesterday.

These 3 sentences from Kuroda reflect the insanity of what the BoJ has done: “Our most important goal is to achieve our 2% inflation target at the earliest date possible. We won’t raise rates just because the economy is improving. We will look at this from the perspective of achieving our price target.” He thus doesn’t understand that low inflation leads to good economic growth and by targeting an arbitrary, completely unrealistic inflation target, he is left with endless stimulus.

A day after seeing a slight moderation in German business confidence, French business confidence in December rose 1 pt. The euro is little changed in response but still trades very well vs the US dollar.

-Peter Boockvar, Co-Chief Investment Officer

Bookmark Advisors