Source: Torsten Slok, Deutsche Bank Research

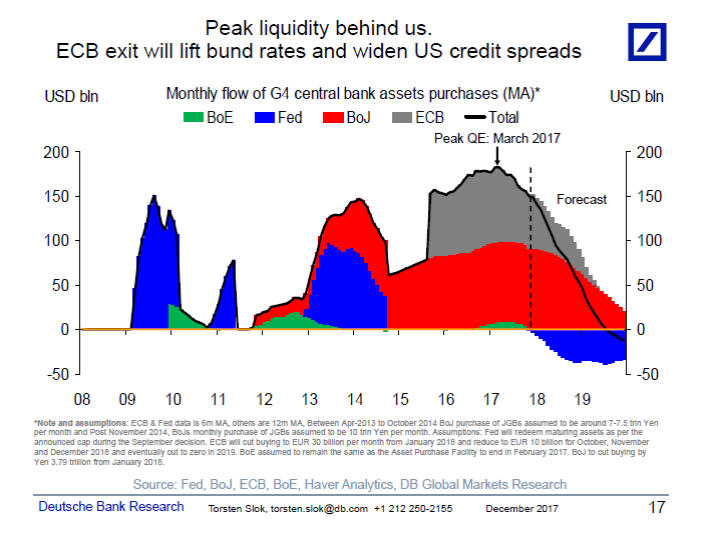

Torsten Slok discusses the ongoing “phase” differences between the FOMC and the ECB. The debate is over each’s expanded balance sheet, and the impact each has on “holding down permanently the level of 10-year Treasury yields and the level of 10-year bunds” (emphasis mine).

The so-called stock effect of QE is to remove government bonds from the market, artificially pushing interest rates permanently lower. Advocates of the stock argument claim the end of QE is a non-event, as interest rates will remain low, stock prices high, and credit spreads tight.

I disagree with this for numerous reasons, most prominently because I do not believe rates will be permanently kept low by the methodology of QE; we know its artificial, and that suggests to me that it is temporary. Once the artifice is removed, markets will (however gradual) reassert themselves, finding a more natural rate level.

I also find with Slok’s explanation compelling:

“First, long rates are not only driven by QE. US and European rates are also driven by forward guidance. And the ECB will in 2018Q2 begin to recognize the strength of the European data and the need to exit. As ECB forward guidance begins to signal that QE and negative interest rates are going away, investors will begin to trade European core rates higher. Put differently, do you think 10-year bund rates, which currently are 30bps, will also be 30bps when we come to the end of 2018 when the ECB is no longer doing QE? We think it will be 1% because markets will begin to price that negative interest rates are also going away.

Second, the stock argument does not take into account how the cash that ECB QE injects into the economy is used. As the ECB carries out QE a real money manager in Europe sells their German bunds to the ECB and gets cash in return, currently 60bn euros per months. The money manager now turns around and invests that 60bn in other assets such as US IG and HY. As the ECB in 2018 slows their purchases to 30bn and ultimately to zero there will be much less demand from foreigners for US IG and HY. In other words, the stock argument is flawed because it only looks at the impact on government bond markets and it ignores the flow effect on the other markets where the QE money is ultimately spent. In plain English, as the ECB slows and ultimately ends QE in 2018 the amount of cash flowing to risky assets such as credit and equities will slow down and ultimately dry up altogether. And for this to be a smooth exit new issuance and refinancings of credit needs to slow in sync, which seems highly unlikely to happen at the same time, see the second chart.

The bottom line is that changing ECB forward guidance is likely to raise bund rates in 2018, and the significant slowdown in flows from Europe into US credit markets is likely in 2018 to widen credit spreads in US IG and HY, even if the US economic data continues to be good.

In light of Europe’s gradual economic improvement, these interesting and important monetary policy changes bear watching.