Source: AEI

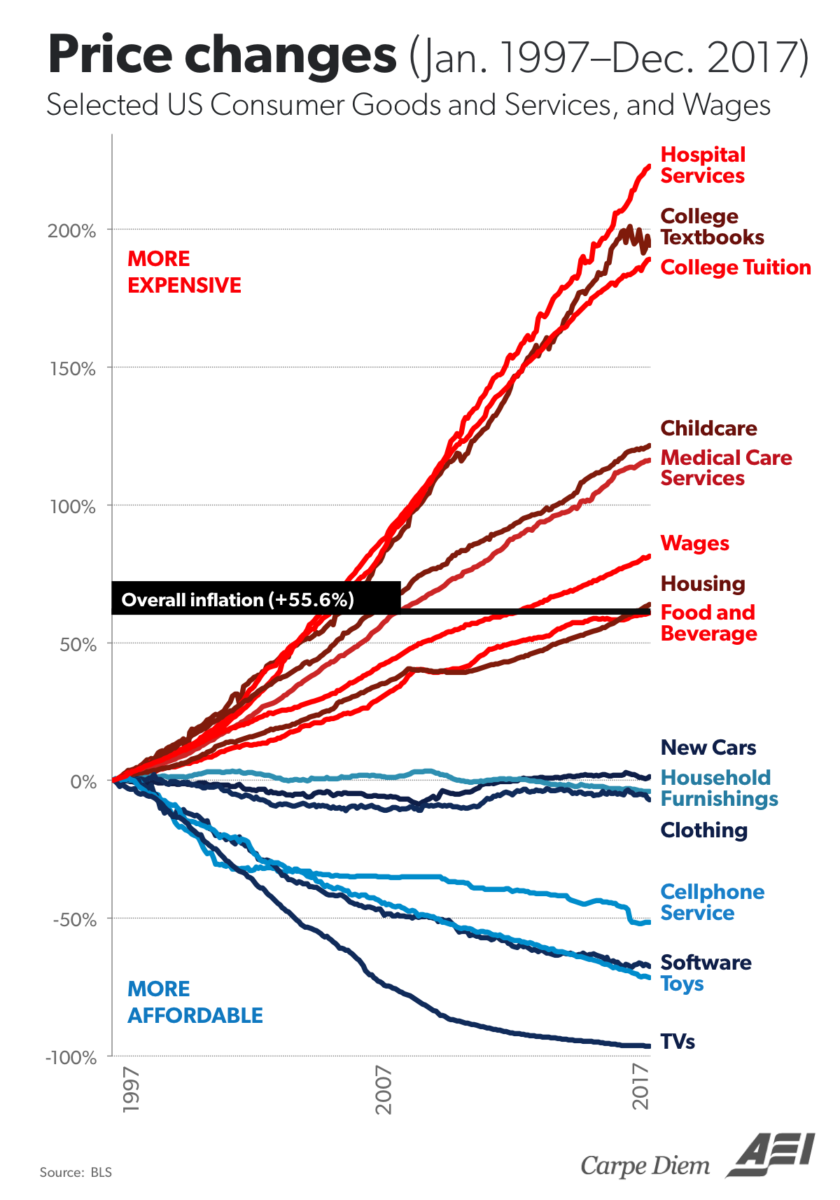

I have shown versions of this chart before (see this and this) but the update is worth reviewing given that some people have been blaming inflation generally and rising wages in particular for the recent increase in market volatility.

It is notable that the two big outliers to the upside are health care (hospital, medical care, prescription drugs) and college (tuition, textbooks, etc.)

Clothes, cars, TVs, cell phones, software — technology in general — showed disinflation or outright deflation in prices.(Housing and food & beverage have been right at the middle of inflation levels).

Wages have barely ticked over the median inflation measure, but that did not stop some people from blaming the correction on rising wages.

Reading the pundits, I cannot tell which fate awaits us: the robot-driven apocalypse where we are all out of work, or the inevitable spike in wages that sends rates much higher and kills the market. Perhaps both — higher wages sends employers into the waiting arms of our automated future.

Regardless, I expect wages are ticking higher, but not appreciably so that the Fed must do anything drastic. And the increased comp should accrue to sectors like retail, housing, durable goods, travel, automobiles, etc.

We are a long ways from the sort of wage push inflation of the 1990s . . .