The Signs of a Market Blip or Something Worse

The bulls probably still rule, but volatility is back and so are ups and downs.

Bloomberg, February 5, 2018, 9:28am

The market sell-off that started last week has made investors nervous. A quick skim of the headlines reflects fears that the bull market is over and that this is more than a mere blip. Futures suggest there will be more red on screens today.

It is too early to definitely declare this the start of a correction (a 10 percent decline that quickly reverses) or the end of the bull market. But rather than rely on gut instinct, we should instead look at the data to help us understand the details of this rally. It is as a good time as any to discuss how market tops and bottoms are made, and why they tend to be such different events.

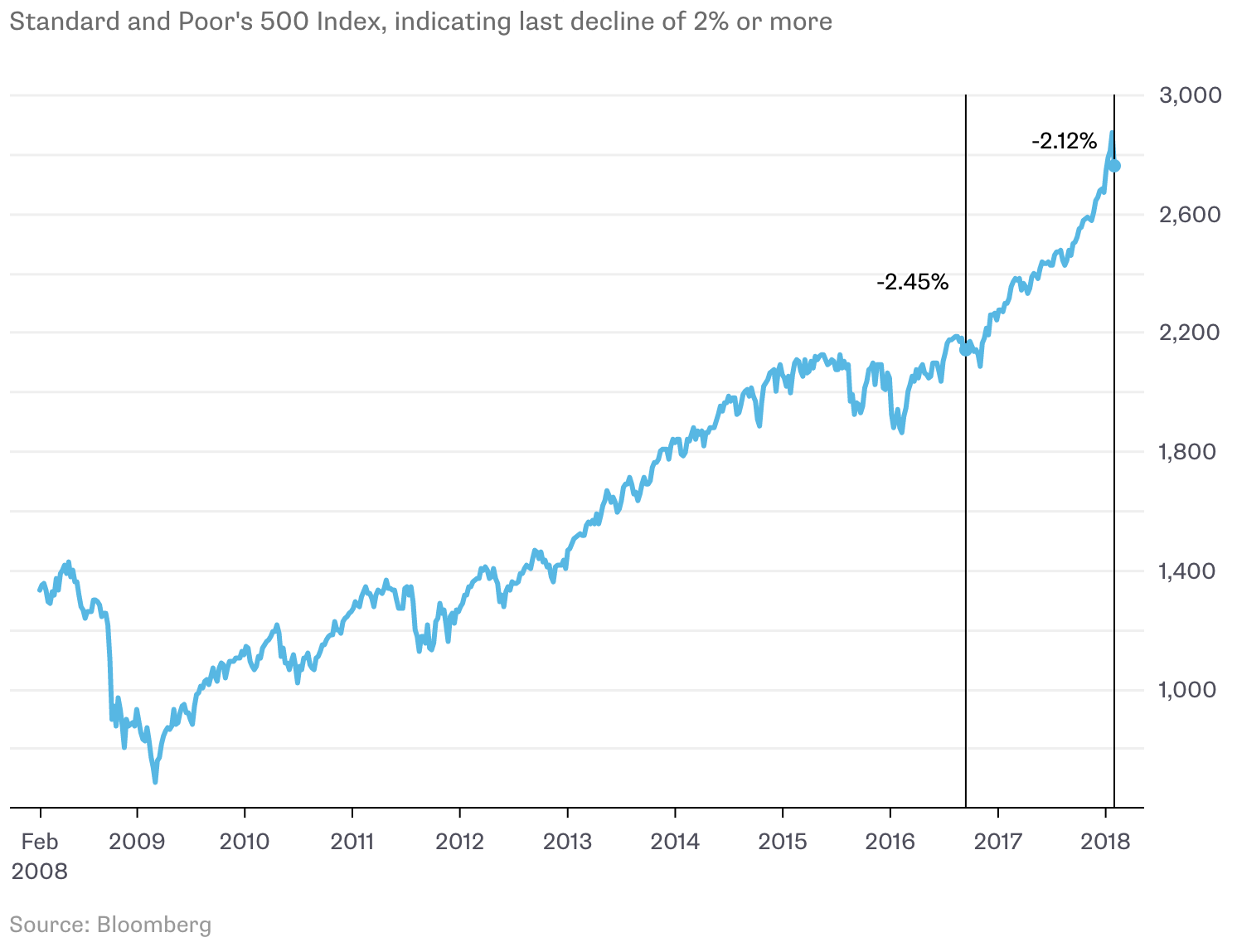

Let’s begin with a few stunning data points: before last week, the Standard & Poor’s 500 Index had gone 112 trading days without closing down 1 percent in a single day. That is the longest such streak in more than three decades.

The S&P 500 hasn’t had a two-day 2 percent decline since September 2016. That was 349 days before the most recent prior fall. Similarly, U.S. markets haven’t seen a streak that long without a 2 percent decline in more than three decades.

What does this have to do with tops and bottoms? In a word: psychology. The turning points in markets reflect very different investor emotional states. It is the classic tale of fear and greed. This manifests itself thusly: Tops are a process, while bottoms are an event.

Pardon my narrative explanation, but I find it the best way to explain this mindset.

Think about investor psychology during bull markets. Sales of shares turn out to be a mistake. Dips should be bought, as selloffs eventually recover and are surpassed. The muscle memory of buying gets strengthened. Bull markets tend to run further and go on for longer than most people expect.

What happens in the late innings of a bull run is that people take it for granted and almost lose interest. Gains become de rigueur, and we adapt to them as our frame of reference. Elie Wiesel once said, “The opposite of love is not hate; it’s indifference.” That is certainly true for investors.

Tops are a long process, involving not so much selling, as a gradual reallocation of capital toward other assets. The enthusiasm fueling further gains starts to slowly fade. Greed gets replaced with something much less amorous — complacency and inaction.

Investment funds that have done well experience modest withdrawals. I recall during the tech boom from 1996 to 2000 when lots of money rolled out of equities and into real estate. This wasn’t a market call as much as it was a lifestyle upgrade for those who had lived through the terrible 1970s markets and invested in the early 1980s boom.

If you want a quantitative way to look at the way markets top, use the 10-month moving average for equities to track how much enthusiasm there is for the asset class. Different stocks have a different level of sensitivity to market weakness, with the large capitalization indexes being the last to fall.

Bottoms, on the other hand, are an event. The investor psychology of losses leads to concern then to fear then to panic, as gains appear to evaporate. Unlike the indifference of tops, fear leads to rapid action — selling. We saw this in the 2008-09 collapse.

My suspicions are that this is neither a top nor a bottom but instead is a period of digesting the gains of the past year or so. As we noted before, most of the current bull market has been a surprisingly slow, steady grind. Indeed, there have been remarkably few days when the market moved more than 1 percent in either direction. In a streak that ended Jan. 26th, the S&P 500 gained a hefty 14 percent during a 4 ½ month period without experiencing a single 1 percent up day. This has never happened before.

That rapid gains could be simply a case of too fast, too far. If you are looking for a comforting narrative explanation as to why markets are correcting, that is as good a guess as any. Prices simply got way ahead of themselves on investor enthusiasm for tax cuts, strong corporate earnings and global economic growth. Or if you prefer, it is a merely the drunken random walk of Mr. Market.

Either way, the bull market seems to be intact, though volatility has returned, along with markets that can move in both directions. The past few months have been aberrational; what is occurring now seems to be a possible reversion to more normal market behavior.

Originally: The Signs of a Market Blip or Something Worse