This week, I am in Chicago visiting our new offices here, seeing clients and meeting new people. I will be re-running several of our favorite pieces. This one is from Michael Batnick, who is the Head of Research at RWM. Enjoy.

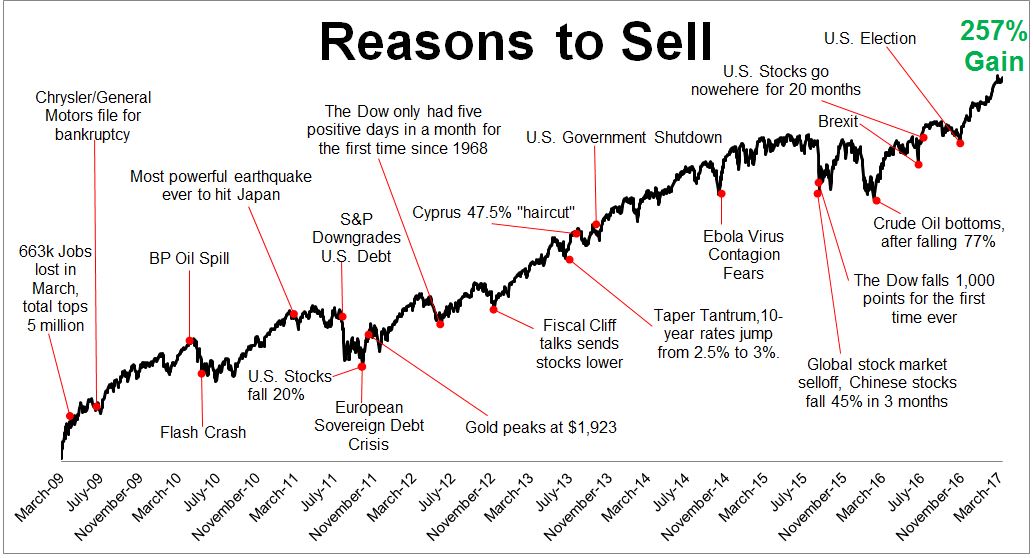

When I sat down this morning to create a “Wall of Worry” chart, the hard part wasn’t coming up with the list, but rather choosing what to leave off. Since stocks bottomed in 2009, there have been so many potential reasons to sell that it wasn’t possible to fit them all. Below are a few that didn’t make it:

- MF Global Bankruptcy

- All the quantitative easing programs

- Ashton Kutcher is a venture capitalist

- China hard landing(s)

- Occupy Wall Street

- Is Deutsche Bank the next Lehman?

- Yuan devaluation

- Celebrities buying stocks, Mila Kunis, Joe Theismann, Kenny G

- Tony Robbins is a financial advisor

- Peak profit margins

- Margin debt all-time high

- Buyback-palooza

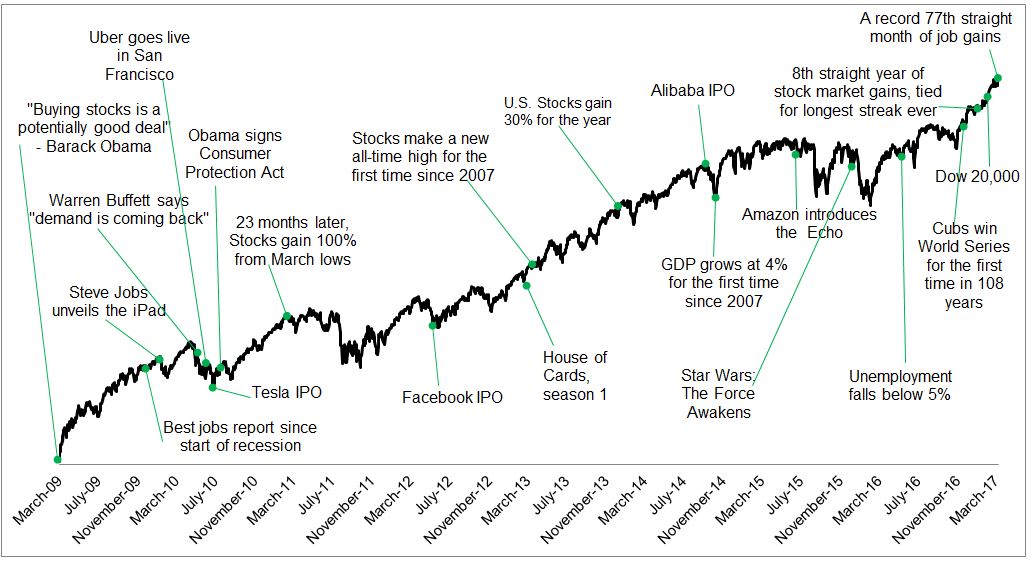

We’ve seen a thousand versions of this chart, but we haven’t seen the opposite, one that plots all of the positive developments over the last nine years. So I decided that would be fun to create, but I quickly realized, as I stared blankly at the screen, that coming up with this list was much harder than I thought it would be. This reminded me of something Bill Gates said: “Headlines, in a way, are what mislead you, because bad news is a headline, and gradual improvement is not.”

All of the items below were headlines, but they weren’t necessarily “reasons” to buy, which is why I’ll refer to this as the opposite chart, but not really.

I really had to stretch to fill this in, you’ll notice stocks didn’t care much about House of Cards or the Cubs winning the World Series.

Over the last nine years, it’s impossible to deny that things have gotten better; Better for the economy and better for the consumer. The thing is, better doesn’t go on a chart, because gradual improvements go unnoticed.

Here are some of the great things that didn’t necessarily make headlines, but are reflected in the 260% rise in the stock market.

- Advances in medicine

- Transparency increasing for financial consumers

- The explosion in quality podcasts

- Professional content curation, like Abnormal Returns

- The experience of travel, specifically airplanes

- Costs going down for financial products

- Technology costs coming down, like televisions, for example.

- Google maps is free and incredible

- High-speed wifi, everywhere

- Fuel economy of an automobile. Average miles per gallon improves every year

- Solar energy is a viable option.

The fact that bad news is disseminated ten times as fast as positive news is one of the biggest reasons why it’s so difficult to just capture market returns. You would think it’s as simple as buying the total market index fund and leaving it alone. And it is that simple, but it certainly isn’t that easy, because bad news smashes your face against an amplifier, while good news just plays quietly in the background.

Doing nothing should be the default setting for most investors, but as the charts above show, that’s easier said than done.

~~~

This originally was posted at the Irrelevant Investor March 20, 2017