This afternoon, I am speaking at the Inside Smart Beta Conference, playing the role of curious skeptic in a room full of enthusiasts. ETF.com’s CEO Dave Nadig is going to grill me on why we have not moved $850 million of client assets into Smart Beta holdings.

A few caveats: the term “Passive Indexing” is a less than optimal phrasing, and my preferred language is “Low cost indexing.” Same with and “Smart Beta” — another confusing phrase; “Fundamental Indexing” is a much preferred verbiage. And I agree that passive is less passive than many people believe, and that reasonable people can look at the data and amicably disagree. This is not a holy war.

Please understand, I have no objection to having some of your portfolio be in either (low cost) active funds or non-cap weighted indices. However, you need a compelling reason why, you must demonstrate you can make that allocation and be disciplined with it, and that your behavior won’t get in the way, be it style drift or shiny objects or whatever intervening.

Another issue is the basic question of “Are we just buying factors?” If you want a tilt towards small cap, value, beta, momentum, and quality — I know I do — I believe I can get all of that and more, at a lower cost, via a firm like Dimensional Funds Advisors.

And we do.

I have yet to be convinced that Fundamental Indexing can justify the higher turnover and inherent costs of this type of indexing versus a capitalization weighted indices. Smart Beta has a 10-20 percent annual turnover and rebalancing versus a 1-2 percent for the S&P500. So over long periods of time, I would expect those costs will make a difference. There is an expense associated with that turnover, and it is an ongoing drag on returns.

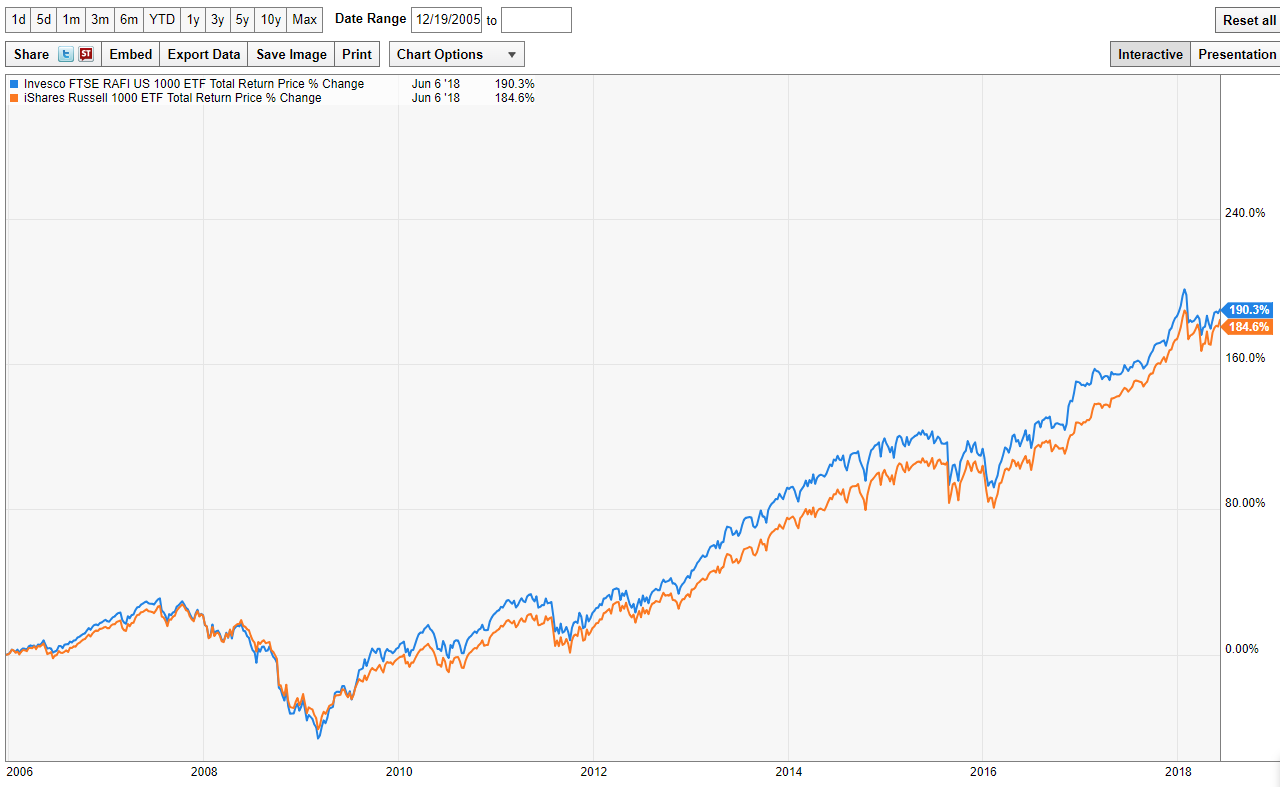

I asked Mike to pull a few charts comparing Fundamental Indices versus its best benchmark. He grabbed (on his own) the FTSE RAFI Index versus the Russell 1000:

As you can see, going back to 2005 gives a slight edge to FTSE RAFI – it outperforms the Russell by a few bps per year. After 13 years, it amounts to a little less than 6 percent total differential:

FTSE RAFI 1000 vs Russell 1000, 2005-2018

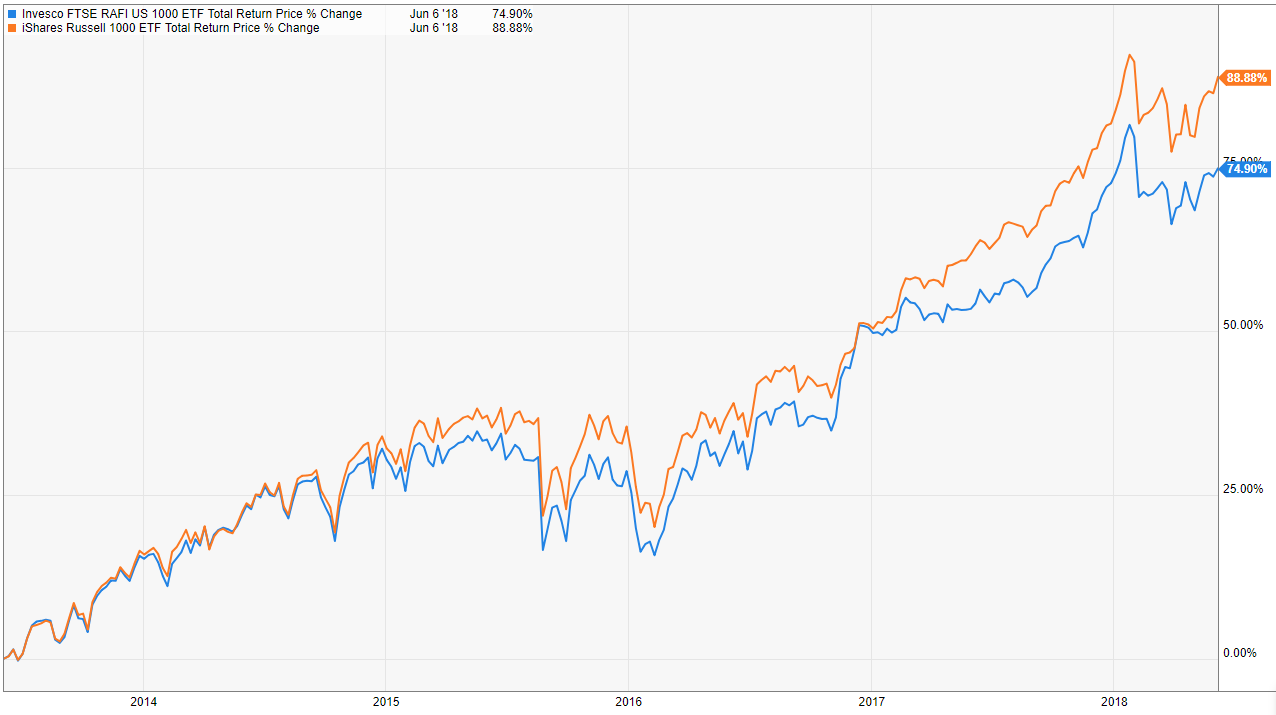

But what about lately? The Russell is a full 14% ahead. That becomes a problem from a behavioral perspective, because investors tend to get bored and restless; that under-performance gives them an excuse if they are semi-active, to make changes. And nearly all of the time, that is where they make some regretful mistakes.

FTSE RAFI 1000 vs Russell 1000, 2014-2018

There are some more items that are worth reading below, but the bottom line is that Fundamental Indexing presents an interesting, but not quite compelling to me, investing option.

Some more resources are after the jump . . .

See also:

Barron’s: Rob Arnott on Beating Stock Indexes

II: Fees Matter When Picking Funds — but They Aren’t Everything

WSJ: Burton Malkiel Is Still an Indexing Fan, but a ‘Smart Beta’ Skeptic

Bloomberg: As Smart-Beta Spreads, Former Fan Wonders If It’s Actually Dumb

Bogleheads: Is Smart-Beta tilting just a marketing ploy?

From Vanguard Blog for Advisors:

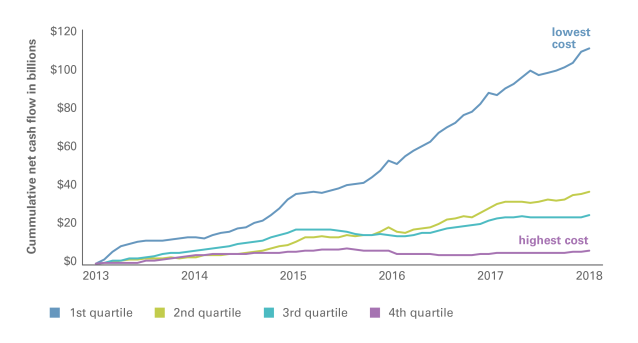

Similar to a theme observed in industry-level cash-flow trends, investors have been directing more cash flow to lower-cost U.S. equity factor-driven products.

Source: Vanguard Blog for Advisors