Where’s Your Raise? It Should Be Coming

Pressures for bigger pay increases are building, but have yet to show up in the data.

Bloomberg, July 11, 2018

During the past few years, I have written that I expected wages would begin to rise. They have, at least on a nominal basis, or before accounting for inflation.

With unemployment at or near four-decade lows, I have argued that the only solution for employers is to raise wagesto attract and retain employees. There is certainly anecdotal evidence of companies raising pay, but across the board the signs are mixed.

If my thesis on rising wages is going to be proven wrong then lack of pay raises during the next 12 months might do it.

So today, I want to look for both confirming and contrary data points to see if we can glean what might happen next.

Let’s start with the basic wage data: The nominal average hourly earnings of all private-sector employees rose 2.7 percent year over year, up from a low of 1.5 percent in October 2012. That has been a slow but steady improvement since the recovery really took hold in 2010, but it is still a good deal below what we saw before the financial crisis.

Given that starting point, is the data supportive of higher wages or not? Consider these positives:

No. 1. Job openings to job seekers: In 2016, there were 1.3 job seekers for each opening. Today, its 0.9 people for each opening, meaning there are more jobs than job seekers. For context, at the height of the financial crisis the ratio was 6.6 to 1. The basic laws of economics tell us that when a good or service is in limited supply (labor) then the cost of that product (wages) should rise.

No. 2. Quit rates: As the Bureau of Labor Statistics reported, a record number of people were quitting their jobs — 3.56 million workers in May, the most since this data series began in December 2000. Job-hopping is increasing, and when quit rates rise, it is typically because lots of workers are leaving to accept better paying jobs. The challenge with this data series is determining if this is a broad trend or limited to specific narrow sector gains.

No. 3. Unemployment rate: The unemployment rate ticked up 0.2 percentage points to 4 percent in June, from 3.8 percent, but not because people were losing their jobs. It rose for the best possible reason: people who had previously left the labor market were re-entering the work force and looking for jobs. This typically speaks to confidence among workers that jobs are plentiful and are paying a worthwhile salary versus either being in school, retired or otherwise not working.

Those points all suggest pressures for higher wages are building.

Now for the counterpoints.

No. 1. Tax cuts: As has been widely reported, the benefits of the tax cuts have been going mostly to shareholders, not workers. An analysis earlier this year put workers’ total gains at $6 billion versus $171 billion for shareholders in buybacks and dividend increases. Since then, total announced buybacks have risen to $437 billion. If management continues these priorities, some argue, workers are less likely to see substantial wage gains.

No. 2. Productivity gains: This is a long-standing conundrum that won’t be settled here, but rising productivity hasn’t benefited workers very much. Despite producing more goods and services, labor’s share of the total pie — which has been falling for at least two decades — hasn’t gotten back to where it was before the financial crisis.

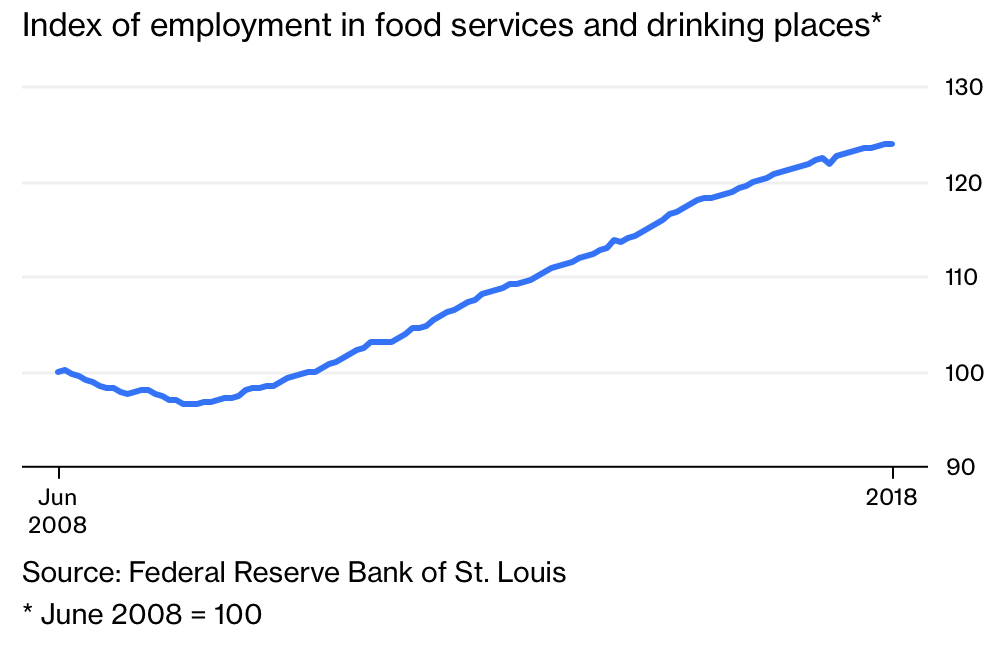

No. 4. Demographics: As my Bloomberg Opinion colleague Michael Strain has noted, “the composition of the work force is changing in ways that affect pay.” Older, better-paid workers are retiring, and more, young workers are accepting lower-wage jobs in services industries, such as restaurants and bars as the chart below shows. This skews the average wage gain.

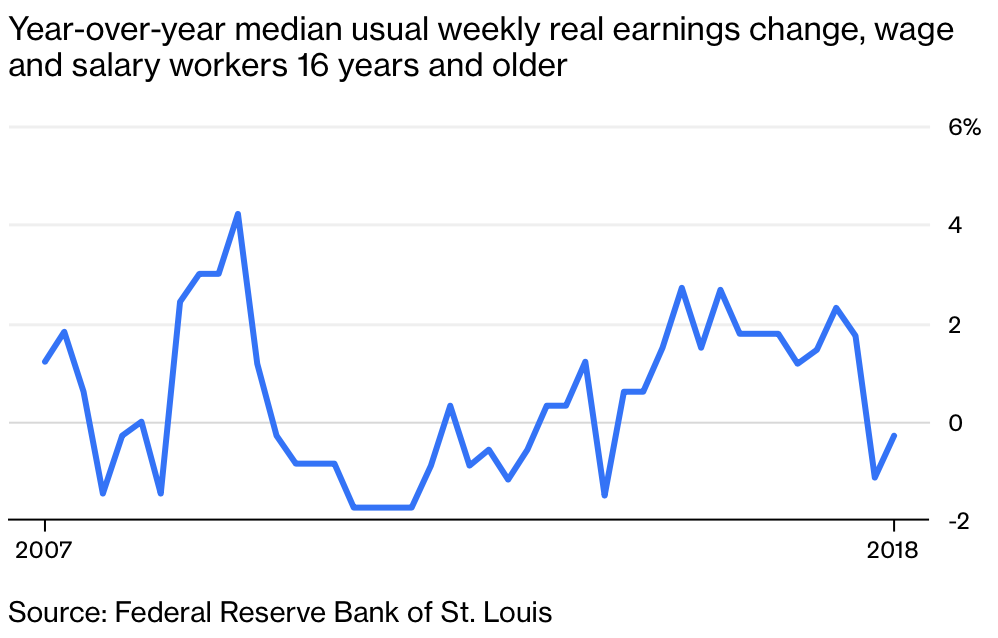

No. 5. Real Wages: As the chart below shows, even when wages finally do tick up, they tend to not keep up with inflation. This means that workers are merely treading water despite rising wages. If you thought stagnant wages created populist discontent before, wait until people figure out that their raises do nothing to raise living standards.

Here’s how I see things when all these factor are taken into account. The negatives are mostly older, longer-term trends, while the positives are all fairly recent developments that will get stronger as the economy chugs ahead. Based on that, my expectation is that positive wage pressures should become more evident during the next several quarters as employers have no choice but to pay more to attract and keep workers.