My morning train WFH reads:

• Starbucks, monetary superpower: Starbucks has around $1.6 billion in stored value card liabilities outstanding. This represents the sum of all physical gift cards held in customer’s wallets as well as the digital value of electronic balances held in the Starbucks Mobile App. It amounts to ~6% of all of the company’s liabilities. (Moneyness)

• Small Tech Stocks Soar as the Future Arrives Early: The giants aren’t the only ones. A subset of software, streaming, security and e-commerce firms are also posting eye-popping gains. (New York Times)

• Auction Prices That Take Your Breath Away: Prices for works by some relatively new artists have skyrocketed, seemingly overnight. (New York Times)

• How To Get People to Save More Money: Take the decision out of their hands and make it automatic because people generally take the path of least resistance. (A Wealth of Common Sense)

• “You Can Do Everything Right and Still Fail”: Music venues might be the most screwed businesses of the pandemic. Our last chance to save them is right now. (Slate)

• How the 1970s Changed the U.S. Economy: The U.S. economy underwent a fundamental shift in the early 1970s. The cause of that shift is still elusive. But it’s a good bet changes in energy technology probably had something to do with it — with lessons for our economic future. (Bloomberg)

• Electric Engines Give Classic Cars a Recharge: EV modifications and interior-tech overhauls are breathing new life into iconic autos that have struggled to stay road-worthy (Wall Street Journal)

• The Return of Anonymous: The infamous hacker group reemerges from the shadows. (The Atlantic)

• The Italian Fishermen Who Brought the Sea Back to Life When overfishing decimated Puglia’s biodiversity, conservationists and fishermen created a marine reserve that turned their catches around. (Reasons To Be Cheerful)

• Witness California’s record blazes through the eyes of frontline firefighters: Climate change, misguided fire suppression, population boom—the current wildfire crisis has been building for decades, and crews are now fighting in unprecedented conditions. (National Geographic)

Be sure to check out our Masters in Business interview this weekend with Doug DeMuro, one of the most popular YouTube car reviewers. His channel videos have been streamed more than 1.1 billion times, averaging 2 million views each. He is also the co-founder of the auction site Cars & Bids, and the author of “Plays With Cars,” and “Bumper to Bumper.”

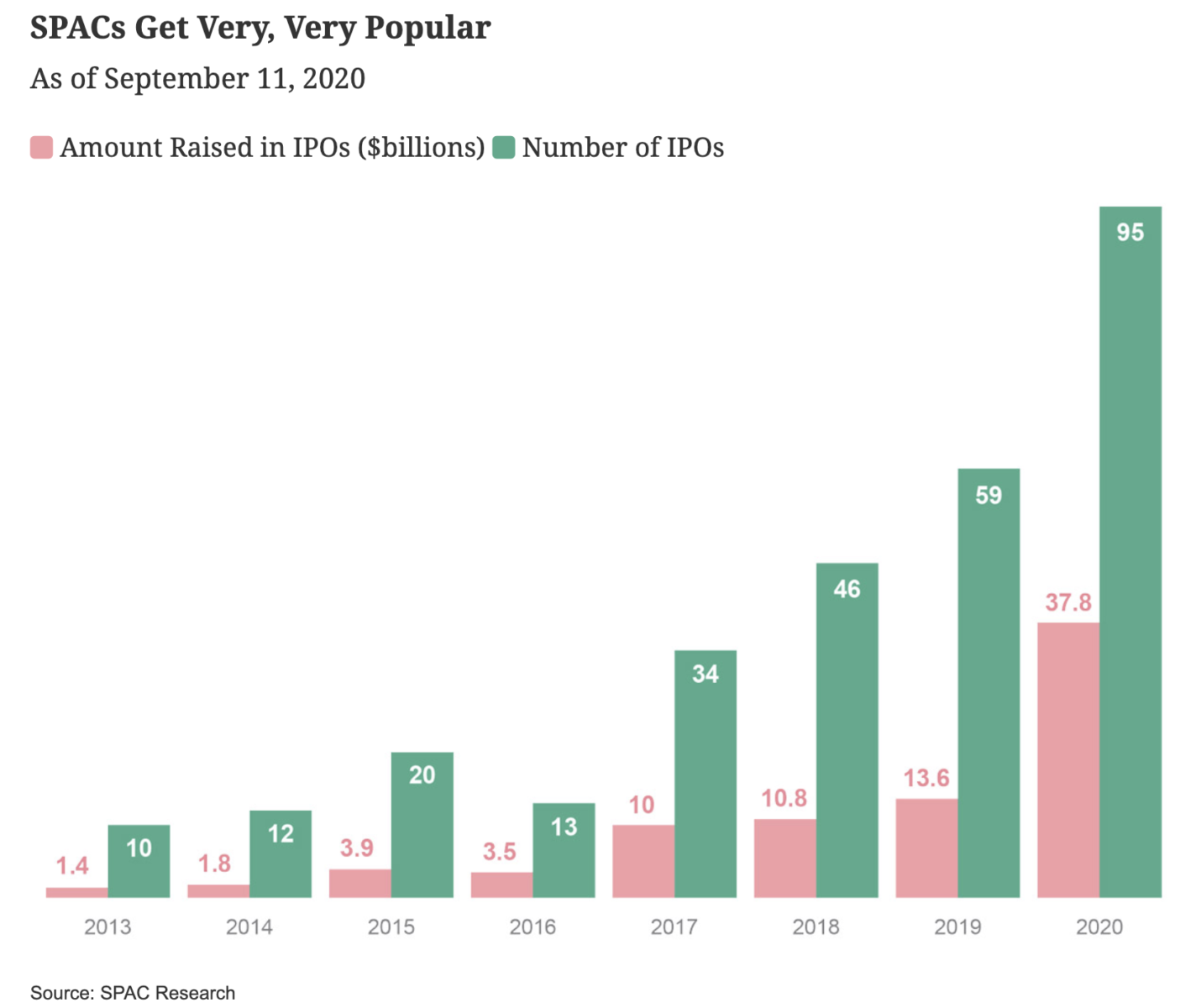

Are SPACs Too Good to Be True?

Source: Chief Investment Officer

Sign up for our reads-only mailing list here.