My post-rally, Two-for-Tuesday morning train WFH reads:

• What If Interest Rates Don’t Matter as Much as We Think? Just because stocks have done fine when rates have risen in the past doesn’t mean it will happen in the future. But interest rate levels, in and of themselves, aren’t the sole cause of every market movement. They are just one factor among many that impact how people allocate their assets. And maybe, just maybe, they don’t matter as much as we all think. (A Wealth of Common Sense) see also Is Inflation a Risk? Not Now, but Some See Danger Ahead Though slack in the economy and a vigilant Fed currently keep prices well in check, some economists say political pressure and new emphasis on maximizing employment could test central bank’s resolve (Wall Street Journal)

• It’s Hard to Run on Bond ETFs For an S&P 500 ETF you can go buy all the S&P 500 stocks fairly efficiently and electronically, but for a 500-bond ETF it would be very difficult to go buy 500 bonds (Bloomberg)

• How a 10-second video clip sold for $6.6 million In October 2020, Miami-based art collector Pablo Rodriguez-Fraile spent almost $67,000 on a 10-second video artwork that he could have watched for free online. Last week, he sold it for $6.6 million. (Reuters) see also NFTs and a Thousand True Fans NFTs are blockchain-based records that uniquely represent pieces of media. The media can be anything digital, including art, videos, music, gifs, games, text, memes, and code. (Andreessen Horowitz)

• ‘Share-plunge’ GameStop traders serve valuable function Without short sellers, the investing public is truly doomed. And for proof, look no further than a one-time penny stock that’s headed back to nosebleed levels. What was largely overlooked during the hearings was that even as the hedge funds lost money, they were eventually proven right. As they predicted, shares of GameStop collapsed. Small investors who ignored the short thesis and engaged in the Reddit-induced mania by buying near the top (sometimes with borrowed money) got crushed as the stock plummeted below $50. (New York Post)

• Clubhouse Won Over Elon Musk. Now It’s Conquering the World. The buzzy chat-room app is beating Instagram, TikTok, Zoom and WhatsApp in App Stores around the world. And that’s a good thing. (Bloomberg) see also Podcasting Is Booming. Will Hollywood Help or Hurt Its Future? A frothy adaptation market is just one sign of the rapid evolution of the industry. But some worry that big money will stifle the D.I.Y. spirit that has driven much of its success. (New York Times)

• E-mail Is Making Us Miserable: In an attempt to work more effectively, we’ve accidentally deployed an inhumane way to collaborate. (New Yorker)

• How Europe Became the World’s Biggest Electric-Car Market—and Why It Might Not Last Subsidies and more choices have helped spur consumer demand, but China serves as a warning that such momentum can be fleeting (Wall Street Journal) see also Lucid’s and Churchill’s investor deck for Churchill Capital IV SPAC deal Lucid, a leader in EV technologies, defines a new generation of EVs, ushering in a new paradigm for the automotive industry and is positioned at a fraction of Tesla’s valuation multiple. (Lucid)

• How Covid’s Toll Compares With Other Things That Kill Us Stacking up the disease’s impact on young and old against other causes of death in the U.S., including influenza, heart disease, car accidents and drownings. (Bloomberg)

• Studies Examine Variant Surging in California, and the News Isn’t Good Two studies confirm that a new coronavirus mutant in California is more contagious, although the scale of its threat is unclear. (New York Times) see also How the UK gained an edge with AstraZeneca’s vaccine commitments A comparison of the UK and EU contracts shows that the London’s deal has extra teeth. (Politico)

• Surf’s Up. The Temperature Isn’t. Growing numbers of surfers are taking to the Great Lakes — even when the weather is well below freezing. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Jean Hynes, incoming CEO of Wellington Management. The firm has over $1 trillion client assets under management. Hynes also runs the $51B Vanguard Healthcare Fund – the country’s largest health care fund.

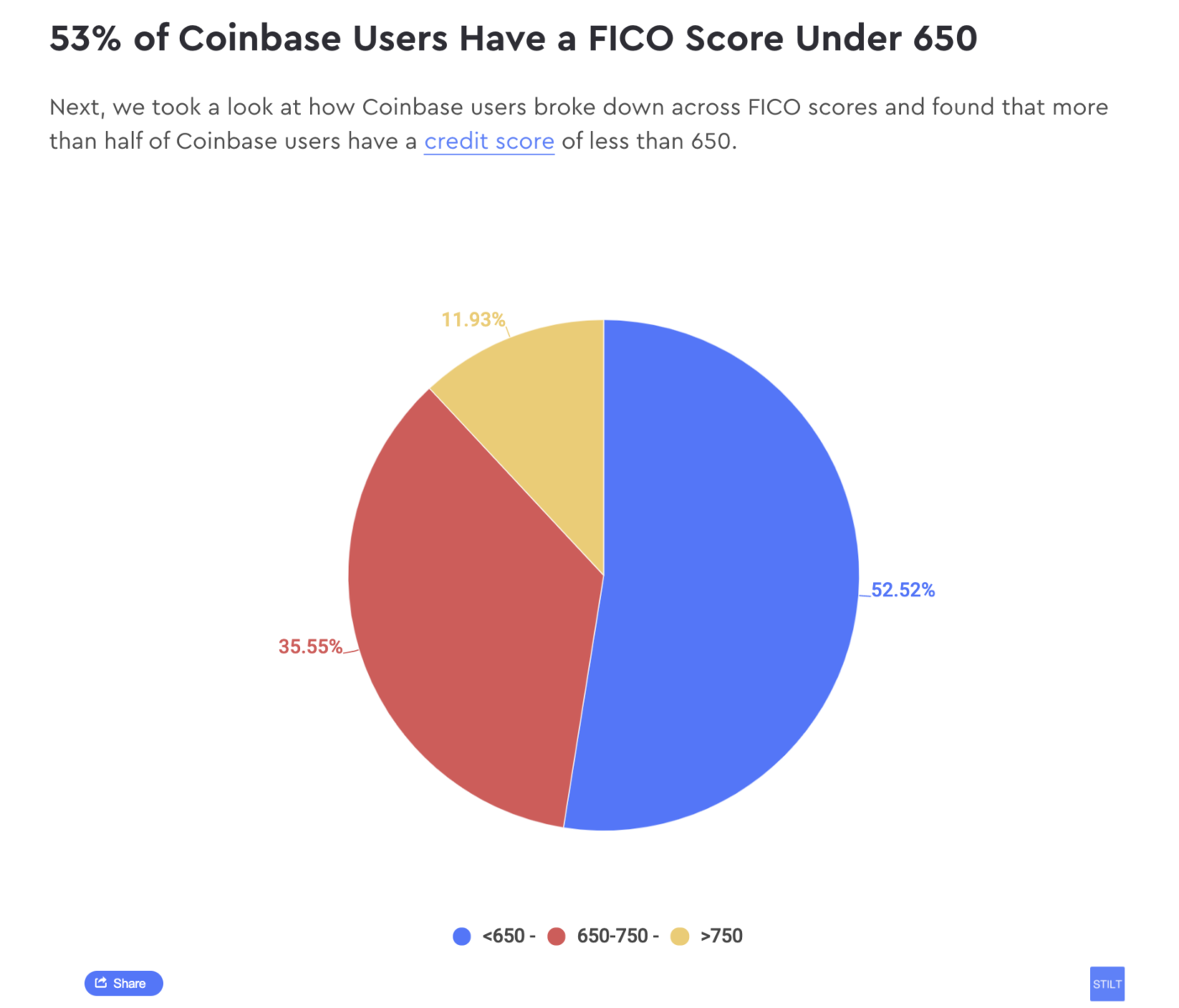

Low FICO Users Driving Crypto Growth with balances growing by 340% YoY

Source: Stilt

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.