My morning train WFH reads:

• The Mythology of Red Bull The beverage company had spent $50 million and 7 years on the Stratos project. In its quest to break the record for the highest skydive, Red Bull enlisted expert engineers, medical staff, and others from the scientific community, running unmanned and manned practice jumps at lower altitudes. It was, in its singlemindedness, a remarkable achievement and one that captured the world’s imagination. One YouTube video of the jump has been viewed 43 million times; others racked up millions more. And all of it — the years of engineering, the mortal risk— was contrived to sell a fizzy drink. Economists estimated that Red Bull derived $6 billion in value from the project. (The Generalist)

• Nearing the Topps? How a Baseball Card Company Illustrates Sentiment Now You won’t get this nexus of fads in a typical early bull market. (FI) see also The Bubble Burst Well, that was fun. Here is a look at my Top Shot account. (Irrelevant Investor)

• Free trading is like “Giving chainsaws to toddlers” With Robinhood and GameStop and the other short squeezes that are going on, there’s now a significant population of relatively young people who really believe that this is the path to effortless wealth, and they’ve already made it to easy street, and they’re quite excited about it. (Evidence-Based Investor)

• ‘They can do what they want’: Archegos and the $6tn world of the family office The implosion of Bill Hwang’s investment firm has focused attention on a pool of capital almost twice the size of hedge funds (Financial Times)

• Who’s Afraid of the Big Bad Economic Boom? There’s too much whining about the super-strong recovery. You don’t get a spurt like this without a few bruises. (Bloomberg) see also How Bidenomics Seeks to Remake the Economic Consensus Declaring end to neoliberalism, new thinkers play down constraints of deficits, inflation and incentives (Wall Street Journal)

• Rivian Will Go Where Even Tesla Doesn’t Dare Its charging map is wild, adventurous, and way less risky than relying on third parties (Green)

• When asked to fix something, we don’t even think of removing parts As a society, we seem to have mixed feelings about whether it’s better to add or subtract things, advising both that “less is more” and “bigger is better.” But these contradictory views play out across multibillion-dollar industries, with people salivating over the latest features of their hardware and software before bemoaning that the added complexities make the product difficult to use.(Ars Technica)

• You Probably Have an Asymptomatic Infection Right Now No, not COVID-19. Many, many viruses can infect humans without making us sick, and how they do that is one of biology’s deepest mysteries. (The Atlantic)

• Voting Fight Signals a Rupture Between Big Business and the GOP Trump’s racialized politics made it harder for Coca-Cola, Microsoft, and other corporations to stay on the sidelines. (BusinessWeek)

• A Tiny Particle’s Wobble Could Upend the Known Laws of Physics It’s not the next Higgs boson — yet. But the best explanation, physicists say, involves forms of matter and energy not currently known to science. (New York Times)

Be sure to check out our Masters in Business interview this weekend with John Schlifske, CEO of Northwestern Mutual. The firm underwrites over $2 trillion in life insurance, with $200 billion in client assets. Schlifske joined Northwestern Mutual in 1987 as an investment specialist, and climbed through the ranks, becoming CEO 11 years ago. The firm announced a record $6.2 billion dividend in 2021.

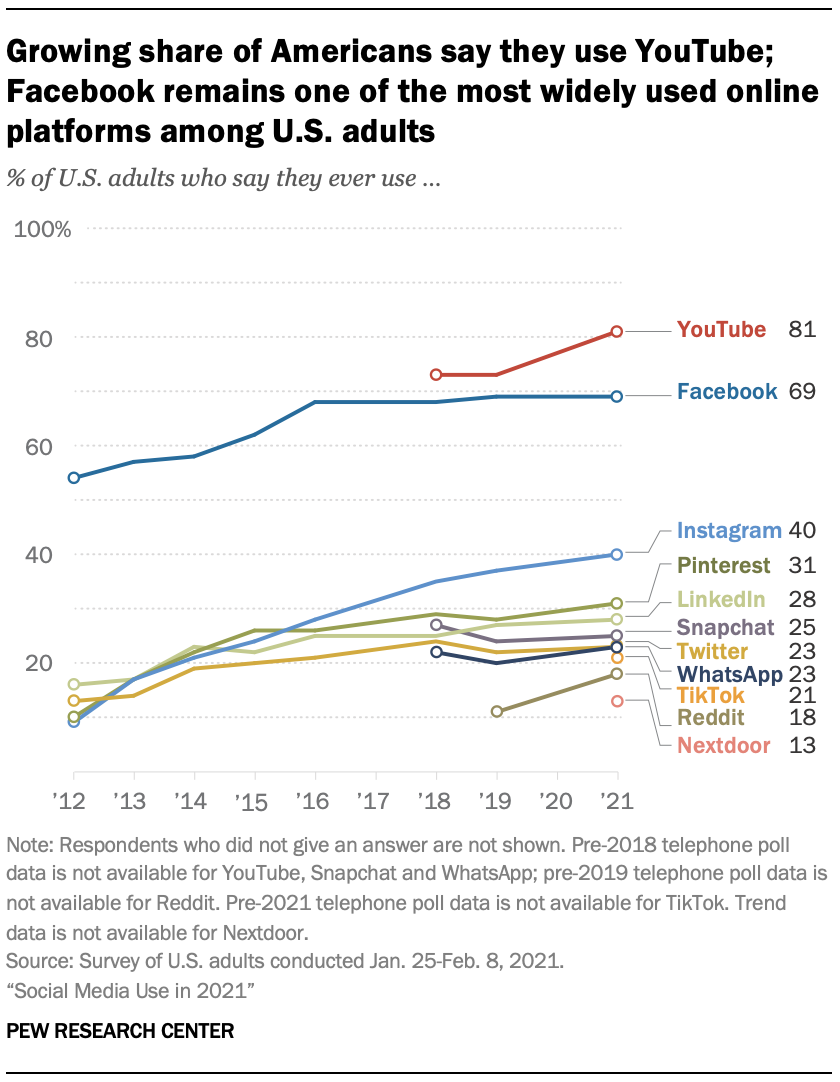

Social Media Use in 2021

Source: Pew Research Center

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.