Note: We are off to California and Arizona for a few events; no Morning Reads for the next few days…

My mid-week morning train plane reads:

• How the Swiss ‘trinity’ forced UBS to save Credit Suisse: The takeover of its local rival could end up being a generational boon for UBS. But the government-orchestrated deal has angered many investors. (Financial Times Alphaville)

• Why Job Reshoring Is Merely a Trickle: U.S. manufacturing can’t compete on cost, but it has a leg up in some areas. (CIO) see also Job Listings Abound, but Many Are Fake: In an uncertain economy, companies post ads for jobs they might not really be trying to fill. (Wall Street Journal)

• Volatility is Nothing New: I’ve been in the finance industry for close to 20 years and it feels like we’ve lived through every type of environment imaginable — booms, busts, rising rates, falling rates, 0% rates, low inflation, high inflation, deflation, bull markets, bear markets and everything in-between. Even though it feels like I’ve lived through every economic or market environment imaginable, I know there will be plenty of stuff that happens in the future that will surprise me. (A Wealth of Common Sense)

• What is a Bailout? “When an individual or company, through their own behavior and risk management, suffers a disastrous loss — but is then somehow made fully (or even partially) whole, and they do not have to suffer the impact of their own decision-making.” (The Big Picture)

• Falling Lithium Prices Are Making Electric Cars More Affordable: An unexpected decline in the price of an essential battery material, along with those of other commodities, is good news for buyers. But experts disagree on how long low prices will last. (New York Times)

• Cool People Accidentally Saved America’s Feet: Millennials popularized bulky, super-cushioned shoes. Then Millennials got old. (The Atlantic)

• Will the Ozempic Era Change How We Think About Being Fat and Being Thin? A popular, growing class of drugs for obesity and diabetes could, in an ideal world, help us see that metabolism and appetite are biological facts, not moral choices. (New Yorker)

• Iraq war, 20 years later: An insider reflects on the nightmare — and what America has learned A former State Department official reflects on the road to war and the traumas that followed. (Grid)

• Inside the 3 Months That Could Cost Fox $1.6 Billion: The decision by Fox News executives in November 2020 to treat the more hard-right Newsmax as a mortal threat spawned a possibly more serious danger. (New York Times)

• The Big Winners From A Mad First Week Of The Men’s NCAA Tournament: No teams added more to their Final Four odds than Tennessee, Michigan State and Creighton. (fivethirtyeight)

Be sure to check out our Masters in Business this week with Cliff Asness, co-founder and chief investment officer at AQR Capital Management. The quant firm manages $100 billion in 40 diversified strategies across equity and alternatives, applying mathematics to market data and making evidence-based investments. His published research can be found at Cliff’s Perspectives.

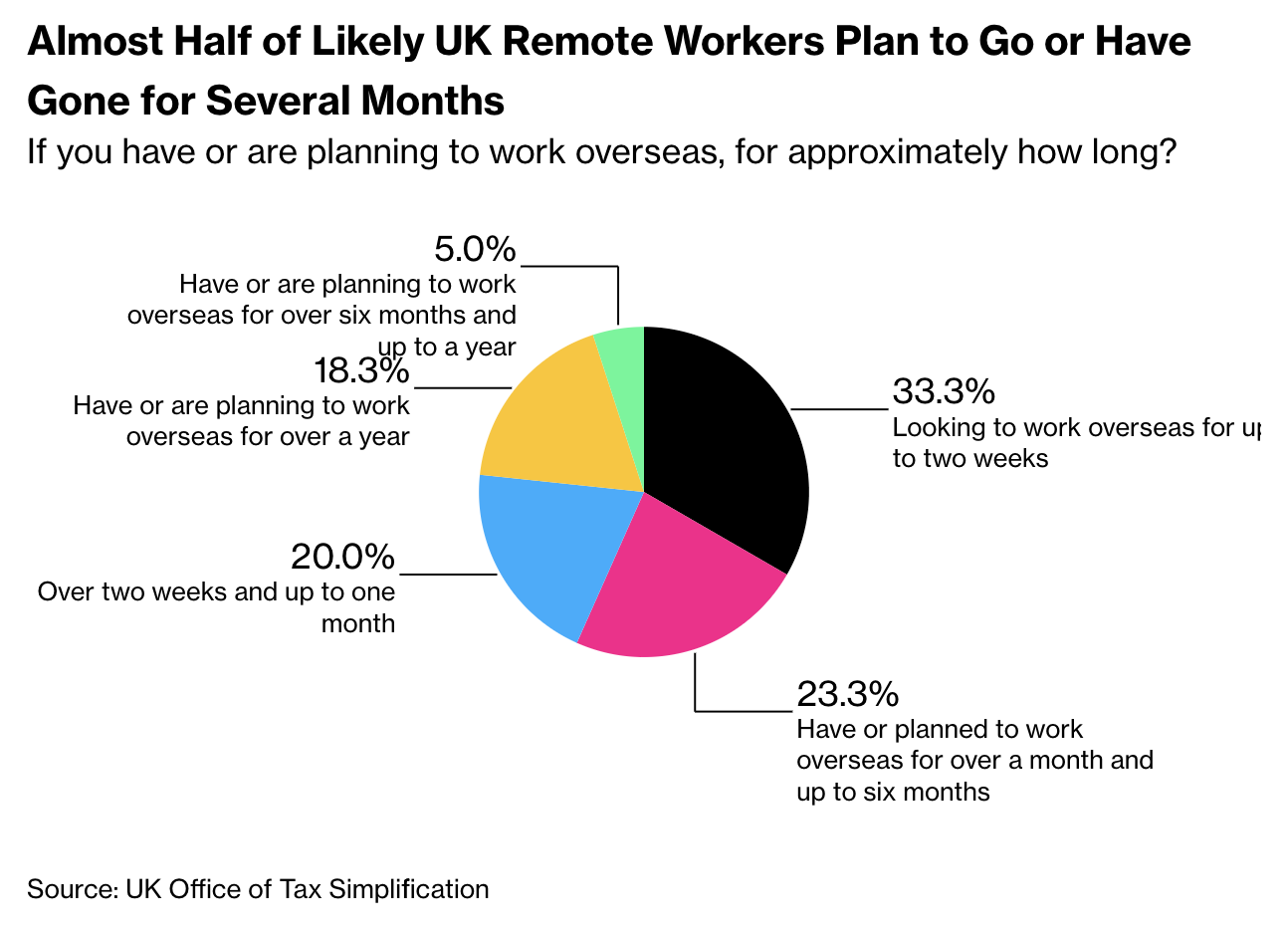

Logging Into Zoom at the Beach Could Land You a Tax Bill

Source: Bloomberg

Sign up for our reads-only mailing list here.