Every now and again, a meme pops up that cries out to have its head chopped off. The latest such idiocy: People leaving finance to find more “fulfilling” work.

I noticed this over the past week when several such articles hit my inbox: The first I saw was a sincere discussion by Mathbabe explaining why she was happy having left finance; the next was a wholly disingenuous exit tale about Chelsea Clinton leaving a hedge fund for that “Career With Meaning.”

There may be underlying elements of truth in each of these tales, but they are undercut by lots of self-rationalization. Before we get to that, let’s look at two key elements that put this into broader context:

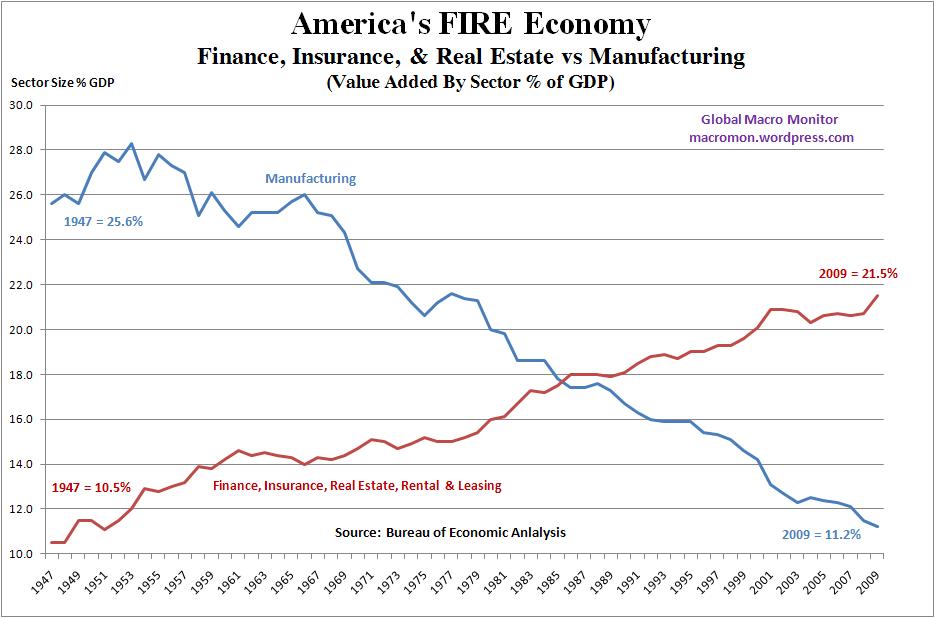

The first is the multi-decade “Financialization” of the US economy. Over a 30+ year period, that financialization led to excess salaries, enormous bonuses, and a huge number of people flowing into Wall Street who otherwise would never give finance a second glance. (Nassim Taleb calls this “mis-financialization”) I do not in anyway want to discourage the people who are now leaving finance – especially those of you who are here for the wrong reasons. Please, don’t let the door hit you in the ass on the way out.

For the rest of you, let’s delve deeper.

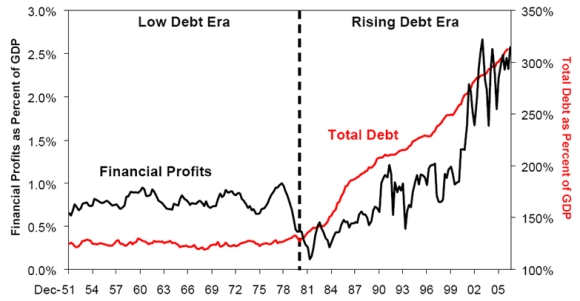

Exactly what do we mean by Financialization? It is the process by which Finance as a sector that was previously serving other industries and individuals had morphed into an industry serving mostly itself. In the US, financialization was accompanied by 1) a significant elevation of finance that 2) a dramatic increase in overall debt, systemic leverage leading to 3) broad transfers of revenue and profits from the “real” economy to the financial sector and 4) a significantly greater policy influence by Wall Street bankers (as well as capital markets). This culminated in 5) the credit crisis and 6) TARP and the Wall Street bailouts of 2008-09.

Source: Peakwatch

We can debate the details, but speaking broadly, this came about due to the combination of massive financial leverage, increased corporate debt, decreased cost of capital, and regulatory capture by the industry. The net result of this was finance became an outsized portion of the S&P500 profits, rising from 12% to 23% over a few decades. Bill Black points out that over forty years, “our real economy grew better with a financial sector that received one-twentieth as large a percentage of total profits (2%) than does the current financial sector (40%).”

Source: Macroman

The net result of all this was an enormous amount of money sloshing through the sector – and a huge influx of people into the sector. Many came for the money, and later rationalized they were here for “purer” reasons. The competition for talent – primarily in mathematics and computer science but also in academia, sales and other fields – was fierce. Bonuses became enormous. Finance drew too many people from these other areas who harbored dreams of avarice.

Consider for a moment the BusinessWeek article about Chelsea Clinton. She was hired as 26 year old by Avenue Capital Group, a NY hedge fund whose founders had ties to the Democratic party. Why? Was it because she would eventually get a Master’s degree in public health from Columbia University?

No. She was hired because her father was the former President of the United States. Gee, why wouldn’t that be personally fulfilling and meaningful?

I have only a touch more sympathy for the story Cathy O’Neil, a former D. E. Shaw analyst and now blogging as the mathbabe, tells. She left her hedge fund finance job, and is now working at a start-up. This I find to be rather ironic: The grab for the brass ring is still there, only instead of enormous salary and bonuses, the payoff comes when the start-up finds an exit strategy through being acquired or going public. I expect to read a sad “Leaving a start-up” post in 3 years, complaining about the insanely long hours, deeply unfilling work, and the unreasonable demands of their Venture Capitalists.

Meet the new boss, same as the old boss.

The bottom line is that if you came to finance for the vast riches, you are here for the wrong reason. You might as well join the NBA and hope to be the next Michael Jordan.

The personal ruin of the people who came to finance, leveraged up and are now suffering is tragic. It is the high rent version of the sub-prime borrowers who got in over their heads.

There are lots of reasons to work in finance, but if your prime motivation is money, what happens when the money slows or even stops? Many of these are the folks now exiting stage left. They came to pan for gold, and left when the vein ran dry.

Good riddance, I say.

Sources:

Chelsea Clinton Exited Wall Street to Seek Career With Meaning

Lindsey Rupp

BusinessWeek, October 03, 2012

http://www.businessweek.com/news/2012-10-03/chelsea-clinton-exited-wall-street-to-seek-career-with-meaning

Telling people to leave finance

MathBabe September 30, 2012

http://mathbabe.org/2012/09/30/telling-people-to-leave-finance/

Banks should learn to say “Just Go”

Hugo Dixon

Reuters, September 24, 2012

http://blogs.reuters.com/hugo-dixon/2012/09/24/hugo-dixon-banks-should-learn-to-say-just-go/

Previously:

Advice to a Young Market Participant (March 5th, 2010)

How Hard is it to Become the Michael Jordan of Trading? (July 14th, 2011)

Further Reading:

Those of you who want to explore the concept of Financialization have a number of books

Kevin Philips, Bad Money: Reckless Finance, Failed Politics, and the Global Crisis of American Capitalism

Matt Taibbi, Griftopia: A Story of Bankers, Politicians, and the Most Audacious Power Grab in American History

Michael Hudson, The Monster: How a Gang of Predatory Lenders and Wall Street Bankers Fleeced America–and Spawned a Global Crisis

Dylan Ratigan, Greedy Bastards: How We Can Stop Corporate Communists, Banksters, and Other Vampires from Sucking America Dry

John Authers, The Fearful Rise of Markets: Global Bubbles, Synchronized Meltdowns, and How To Prevent Them in the Future

What's been said:

Discussions found on the web: