Index-Investing Critic Takes Aim, Fires, Misses New arguments against low-cost, passive investing are no better than the old ones....

Read More

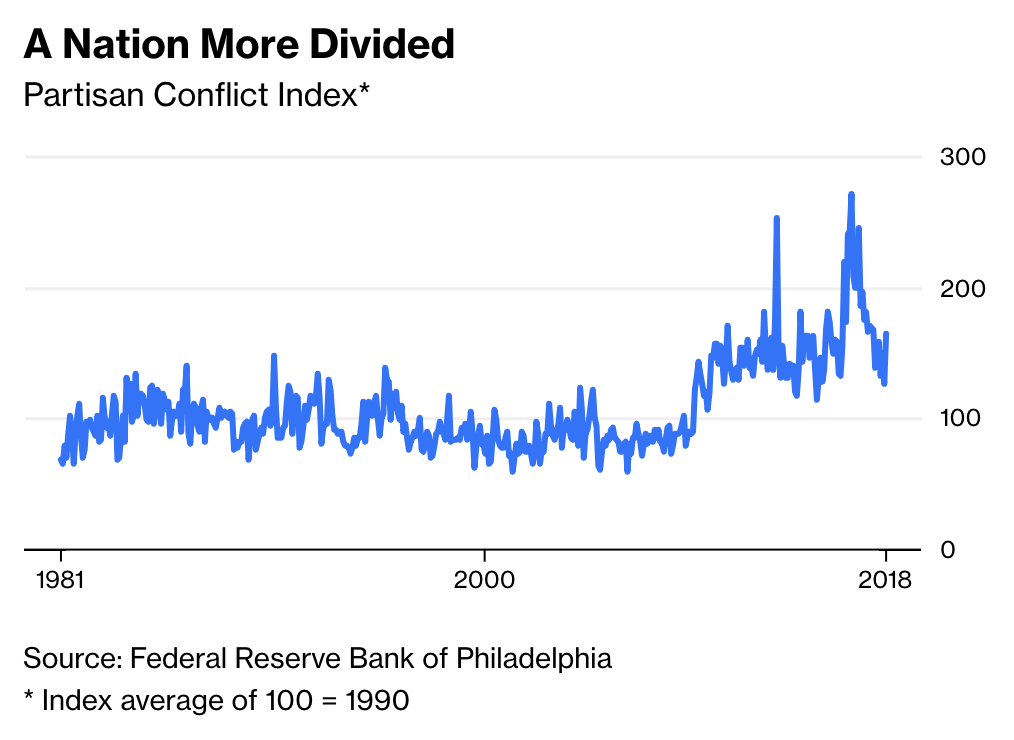

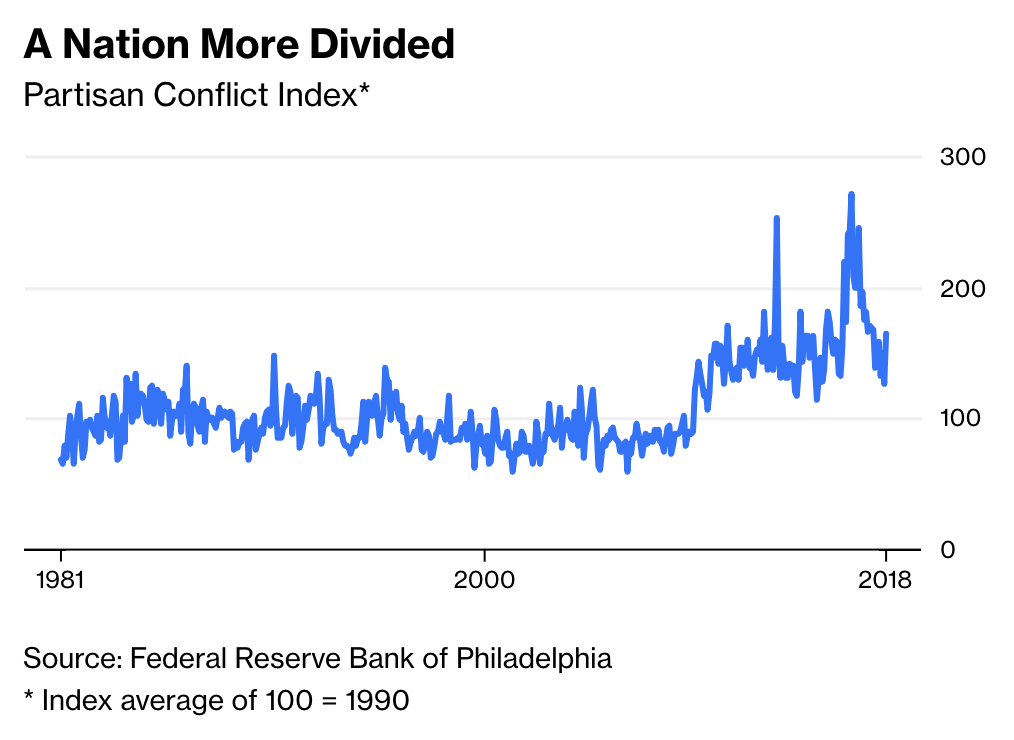

Don’t Like Trump? Your Financial Analysis Might Be Biased Partisanship should have no place in a corporate-credit rating. A new study...

Don’t Like Trump? Your Financial Analysis Might Be Biased Partisanship should have no place in a corporate-credit rating. A new study...

Read More

Don’t Like Trump? Your Financial Analysis Might Be Biased Partisanship should have no place in a corporate-credit rating. A new study...

Read More

I was saddened to learn today that Paul Desmond of Lowry’s Research has passed away. Paul was instrumental in our understanding of...

Read More

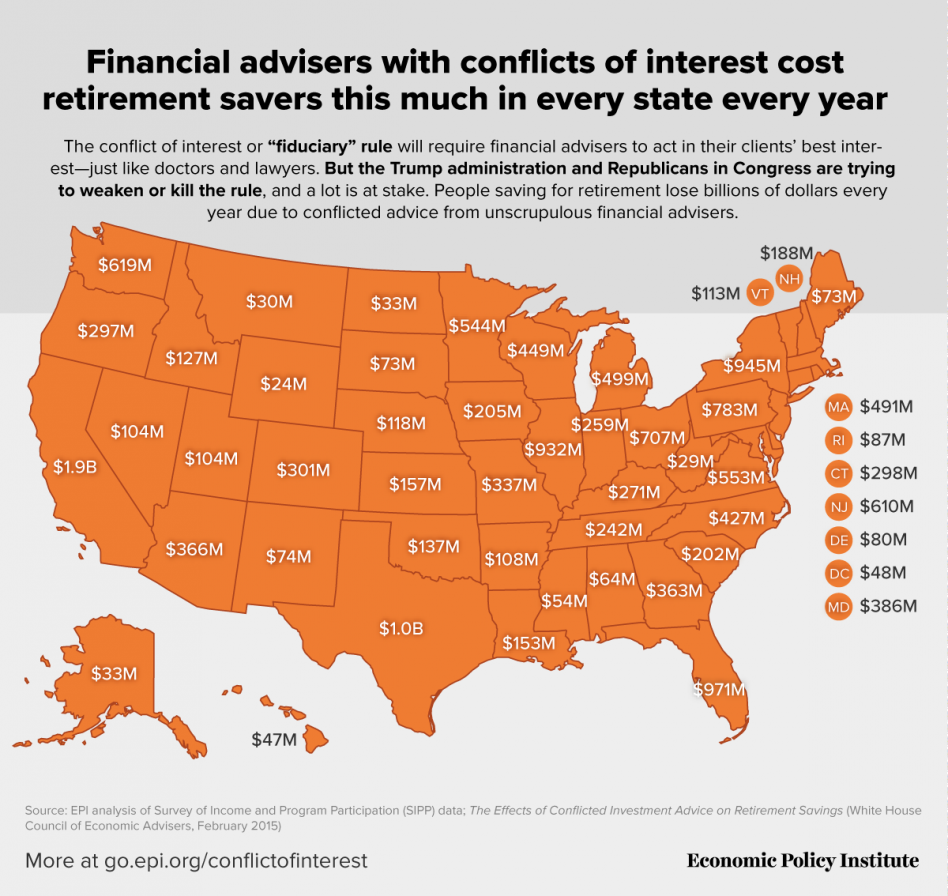

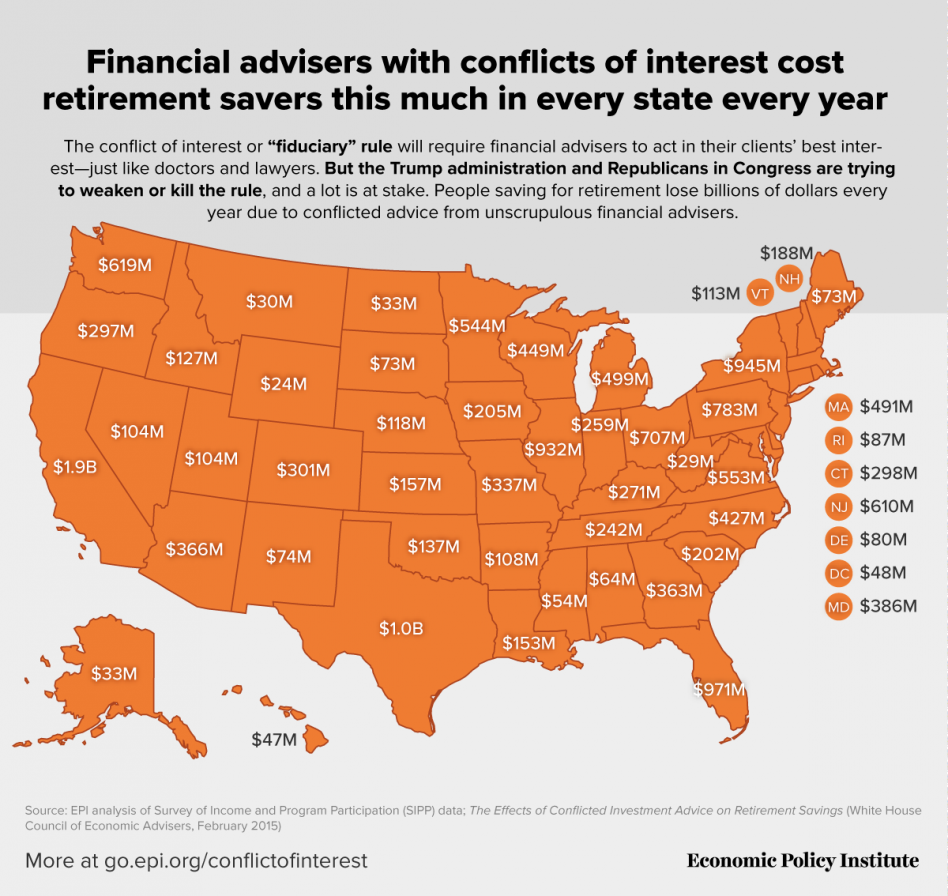

Source: Economic Policy Institute We have been discussing the fiduciary standard of care owed to investors for some time...

Source: Economic Policy Institute We have been discussing the fiduciary standard of care owed to investors for some time...

Read More

Wall Street Wises Up to the Folly of Forecasting One economist says what should be obvious: Making predictions only means you will be...

Read More

Morningstar’s Star System Was Always a Bright Shiny Object The ratings look backward and give a false sense of comfort. Bloomberg,...

Read More

One of my favorite behavioral economists, Richard Thaler, has finally been moved off of the short list: The Royal Swedish Academy of...

Read More

This week’s MiB is with Matthew Rothman, currently head of Global Quantitative Equity Research at Credit Suisse, and Senior...

Read More

If you want to have a better understand why Howard Marks is considered one of the all time greats in investing, have a look at this...

Read More

Don’t Like Trump? Your Financial Analysis Might Be Biased Partisanship should have no place in a corporate-credit rating. A new study...

Don’t Like Trump? Your Financial Analysis Might Be Biased Partisanship should have no place in a corporate-credit rating. A new study...

Source: Economic Policy Institute We have been discussing the fiduciary standard of care owed to investors for some time...

Source: Economic Policy Institute We have been discussing the fiduciary standard of care owed to investors for some time...