Silicon Valley Bank depositors made whole; Credit Suisse counter-parties saved; First Republic bondholders protected — are...

Silicon Valley Bank depositors made whole; Credit Suisse counter-parties saved; First Republic bondholders protected — are...

Read More

The news broke Sunday afternoon that depositors would be made whole and would have full access to their accounts and money today;...

The news broke Sunday afternoon that depositors would be made whole and would have full access to their accounts and money today;...

Read More

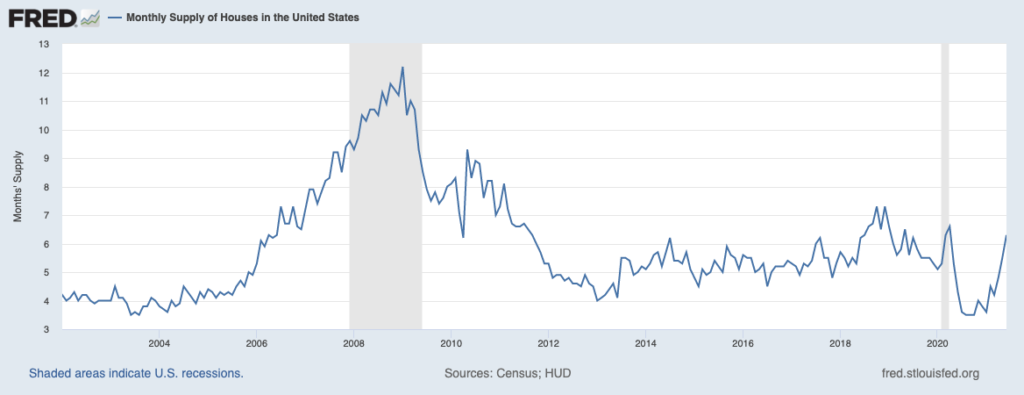

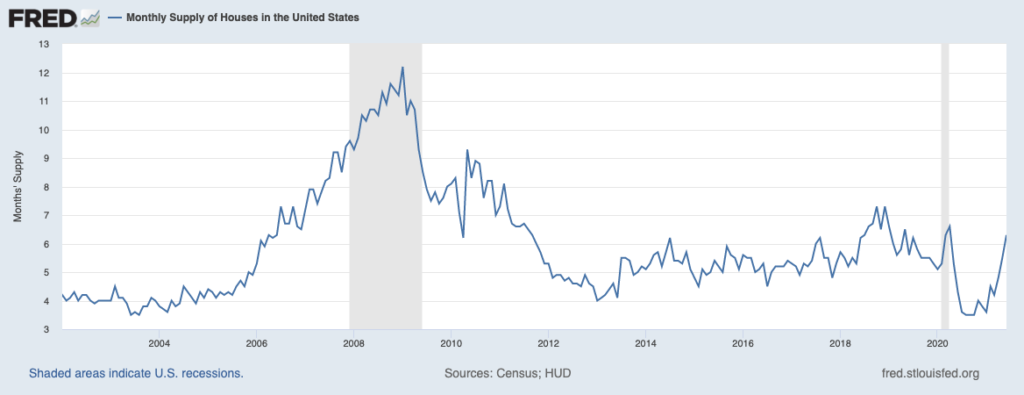

To hear an audio spoken word version of this post, click here. Why are there too few houses in general, and...

To hear an audio spoken word version of this post, click here. Why are there too few houses in general, and...

Read More

Bad Explanations for the Financial Crisis Won’t Die Sorry, but the simple explanations don’t hold up. The causes were many,...

Read More

In my recent conversation with Scaramucci, he said some lovely things about Bailout Nation. Afterwards, I went back to look over some...

Read More

Today is the eighth anniversary of the Lehman Brothers bankruptcy. Not enough time has passed yet for me to recall those anxious days...

Read More

Let’s Put the Lehman Bailout Debate to Rest Rescuing the securities firm wouldn’t have mattered. The financial crisis was...

Read More

Lessons from the Crisis: Ending Too Big to Fail Neel Kashkari | President Brookings Institution, Washington, D.C. February 16, 2016...

Read More

The ‘Big Short’ Gets It Right Explanations driven by ideology don’t hold up. Bloomberg, January 6, 2016 ...

Read More

One of the most widely anticipated films of the holiday season was released to big audiences and wide acclaim. It tells the tale of an...

Read More

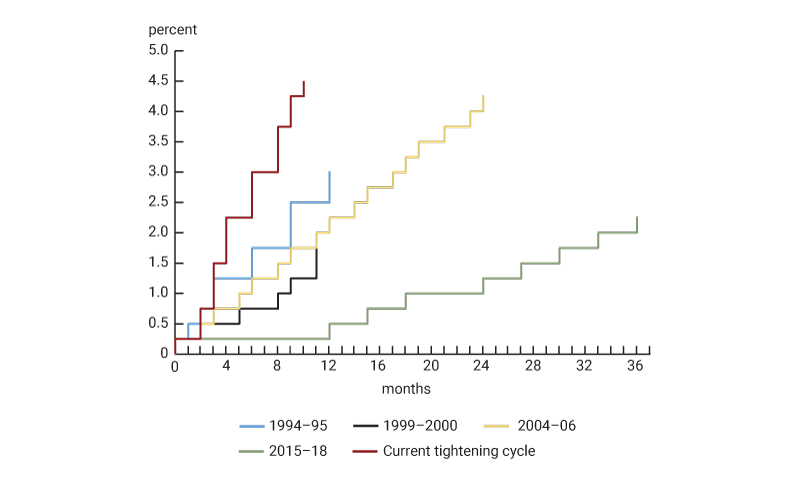

Silicon Valley Bank depositors made whole; Credit Suisse counter-parties saved; First Republic bondholders protected — are...

Silicon Valley Bank depositors made whole; Credit Suisse counter-parties saved; First Republic bondholders protected — are...

Silicon Valley Bank depositors made whole; Credit Suisse counter-parties saved; First Republic bondholders protected — are...

Silicon Valley Bank depositors made whole; Credit Suisse counter-parties saved; First Republic bondholders protected — are...