My RWM colleagues Josh Brown and Michael Batnick do a bang-up job each week diving into the specifics of the newsflow in What Are...

My RWM colleagues Josh Brown and Michael Batnick do a bang-up job each week diving into the specifics of the newsflow in What Are...

Read More

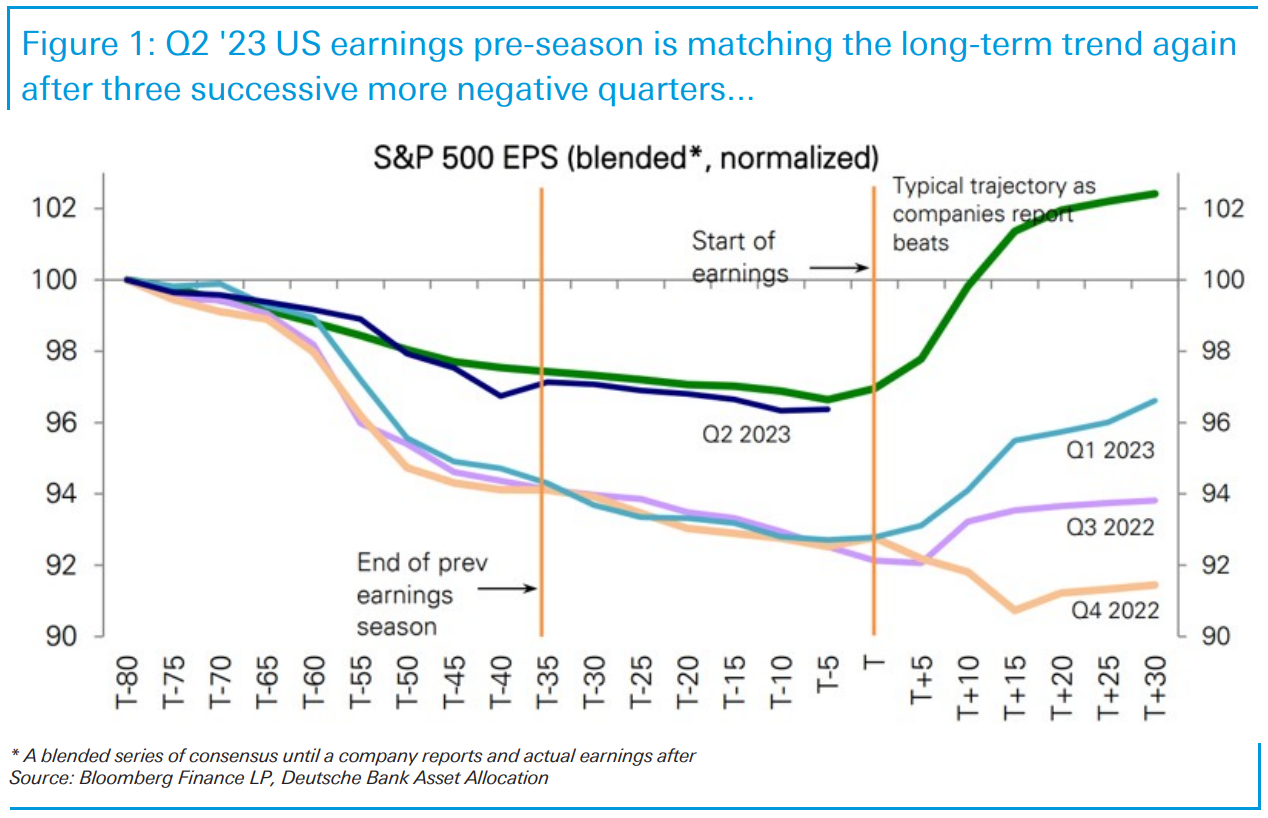

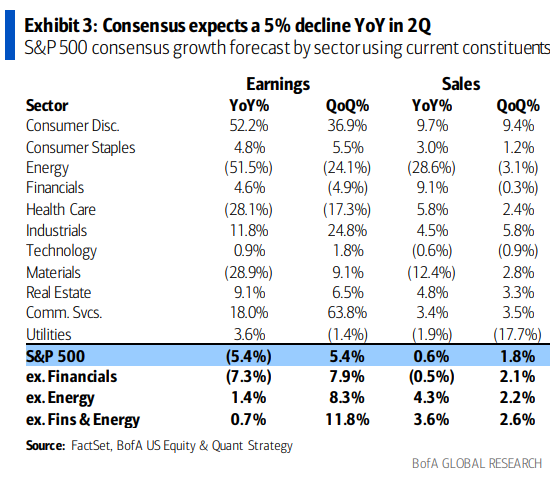

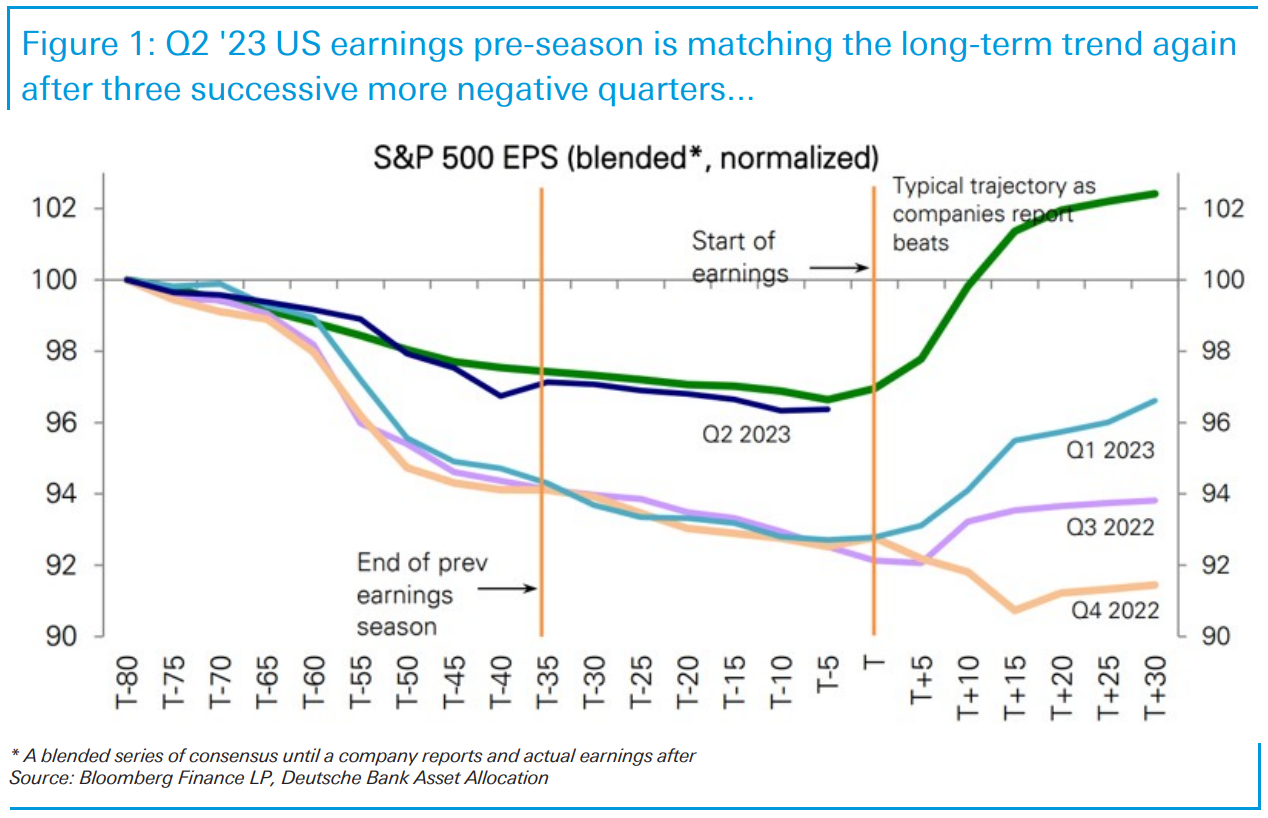

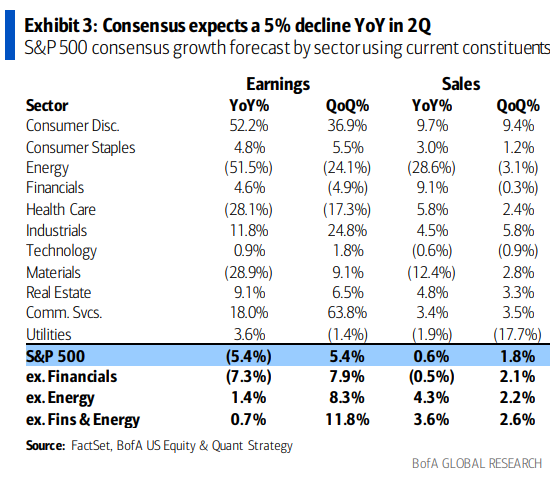

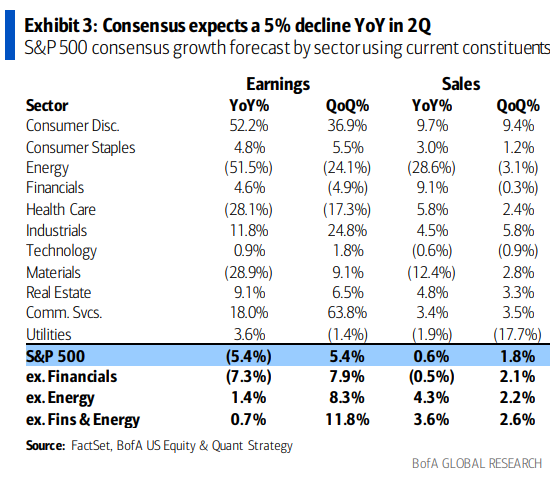

Jim Reid of Deutsche Bank notes the pattern of gradual downgrades before earnings season begins is back to normal. As the rest of...

Jim Reid of Deutsche Bank notes the pattern of gradual downgrades before earnings season begins is back to normal. As the rest of...

Read More

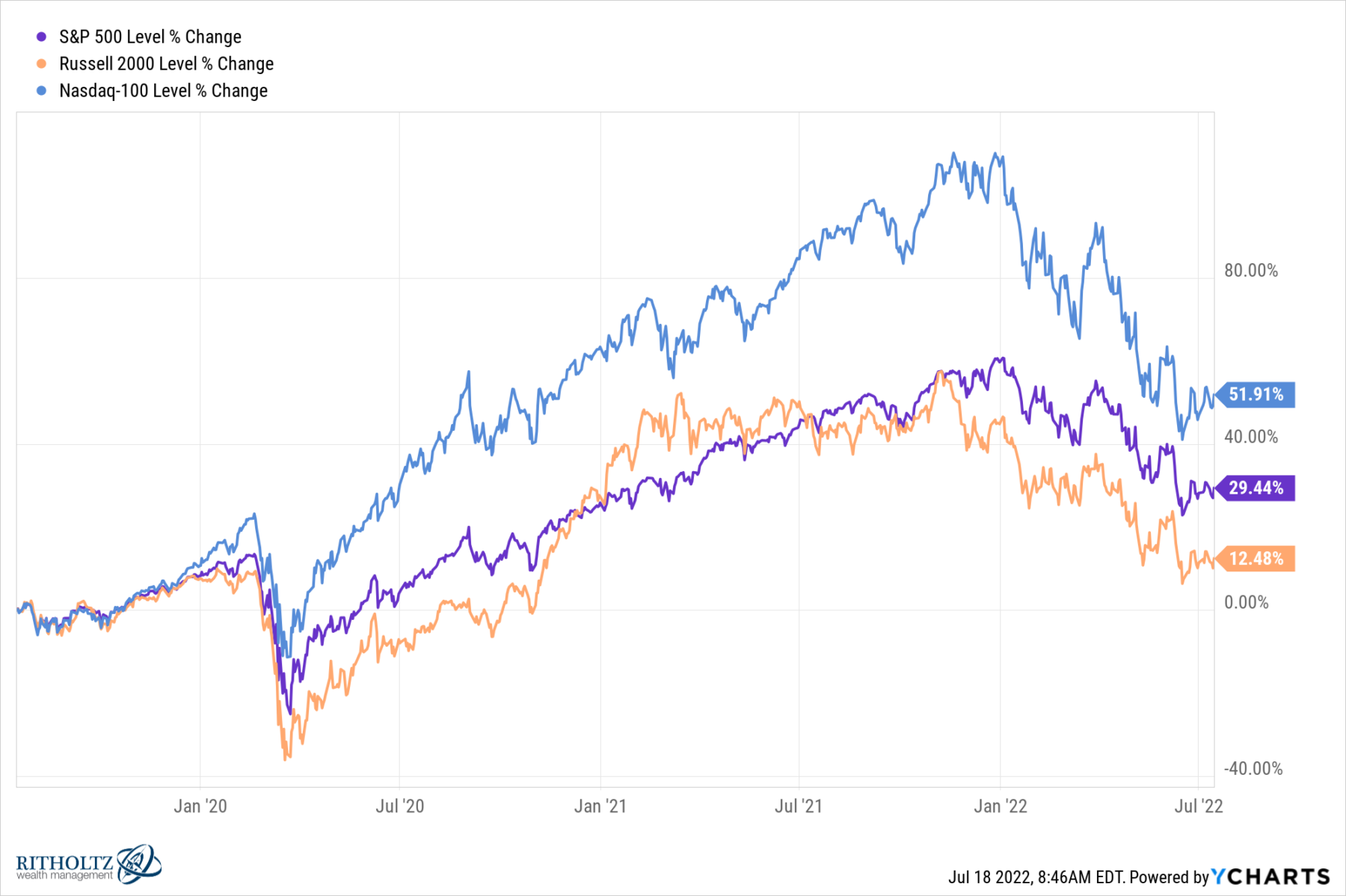

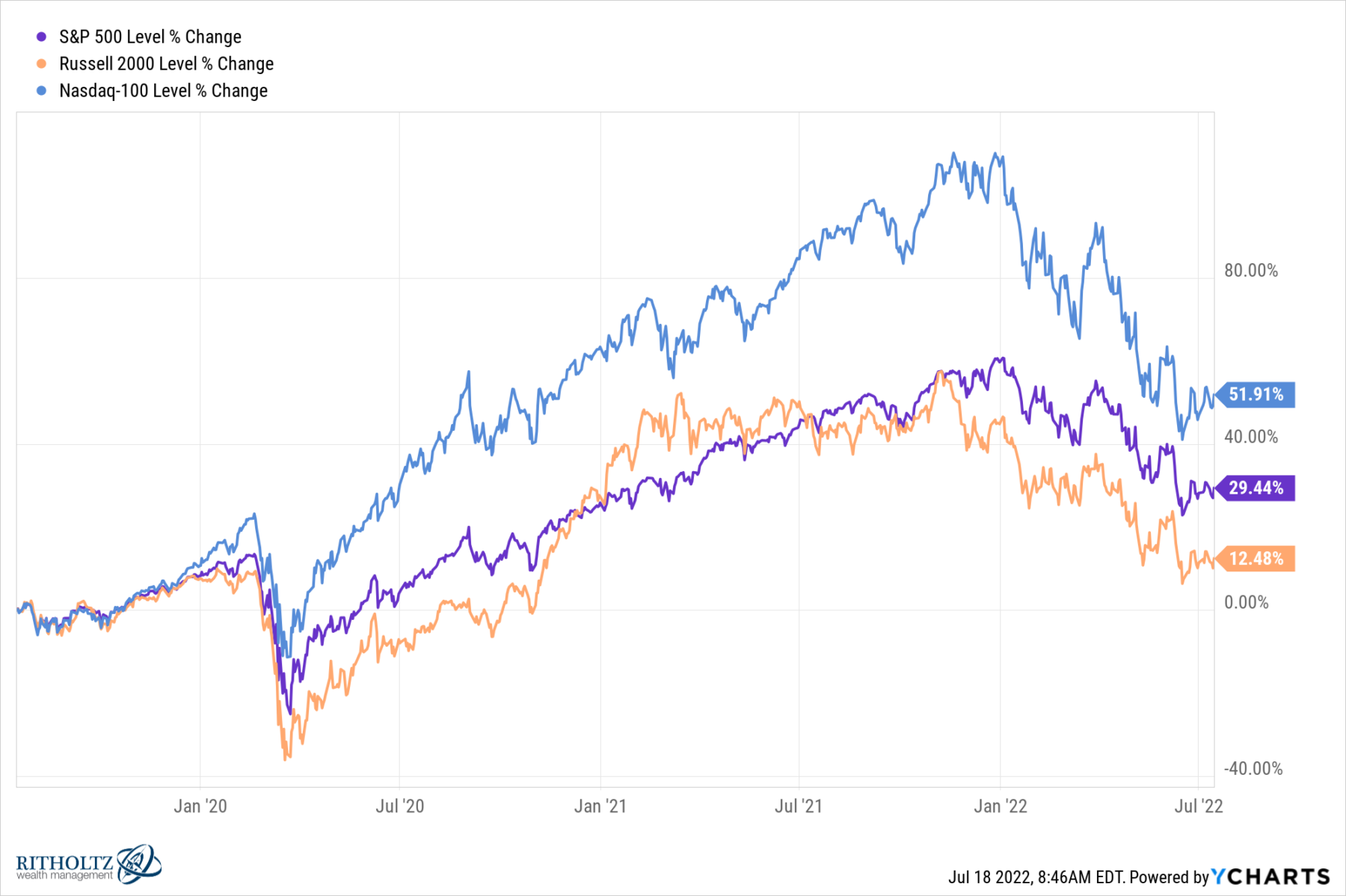

Ignore the emojis in the headline long enough to ask yourself this question: What might the rest of 2022 look like? I did...

Ignore the emojis in the headline long enough to ask yourself this question: What might the rest of 2022 look like? I did...

Read More

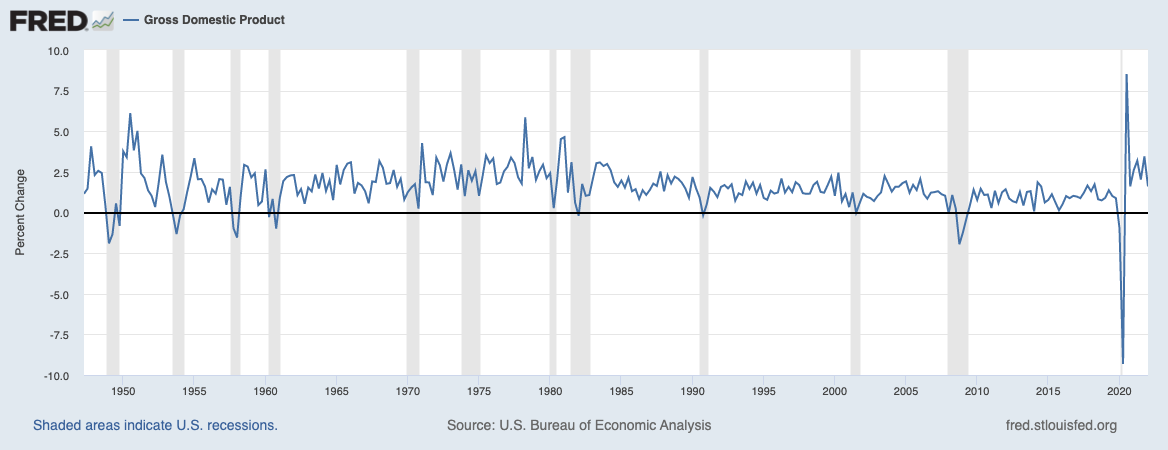

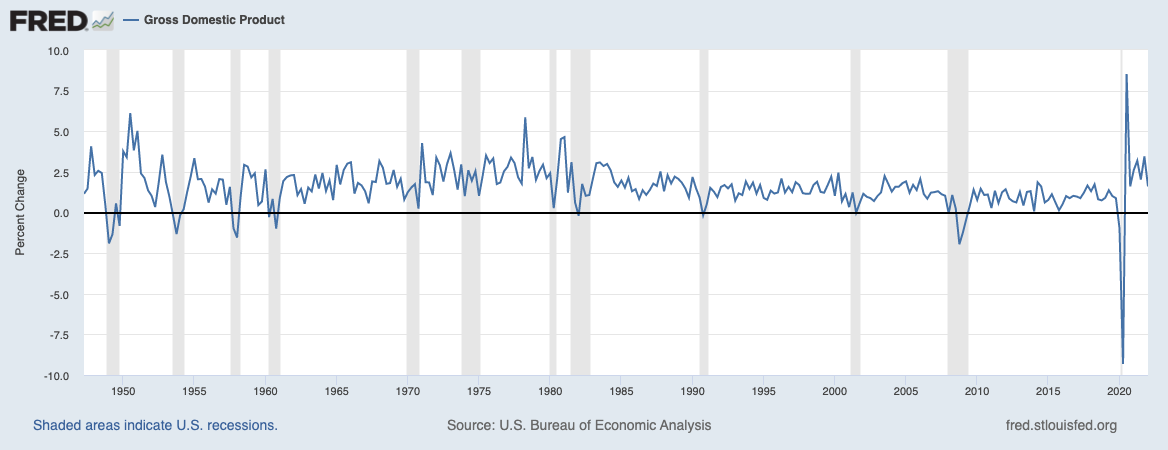

There is some confusion about a) What a recession actually is, and b) Why it matters. Sometimes, ideas we think of as...

There is some confusion about a) What a recession actually is, and b) Why it matters. Sometimes, ideas we think of as...

Read More

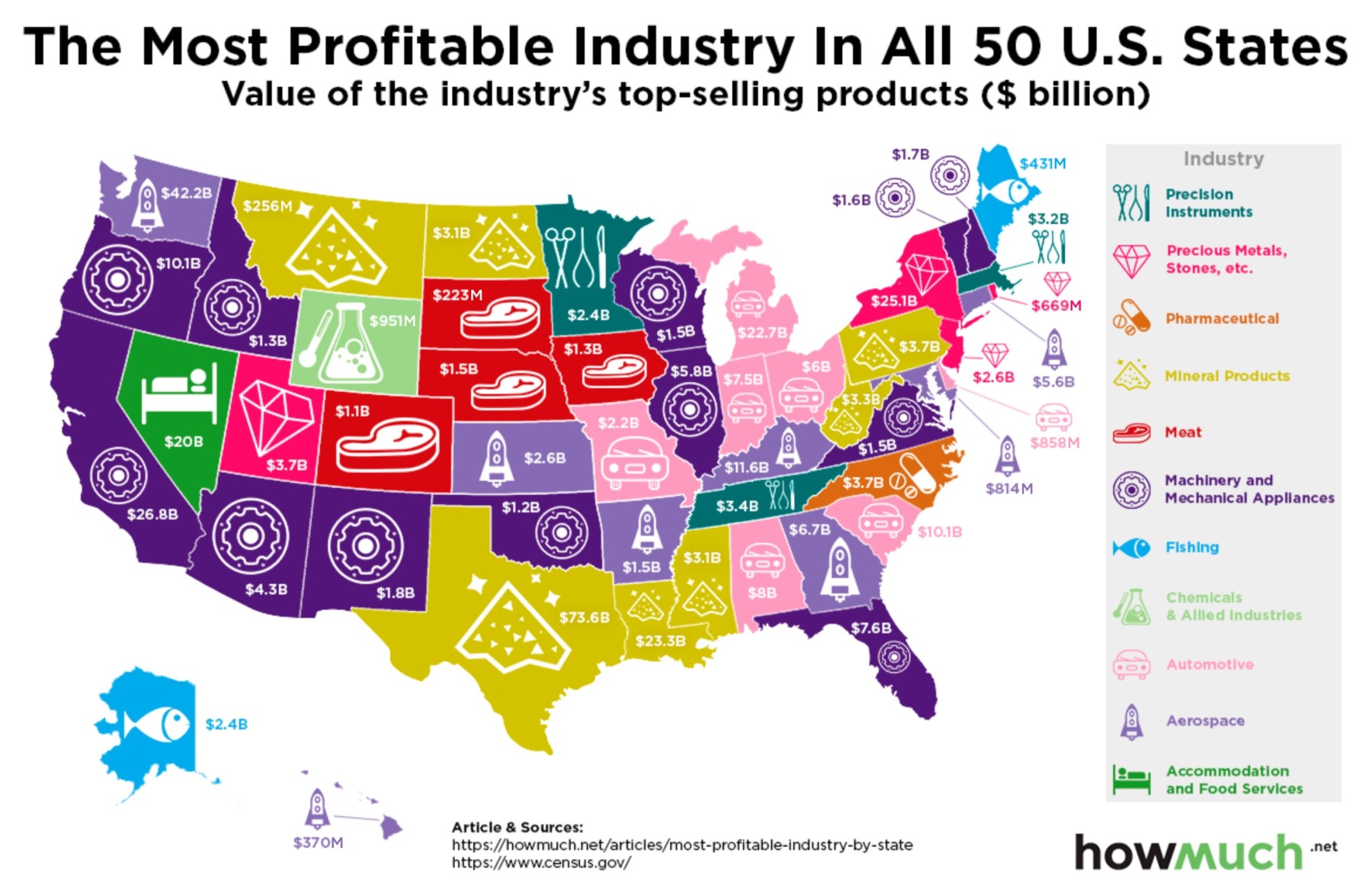

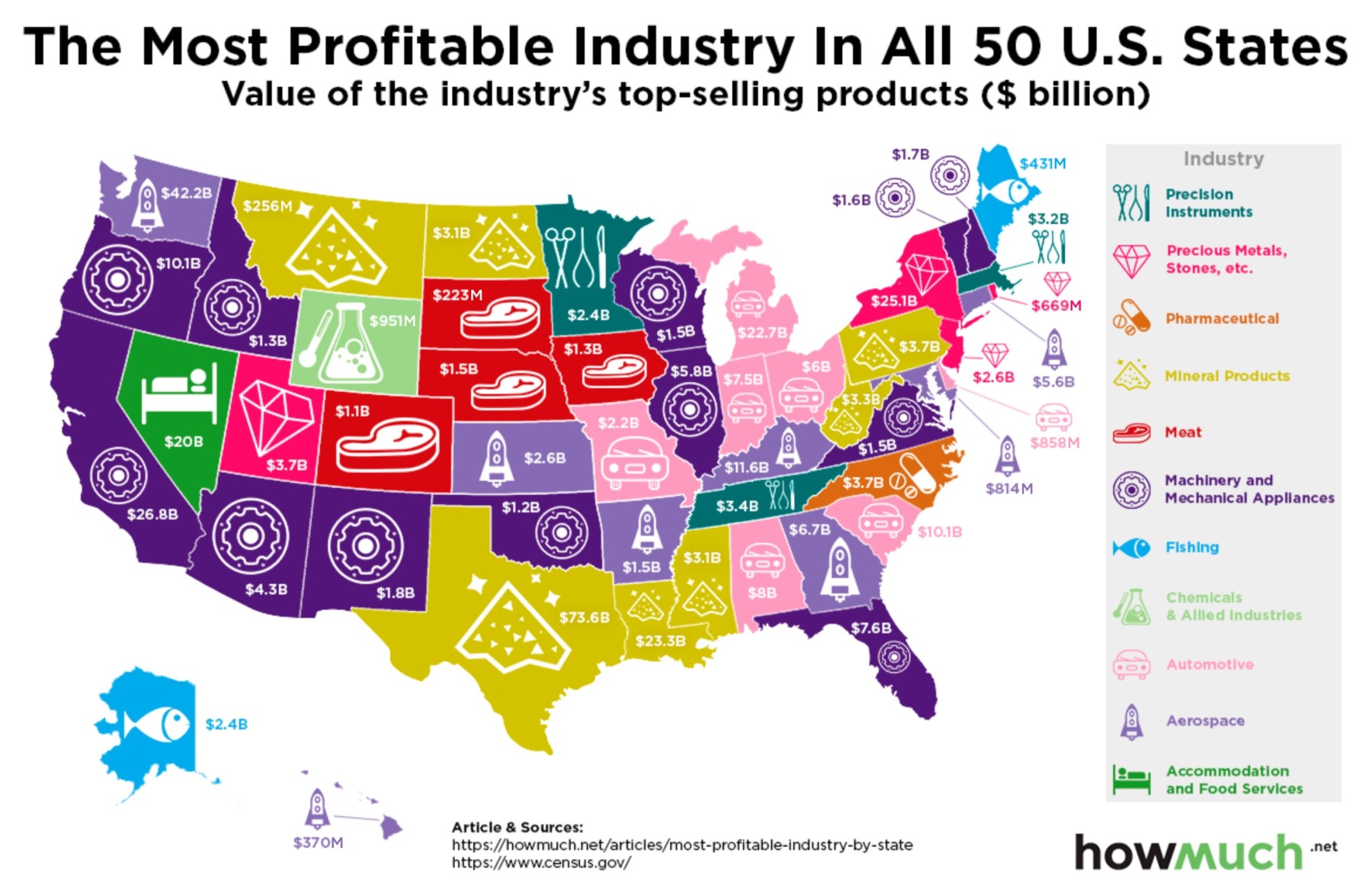

Source: How Much This is kind of fun: based on data compiled by 2017 US Census Bureau data, what is the value of each...

Source: How Much This is kind of fun: based on data compiled by 2017 US Census Bureau data, what is the value of each...

Read More

Josh and I discuss a recent Bloomberg column of mine — Report Earnings Daily — debating what quarterly earnings report does...

Read More

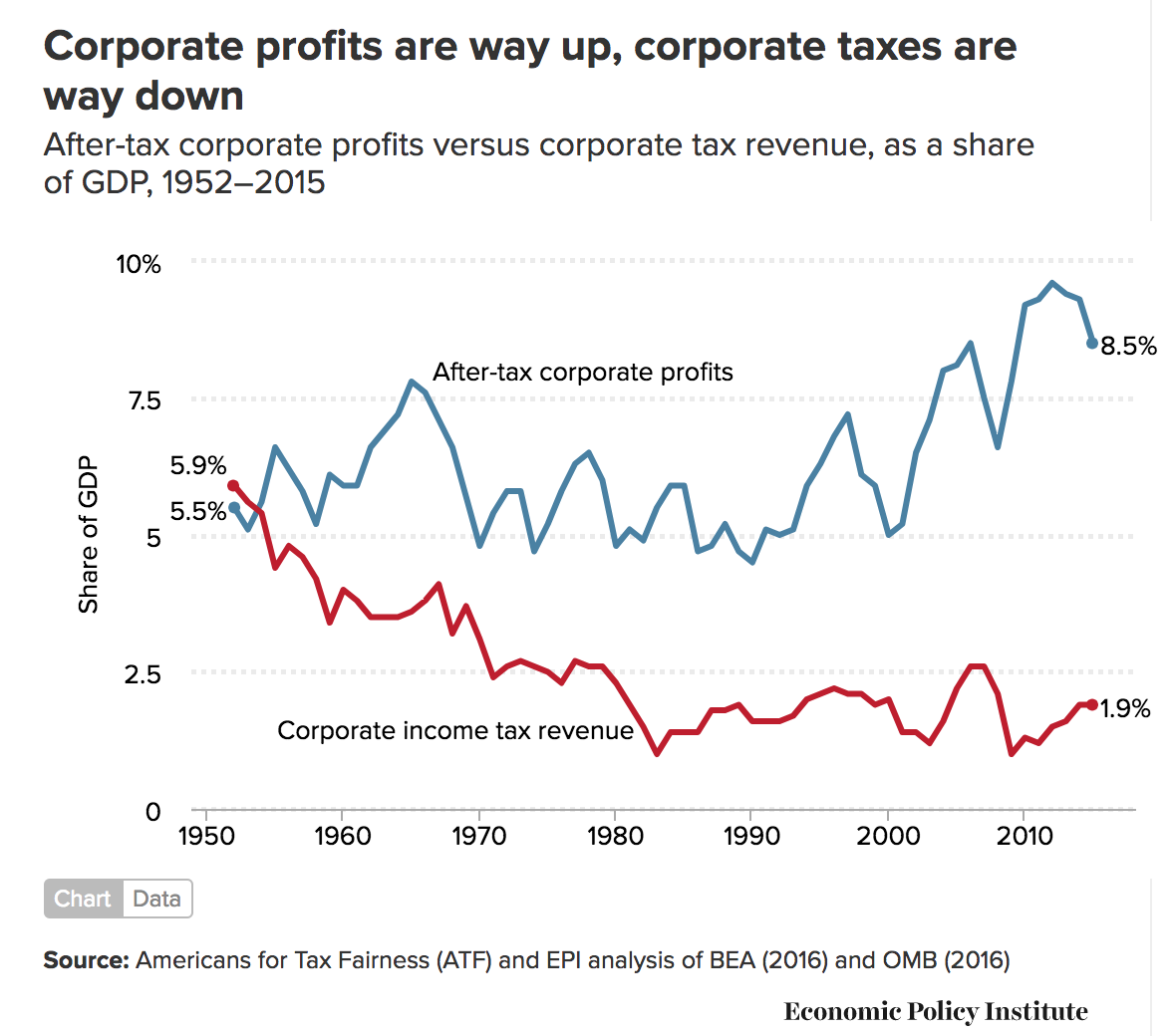

Reporting Profits Daily Would End Corporate Short-Termism Think there’s too much hoopla about quarterly earnings? Imagine if the circus...

Read More

Reporting Profits Daily Would End Corporate Short-Termism Think there’s too much hoopla about quarterly earnings? Imagine if the circus...

Read More

Inflation Is Coming Thanks to Trump’s Tariffs Levies on steel and aluminum have yet to filter through to prices. But they will....

Inflation Is Coming Thanks to Trump’s Tariffs Levies on steel and aluminum have yet to filter through to prices. But they will....

Read More

My RWM colleagues Josh Brown and Michael Batnick do a bang-up job each week diving into the specifics of the newsflow in What Are...

My RWM colleagues Josh Brown and Michael Batnick do a bang-up job each week diving into the specifics of the newsflow in What Are...

My RWM colleagues Josh Brown and Michael Batnick do a bang-up job each week diving into the specifics of the newsflow in What Are...

My RWM colleagues Josh Brown and Michael Batnick do a bang-up job each week diving into the specifics of the newsflow in What Are...