Trading Football for Finance (and Vice Versa)

What do you do as a football coach when the sheriff serves divorce papers on you? if you are Joe Moglia, you join...

To hear an audio spoken word version of this post, click here. I am crypto curious. You might have read that...

To hear an audio spoken word version of this post, click here. I am crypto curious. You might have read that...

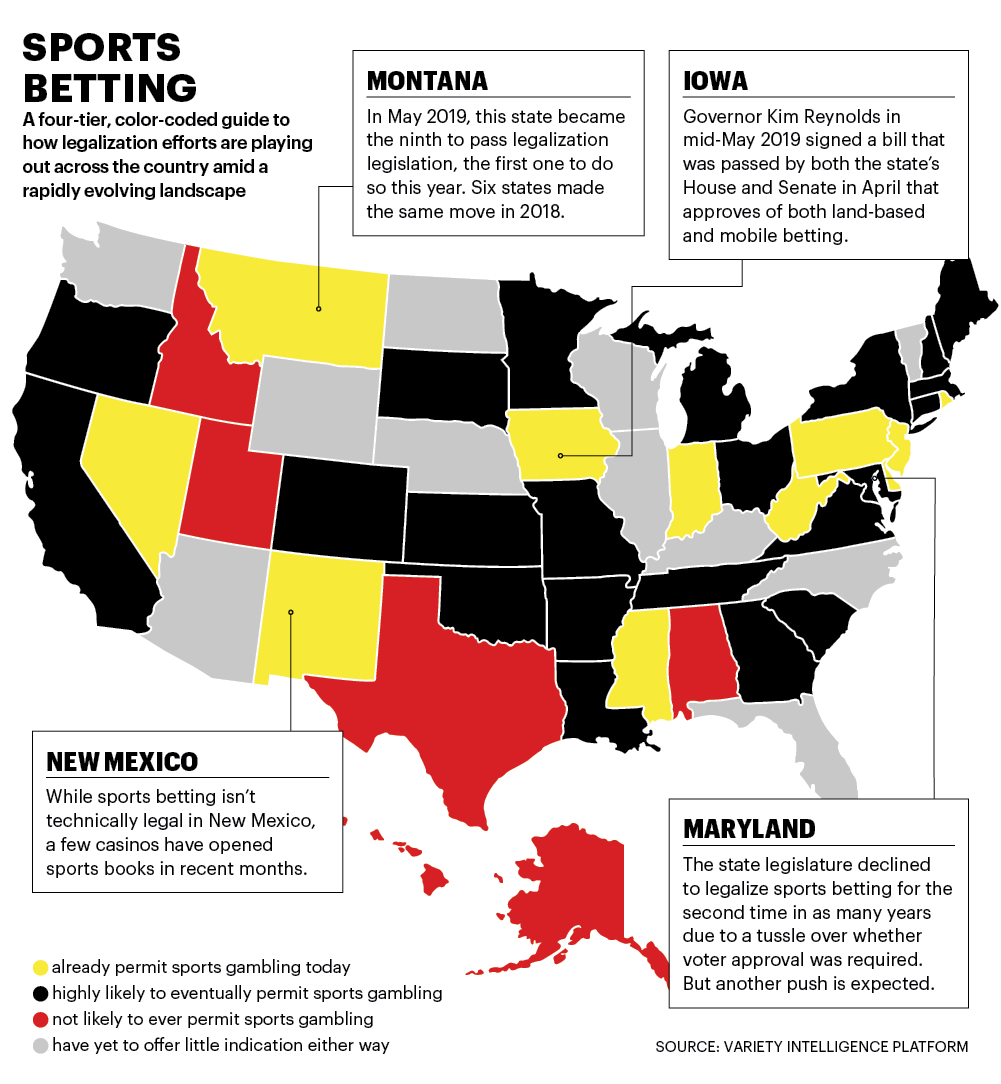

Sports betting is now legal in 11 states (including Nevada). Source: Variety Its been a year since the U.S. Supreme Court struck...

Sports betting is now legal in 11 states (including Nevada). Source: Variety Its been a year since the U.S. Supreme Court struck...

Get subscriber-only insights and news delivered by Barry every two weeks.