I keep repeating I am not a fan of the 1987 parallel to 2007. I am not saying its impossible — just less likely than other potential parallels (My choice is 1973, Doug Kass’ is 1937).

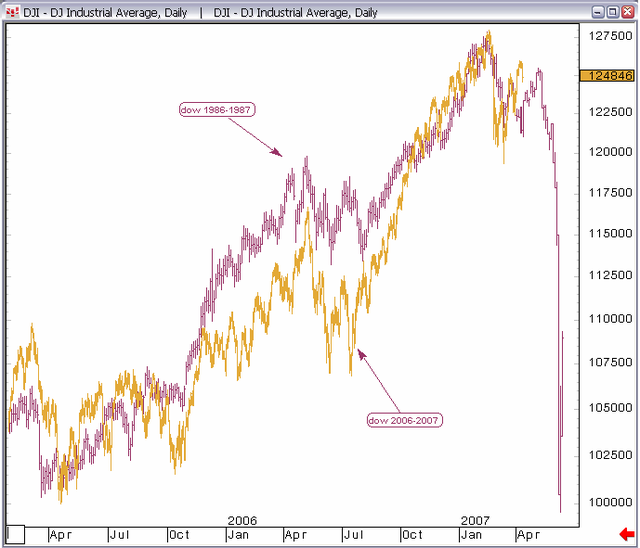

Yet many readers keep drawing my attention to the 1987 conclusion. As a service to those of you who find this compelling, here is an overlay of the chart several of you have sent in.

>

Dow Industrials 1986-87 – 2006-07

>

UPDATE: April 20, 2007 6:21am

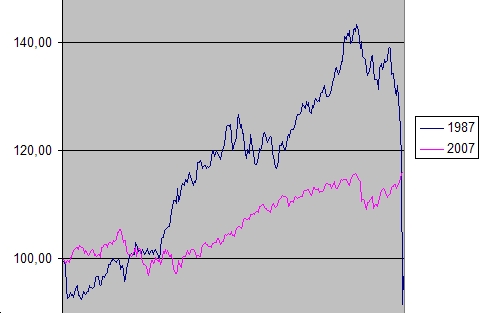

This chart (courtesy of Charles) shows the scale of the run up between the two eras to be very different . . .

Barry – have to say I was with you but if one believes that patterns ar truth and repeat that’s a scary chart. Just for us learning- and memory-impaired types could you re-fresh us on what’s different about the economy ? And what’s different about the markets ?

To my understanding we had a major inflation worry with growing credit problems on the first. But Black Thursday ?

printing machine wont allow this happen

“printing machine wont allow this happen”

…but didn’t the printing machine exist in 2000, and it happened?

I generally agree with BR posts but I have to say, I have been in this business for 20 years and I find historical parallels like this to be a total utter waste of time. Every market is different, and the structure of the market bears no resemblance to 1987, 1937 or any other time in history.

I am as skeptical of this market as anyone, I just don’t think any of this “analysis” has any predictive value.

Jay – I’m not a fan of the 87 parallel either, but I disagree it’s an utter waste of time for two reasons:

1. The price/time/volume patterns are a representation of the thoughts and actions of people, and people have a tendency to respond in similar ways to a later instance of a set of circumstances.

2. There are those who look for patterns and expect them to repeat. By acting on that expectation, they influence the events they were antipating.

Anyway, that is one spooky chart.

In 1987 the market was massively overvalued — the S&P 500 PE on trailing earnings was 22 before the crash when the standard relationship of the PE to rates and/or inflation implied that the PE should have been around 14. All the 1987 crash did was eliminate the massive overvaluation and take the market back to a fairly valued range.

Now these same relationships to rates and/or inflation say the market is fairly valued.

In 1987 we had “portfolio insurance” a new hedging technique that called for managers to sell into falling markets. But the concept had never been properly stress tested and we found out that when too many people tried to use it at once it didn’t work because it just drove the market down.

Maybe we have something similar out there now in all the new ways to slice and dice risk, but as in 1987 we will not find out what it is until it is too late. In 1987 there were people warning that portfolio insurance would work the way it did, but they were generally ignored. Do we now have some specific new management tool or practice that many people are warning us about?

And if the very improbably happened and the trends continued to be similar right over the edge, what would you think then?

moral of the story….take heed when the major indices break below the quarterly low with continued follow-through downward.

I’m just a simple country lawyer, but isn’t that chart a bit misleading? It would have been great to scare the crap out of everyone right after the dip 7 weeks ago, but the chart is now missing another leg up past 127500.

re. the above comment.

I believe that is BR’s point. Juxtapositions are useful, but only to a very limited extent.

So where’s the part of the chart where the indices subsequently recover in relatively short order and then make new highs? I think I’d have to go just about ‘all in’ if we really see a drop like that.

Patterns of denial, acceptance and other behavior in individual humans can follow extremely predictable patterns; patterns of history can rhyme.

How perfect is the rhyme?

Spencer,

I would say that the Yen carry trade could be the “specific new management tool or practice that many people are warning us about”.

Naturally, there are infinite analogs to draw from and extend to absurd/logical (depending on your view) conclusions. If you like the 1987/2007 analogy….

overlay a chart of $INDU starting 8/7/64 (Gulf of Tonkin Incident) with a chart of $INDU starting 3/20/03 (Iraq II). By that analogy, a decline should be setting in soon similar to late 1968.

Presumably under this theory, the inflationary pressures of war spending + expanded entitlements will harm the current US economy just as Vietnam/Medicaid/War of Poverty made the early 70s a bummer.

you can always find elliott wave patterns that will match the present ones, herd psychology being what it is, but they don’t usually resolve in exactly the same way. that makes the overlapping chart thing both unremarkable and not really predictive except in a general sort of way (e.g., yes, we’re likely due for a pullback of some sort).

still, it does give one the willies, doesn’t it?

-)Stocks floating on a sea of cash (check)

-)rising global int rates (check)

-)fallng $ (check)

Now all we need is James Baker saying he’d like to see a lower $. oops! (Sept ’87)

Only thing we didn’t have in 1987 was panic behind the scenes;

High Court steps into US subprime crisis – FT

Not much scientific evidence to support it, but whenever NYC has made plans to start the 2nd ave subway, the U.S has went into a recession. Sept 29 1929(crash was a month later) that was the first time, Oct 1972 and March 1973 was the second time. We were in a recession on Nov 1973. Now we just started work on it April 12th. Lets see what happens

I forgot….since the Bears lost, is that good or bad for the stock market? haha.

BR, I know you do not like the Fed equity valuation model. However, the Fed model accurately signaled a red flat that stocks were unusually expensive versus long bonds in 1987. Today, earnings yields are cheap relative to the 10-yr bond. I suspect this is a key reason for equities performing so well during the past year – as well as why stocks tend to skake-off bad news so easily.

In 1987 we had a sound economy and comparatively cheap stocks.

While I think that a chart like this is nothing more than an amusing curiosity, it is important to remind people of the risk that stocks entail – years of gains can be wiped out in a few days.

Barry just posted this to get us to new highs, right Baar. Went 100% long did u?

Hey, Its just like the old days;

BA,CAT & UTX leading the charge.

Did we start another war somewhere?

Fresh new highs again…Pretty sad when the SPY leads the advance

What’s this 18 or 19 consecutive days of below average volume?

But up they go……

Ciao

MS

Fresh new highs again…Pretty sad when the SPY leads the advance

What’s this 18 or 19 consecutive days of below average volume?

But up they go……

Ciao

MS

—

This is similar to comments on weather boards, where weather weenies “pooh-pooh” lake effect snow as “fake snow”.

Posters on these threads have been pooh-poohing the market everytime it hits new highs…which is been often this year…and pointing out problems (such as low volume). Regardless, last I checked the money in my account generated from the market moving up is real…just like the mountains of “fake snow” that pile up in Tug Hill, NY.

I am always hoping for a downturn, just before I buy more of my long-term holdings!

Lawman-

I’m so friggin happy for you….

Facts speak for themselves. IT is still on lower volume no matter which way you try to spin it. Just so you don’t make the same mistake as other’s here…this is a blog that talks about reasons for economic activity and uses indicators to give us a rationale perspective on why the market goes up or down.

All I see in your post is chest-thumping. Like the world needs more of that.

have a perspective or don’t post.

Ciao

MS

As I recall, the later stages of the Dow advance in 1987 were driven by merger mania, and had very narrow breadth. Sounds rather familiar to me.

barry

you are missing the point

it doesn’t matter if its 1987/1973/1937 a growing number of people believe something bad is going to happen but no one wants to leave the party early

at the first serious trigger point (shanghai was too remote from the major centres)the exits won’t cope with the exodus

particularly beware the cds market and the hedge fund fuelled commodities rgds pcm

The gutters are littered with bogus chart comparisons. There are literally thousands one can make on any given day, to prove any given point.

The fact the so many TBP posters have sent it to you makes me smile from a sentiment perspective.

The bigger question is….

MS:

Why do you get mad when people point out the bullishness of the market? The fact of the matter is that there is nothing different in the economy today than there was at this point last year….yet the market continues to climb.

I’ve been reading for 18 months now about how all the numbers are cooked, how the economy is a farce, how housing is going to crush the market like a grape, how the indicators point to a huge fall. And some of that I buy…but the fact of the matter is that this bull has some life left in it.

Is the market rational or irrational? I submit that if the market were rational, it would not have climbed last year, and would not be up this year.

Ain’t’ gonna happen. Huge difference between now and then is the possibilities for shorting. So when you get a drop, there are always short profit takers who will provide support to the markets, unlike back then when shorts were fewer (by a large margin). Today you have many shorting ETFs, huge options volumes, other derivatives etc etc…

I know you’re not touting anything, but the least you could do is use rate-of-change instead of prices. The 1986-87 period saw prices rise approximately the double of 2006-07. Overlay that and tell me what you see.

So it was all the shorting that kept the market from dropping 600 pts vs just 400?

Lawman-

No anger here. Just your perception of it.

I grow tired of people continuously thumping there chests as if to say “screw you …I got mine”. Yet you have provided no reason other than touting of your portfolio (which I may point out to you is all on paper until you actually make a sale) you may as well be nogo law that came in here and spouted off about how much money he’s made on a house that he still occupies and uses his neighbor’s example of a house sale in 2005…

>>nothing different in the economy today than there was at this point last year.>>

I’d beg to differ as we do not have an election cycle that can be used as a carrot to bloat an already bloated market, also we have foreclosures occuring at a record pace, inflation is basically under-reported (and out of control), the dollar has made fresh new lows, credit limitations being applied to mortgage market, earnings are down (relative to last year), gasoline (not crude) is well over 3 bucks…..shall I continue????

Is it markedly different at this point as opposed to last year…..and yet we are higher than this point last year on shrinking volume….yes that’s called intervention in case you had’nt read anything since last year but I guess you are reading articles from this point last year where none of the above is a factor.

Keep drinking that kool aid

Ciao

MS

yap, would have been worse. And current rally also owes a good deal to covering

I am for 1913. A relatively quiet year were politics was not expected to have a big impact on the investment market.

1913 A quiet year in politics?? The Federal Reserve Act passed that year.

“Here are the simple facts of the great betrayal. Wilson and House knew that they were doing something momentous. One cannot fathom men’s motives and this pair probably believed in what they were up to. What they did not believe in was representative government. They believed in government by an uncontrolled oligarchy whose acts would only become apparent after an interval so long that the electorate would be forever incapable of doing anything efficient to remedy depredations.”

1914/1929 rolled into one?

And what happened after that short, sharp selloff in the autumn of 1987? The market went straight back north. In other words, it was the Mother of All Buying Opportunities.

All that crash did was make 1987 a flat year – hardly the Armageddon the bears on this board have been confidently (and incorrectly) predicting for us here.

I would frankly welcome a repeat of 1987, as I am sure it would be the Daughter of All Buying Opportunities.

ETFC warns like AMTD. So is it bullish meaning a lot of retail money is on the sidelines?

Or bearish…Main Street (barely can make ends meet) has no risk capital left?

Why Market has to instantly reflect the economic realities.Is there a statutory injunction on those lines? First off we are not 100% sure of those main street realities. We know there are problems.Everyone knows it by now, even people who seemingly had a passing interest in economy & financial markets

know that economy is headed for trouble.

But if everybody knows something it’s probably not worth knowing.Even if we all happen to be right about economy and we are headed towards the end of a cliff why the market has to reflect that right away.It might take it’s sweet time. It’s one thing to have a firm grasp of macro-fundies and another thing to have a good grasp of market

moods.Right now Mr Market mood is having a jolly good time.So why not have fun with him until he gets one of his notorious mood swings, which we know he surely will.

“hardly the Armageddon the bears on this board have been confidently (and incorrectly) predicting for us here.”

Armageddon? Someone predicted that here??

Care to quantify WTF is that Armageddon?

A decrease in the progression of the market?

Bwahahahaha!

Francois

Funny how all bears are so hoping for a big crash, and the market keeps going up. I love this. You have been hoping for this over a year and still haven’t learned your lesson that you are wrong.

Does anyone know what the “hemline indicator” was in 1987 vs. 2007? I forgot to take measurements this year!

Charts like this are always interesting. With the surge in the DOW recently the air is feeling a bit light. Even if the NDX seems stuck in a 6 month trading range…

Nogo law, fred, Manhattan,lawman and all the other perma-bulls…..

While I am continually amused at the vigor that is displayed here on why the bear position is wrong and well…..it’s wrong.

Which just about sums up your arguement as to why the bull position is right.

What would be helpful to your consistent cheerleading and chest-thumping is an actual position. You seem to not understand that ALOT of the very same things that have been used by the bull position, ala economic indicators, reports, data, are showing the same thing…..which is in complete contrast to what the stock market is doing.

So I have to ask…..why do you continue to come here if this is all such rubbish????

Ciao

MS

Lawman, you have it right, the boy is just ANGRY. Seek professional help, Michael. Mr. Cho didn’t, and you see how he ended up.

Nova Law, are you merely pursuing the bore-of-the-week award or is that actually the kind of ad hominem, ignoratio elenchi that passes for argument where you come from?

If it’s “ignoratio elenchi” that I’m wanting, all I need to do read your posts, RW.

Holy Frijoles that’s a creepy looking chart! Yet…yet…yet…when I look at 1987 and now…wow…have there ever been as many changes? I dunno, seems that with the “circuit breakers” in place, for one, the slide would halt so’s everyone could get back objectivity. And, those that are looking at international indices (e.g. EAFE) aren’t as concerned…

Me, I keep looking at 2000 and trying to make sure I am not coming under false hopes again…who knows?

I only have a couple of questions:

1) Can anyone here give me a valid, statistically significant, and macroeconomically sound reasons to be long in this market right now?

2) Can anyone do the same for shorting the market right now.

It is an interesting thought exercise.

The key question is, are the causes of the 1987 crash (and not just similar conditions) present today?

In 1986, the capital gains taxes were hiked from 20% to 28%, with no indexing for inflation. Given the high inflation of recent years, investors were very concerned that nominal stock gains would be severely taxed in the years ahead. Their fears seemed to be aleviated by the efforts of Jim Baker III to secure currency exchange agreements with Japan and Germany at the Louvre Accord. On the week of the crash, freshman Fed Chairman Greenspan’s interview in Fortune was published in which he stated the USD would have to be allowed to devalue. Baker gave up the hunt on the Louvre Accord on Wednesday that week and on Thursday stock investors stepped into an elevator shaft.

Looking at today, we have less threatening but similar calls for higher capital gains taxes and inflation is rising. The USD is falling. If a key adminstration or Fed official were to advocate a weak dollar policy, we could see a similar selloff, but I cannot imagine it would be as severe.

$SSEC showing its first significant decline in one month+.

It’ll be interesting to see if parabolic $SSEC has reached a high plateau, or if it’ll unwind poorly.

So many unanswered questions will be resolved by Labor Day. Should be interesting.

here we go again.

anyone else notice the relative underperformance of ge vs. the s&p. same thing happened in the days leading up to the february shocker.

can anyone figure out wtf is going on with the utilities? defensive stocks are the most expensive?pseg’s gone parabolic for christ sake.

total derivative contracts outstanding is someting like the whole worlds gdp times ten. trillions. and what are they secured with? more derivative contracts. scary…this could be the catalyst where BigBen loses control. anyway, spooos futures are off more than five. who knows..stranger things have happened.

Barry or Reader!

Any Recommendation of Japan Real Estate Funds REITS?

I think since Japan is wayyyyy deflated for wayyy many years, think maybe time to buy some Japan REITs? Especially Japan deflation seems coming to an end with economic recovery on good foot since last year.

Added the fact that when yen-carry-trade unwind, huge money has to flow back to Japan to repay the yen-debt, good for yen appreciation.

Strange that I could not find any Japan REIT fund listed heren in USA. Any comments is appreciated!

The Nasdaq market remains significantly below its 2000 highs. Please stop telling me that “the market” just keeps hitting new highs.

Not this market, not even close.

asia is selling off hard tonight. appears yen is starting to roll over again. japan down 400, taiwan down 2.5%…

i’m sure the bulls will pull things together for expiration, although you never know. expirations have been working out counter to the previous weeks gains/losses.

anyone see steinhart on cnbc this afternoon. good to see some balanced reporting for a change from cnbc. he’s hearing the bell ring. also excellent to see chanos.

two rational investors opinions in one day on cnbc? guess i would chalk that up to bullish.

I’m sorta partial to circa 1327, when the buboes of the Black Death took a third of the known population and plunged all of Europe and Eurasia into the Dark Ages.

But, we didn’t have Dr. Benber N. Anke then.

*erik*

Right off, you said the special magic woe-ed… you get the extra fifty dollars:

http://tinyurl.com/y22mp4

http://tinyurl.com/28fsbc

Barringo: “Well, I sort of prefer to link it to 197…”

Luskin: “Aw, STF up!”

Barringo; “No, you STF up!”

Kudlownian Chorus: “NO, YOU STF up Ritholtz!”

Roubini: “You STF up!”

Kudlow: “STF up Roubini!”

Roubini: “STF up yourself, Kudlow!”

Kudlownian Chorus: “No, you STF up!”

Big Pic Chorus: “No, all you f’ers STF UP!”

Kass: “As I was sayin’ it’s more like 193…”

Luskin: “STF up KASS!”

Kass: “YOU sTf-up Luskin!”

Kudlow: “You tell ‘em, Don… STF up Kass!”

Big Pic Chorus: “STF UP!”

Here are the best matches for Dow 2007 utilizing machine vision — 1987 NOT on the list.

I think it has become well imbedded into the market, even global markets, that too many players are increasing their risk to chase ever decreasing returns.

The market will hit them at some point.

There has already been a taste of this though people are forgetting this quickly simply because markets have crept past their previous highs. We broke several 90/10 records for breadth and volume in the market just recently. And China is again seeing a 4% fluctuation in its market today.

There is a huge instability underneath the markets that is being masked.

Machine Vision Vs. Human Vision

A blog entry from Vix and More wore asbestose gloves to deal with an entry from The Big PIcture submitted by users about a cliff diving chart from 1987 that seems similar to 2007. Being a fromer grunt, I hit the mouse and banged the url looking for do…

Hey Eclectic, that’s 1347 for the start of the Black Plague in Europe. You didn’t mean the Great Famine of 1315-1317? Now in 1323 there was an earthquake that destroyed the Lighthouse of Alexandria, though I don’t know if the market consequences were comparamble to 9/11…

Out of curiousity, how many of you were actively working in the business in 1987? Or had access to a Quotron? [remember that fabulous machine?] I had been in the biz for all of 5 months, but I sure remember that day. Of course, this was long before Al Gore invented the Internet and global warming. He is like the modern Edison!

The next bear market will be different from 1987, 1990 [which BTW, was the last great buying opportunity IMO], 2000-2002. That is why I find these graphs totally pointless.

Dudley seems to be on the job already this morning.

Eric, will you please leave the Black Death to me and STF UP!

You need to bone up on your Yersinia… or, or sure… maybe you’re one of those P-a-s-t-e-u-r-e-l-l-a hold-outs, huh?…Nannie, nannie, na!

Nogo-

thought you were still looking for those comments you attributed to me. What is it now almost a week now???

You’re such a waste of a human being…..

but you knew that.

Ciao

MS

2007 = 1987 lmao

1987 comparisons never work, only mean one thing. New bull market highs lie ahead.

Prechter also tried to compare 2003 to 1987, the rest is history.

Ad Hominem, much? Let’s keep it at least somewhat civil.

As an aside, the chart is spooky to glance at, but as others have said, one can manipulate the data to find parallels wherever one wishes to find parallels, that’s the joy of statistics.

I find the conditions of the market as a whole unstable, and as someone who doesn’t have time to monitor his investments 24/7, it makes me very nervous.

Dow Jones made new all-time record high yesterday

1987 comparison bit the dust. Isnt valid.

I remember well in Oct. 1987, a week before the crash, the cover story on Fortune magazine was George Soros touting stocks as the place to be for the foreseeable future.

A week later…well, the rest is history.

If that doesn’t tell you to ignore the gurus I don’t know what will.

CAn I aSk a qUestiOn plEAse??

Will you mother fuckers quit fightin’ on the blog! You are fuckin’ borin’ me to tears! Please!!… take yo asses to the Yahoo boards where they appreciate yo motha-fuckin’ selfs.

Samuel Jackson has spoken!

Fuck bloggin…

FLOGGIN is so much more ffuuunnnnn.

And since no one mentioned it on this entire

useless thread…

Oct 19, 1987 was the monday after expiry.

You can notice that 87’s trends were orderly and predictable, however, 07’s changes between positive and negative are so fast it is understandable how a trader using 87 methods can go crazy over it.

This market’s headed up on rampant liquidity and any downturns will be saved by all the protections built into the market’s now that were not in place in ’87.

“Can anyone here give me a valid, statistically significant, and macroeconomically sound reasons to be long in this market right now?”

If you’ve got money to invest, what alternative do you have? Corporate debt has degraded to junk status, and government bonds are barely able to break even (net of taxes) with inflation. P/Es in the 20s look attractive compared to bonds, especially given that taxes on cap gains are low and can be deferred indefinitely. This is not an argument for going “all in”, nor for buying US indexes. Still, a mass of evidence (refernces on request) has shown that you can’t predict or time the market; although the bear case is very strong, it’s anyone’s guess as to when the chickens will finally come home to roost.

On balance, it seems prudent to stick with modern portfolio theory, maintain allocations in bonds, US equities, and foreign equities, rebalance as necessary, this will have you buying stocks with money from bonds if the market crashes, and taking money out of stocks if the market gets really frenzied.

“Can anyone do the same for shorting the market right now.”

O my gosh, where to start? The bearish case is overwhelming:

1. Valuations as measured by P/E, dividend yield, book values, are high compared with historic levels.

2. Massive US budget and current accounts deficits leading to an ever-sinking dollar.

3. Foreign buyers increasingly discontent with low/negative returns on US debt instruments.

4. Inverted yield curve, absurdly low risk premiums on long-term debt, paid for by foreigners who are trying to find alternatives.

5. Slow-motion energy crunch fueling broad-based inflation in commodities, held in check only by artificially cheap imported goods subsidised by a Chinese Yuan linked to the dollar.

6. Slow-motion disaster in the housing market, possibly leading to cutbacks in consumer spending; combined with inflation pressures could see a return of stagflation.

7. US savings rate at all-time lows (negative), debt at all-time highs relative to GDP.

8. Boomer retirements looming, average boomer has saved nothing, defined-benefit retirement plans disappearing; where’s the money going to come from?

9. Social security system may be “solvent” for decades, but that is irrelevant; what is relevant is that the system has been producing net inflows to the US treasury for years, and this will turn to net outflows within a few years, aggrevating already-high budget deficits.

10. Political factors: whitehouse running the country into the ground, ill-considered war dragging on and on, Democrats long on criticisim and short on any real solutions.

11. Ecological factors: unsustainable human population growth straining the planet, ticking bomb of greenhouse gasses, fossil energy depletion, etc. all of which will cost enormous sums to redress.

I could go on and on. Not reason enough IMO to actually short, which is, statistically, a bad bet. Still, plenty of reasons to be cautious.

I love the comments from the “perpetual bull camp”. Keep on buying guys!!!

All,

This is the first time that I have been on this site. I have been reading alot lately on various sites. I found this link interesting. Here is some charts that support the above overlays. There is a picture developing and people are inorging it. Look at the gold market?

http://usmarket.seekingalpha.com/article/28684

this is really scary

I love the comments from the bear camp!

Keep shorting guys! LOL

Inflacction,bonds down,carry trader,is very emulated 1987,i am belkieve that is can are a crash this summers.

I think its official guys.We are headed into a recession

I think its official guys.We are headed into a recession

TRASH THIS WEBSITEW IS TRASH LOSERS