If you want to know about abstract economic theory, speak to an economist.

However, if you have questions about inflation, I suggest that rather than engaging members of the Dismal Science in a Q&A, try speaking to any small business owner instead. You will quickly learn the difference between theoretical core price increases, and the real world.

A perfect example of this was an article in the Sunday NY Times. It suggested that inflation, tho’ relatively modest for the past few years, is now starting to become an increasing worry: Maybe Inflation Is More Than a Sideshow.

The line that made my head nearly explode was this one: “Inflation has been rather benign throughout this decade.”

How does one begin to even answer such sheer, imbecilic nonsense as that? I will suppress the instinct to engage in name calling about the author’s ancestors, and once again c a l m l y review the available data.

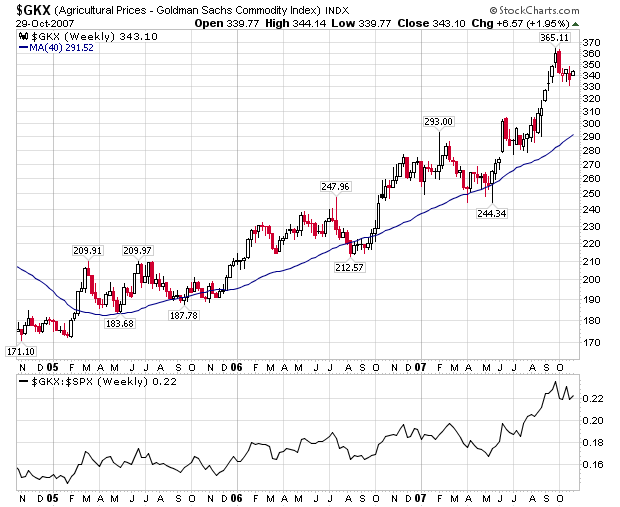

We know that energy prices have skyrocketed: From 2001, when Oil was $18 a barrel, to a recent price of $92, Oil has risen 411%, for an annualized inflation rate of 31.24%. Foodstuffs are also up a similar amount: Beef, dairy, wheat, corn, rice, soy beans all recently hit record highs.

But as we know, the Fed and the BLS do not like counting the very products we each need to eat, travel to work — to survive every day — as part of the inflation basket. If they did, it would force them to admit that inflation is actually quite robust.

And even though these so-called core items are counted separately, they are pressuring their way into other goods and services. For example, FedEx just announced they are raising rate by 4.9%. And a recent WSJ article noted that Business-Travel costs on the rise. Expect to see many of these “non-core” cost increases passed through to consumers and businesses in the coming year.

My favorite example of this comes from our friend Gary who owns a successful restaurant (Bin 23 in Locust Valley). I occasionally ask him about price increases, and beyond the usual — food, electricity, taxes, and insurance — the thing that I find fascinating are his energy surcharges. Last week, he told us that every single delivery he gets has an “energy surcharge” on it — usually $5 or $10.

Now, as a Restaurant that relies on fresh food being delivered 6 days a week, that can add up. But this surcharge is even on linens, flowers, silverware, glasses — essentially everything he uses to run his business. It works out to a few $1000 per month.

I haven’t been able to figure out how the BLS tracks these surcharges, if at all. That suggests to me that another source of price increases isn’t being counted by our friendly governmental statisticians.

~~~

Ironically, its more than just food and energy causing price increases: We know Housing has just about doubled over the past decade (prices are now down about 10-15% over the past 18 months. Medical services and health insurance have been running double digit annual gains for the past decade. Tuition costs are increasing for even longer than that, along with books and other sundries.

This is before we even get to the Dollar. Last week, Venezuela’s Energy Minister Rafael Ramirez said that OPEC is likely to discuss creating a basket of currencies for oil pricing at its next summit due to the steady decline in the greenback. That will reduce energy inflation to some degree — but could be a potential disaster for the USA, which has benefited from having the World’s reserve currency.

~~~

The FOMC begins their two day deliberations about rates, and I suspect they are terrified about the slowing economy and the credit crunch. The result will be at least one more, and possibly two rate cuts, as they attempt to inflate their way out of any slowdown.

I understand some people are afraid of deflation, but we have yet to see any early warning signs of that. Expect prices to continue to rise over the coming years . . .

UPDATE: October 30, 2007 9:59am

A few more examples:

Record Diesel Prices Squeeze Commercial Construction: Today’s average price of diesel, $3.157, ties the all-time high set two

years ago. “This will squeeze contractors’ margins on existing projects

and push up bids on future work, especially highway and other projects

that require a lot of earthmoving, which is very diesel-intensive.”Kellogg Says Escalating Costs Are Limiting Profit Growth: It said rising prices for the ingredients that go into its cornflakes,

Keebler cookies, Pop-Tarts pastries and Eggo waffles were limiting

profit growth.

>

Sources:

Maybe Inflation Is More Than a Sideshow

PAUL J. LIM

NYT, October 28, 2007

http://www.nytimes.com/2007/10/28/business/yourmoney/28fund.html

FedEx to Raise Rate For Express by 4.9%

COREY DADE

WSJ, October 27, 2007; Page A3

http://online.wsj.com/article/SB119340379256272864.html

Business-Travel Costs on the Rise

ANDREA COOMBES

WSJ, October 25, 2007; Page D3

http://online.wsj.com/article/SB119327710926470852.html

OPEC to study currency basket for pricing: Venezuela

Yahoo! India News/Reuters, October 27, 2007 07:05 PM

http://in.news.yahoo.com/071027/137/6mhrn.html

Barry-why would they measure energy surcharges? It is energy, which does not count, remember? LOL. I wish George Orwell were alive to see his fiction becoming fact.

Inflation = price stability!!!

Being somewhat new to the day-to-day in the market, I ask, “has the FED ever not cut rates, when such a high consensus in favor for a cut exists? Why is a rate cut needed, are not rates already historically low? Isn’t the problem a lack of transparency in the credit markets? Obviously I must be missing some piece of the puzzle.

dovish Fed is waging war against ghost “deflation” is nonsense.

Isn’t the erosion of the dollar a type of deflation? Is the US economy being pushed into equilibrium with the rest of the world, particularly emerging economies, through deflation of dollar priced things such as wages? Cutting ones wage causes domestic unrest, but the perceived needed deflation of the US economy is easily done via re-pricing (de-valuing) dollars traded in the global market place.

Scott,

Your comment: “Isn’t the erosion of the dollar a type of deflation?” is definitely going into my top ten knee slapping funny things I have read on the internet this year.

LOL! Thank you

Wage inflation is benign, which is all the corporate fat cats care about. As the prices of goods and services increase, but wages stay down, some business owner somewhere is making money. But the workers are not.

Seems unsustainable to me; if wages don’t rise, who is going to be able to afford that next ipod/xbox/hdtv/car/home/etc?

Pssst….Barry, tell me when the PPT runs out of “chips” and I’ll tell you when inflation will reverse. Until then….keep up the good work!

Once again to the defense of the BLS, the CPI is measuring the inflation that the consumer is feeling, so if the restaurant owner is getting socked with gas fees but is not raising the prices of the meals, then their is no increase in the CPI.

That should however show up in the PPI. Lastly it should show up in lower corporate profits, or lower wages, or in higher productivity depending on how the owner adjusts for that cost.

BTW: If the quality of the food declines or the portion size is reduced to offset the price hike, then it should show up in the CPI.

P/G call

price increases expected top stick:

coffee +48%!!!!

pampers +5-8%

Paper towels +5-6%

“even the private label players are passing increases along and this is unprecedented”

No there is no inflation.

Food price caps around the world

Astounding that no one worried about the doubling and tripling of housing on the way up and now we are worried about a 20% decline? Deflation is the only thing that will restore balance to the market and breath renewed hope into the middle class. Rate cuts will not help anyone on the margin as the decline in equity will more than offset any nominal benefit on the payment side. This reminds me of a speculative run on a currency in slow motion. The central bank continues to try and intervene but the fundamentals lie in wait for for their futile attempts to overturn the tide will fail.

The fed is chasing its tail. They want to protect asset prices at all costs because they have allowed everything else to get out of control. They see the only way out as inflating up peoples lifestyles, however wages can;t rise on a real basis anywhere near enough to offset the asset price inflation (US standard of living deflation). The irony of their approach is it only further streches the class divide.

The futility of this approach reflects the Fed’s underestimating the consumer, who don’t act irrationally forever. The marginal buyer will not step into this market even if they can afford it and the maginal bank will not lend if they know that 6m to 1yr down the road the loan to value could go from 70% to 95% or greater. Not a good bet. Anecdotally, the brokers even in the bliss that is NYC real estate are capitulating to the fact that people arn;t playing the bigger fool game anymore. As Paulsen said today, we have a ways to go. If the Fed would excuse itself, perhaps we can get on with the show

The financial system is out of control, mainly due to the fact that the budget is not in balance. However to bring the budget into balance too quickly, seeing as it is so far out of balance, would be dangerous. The sickness is obvious, the correct cure is not.

Michael Donnelly

Good point, so if prices are going up and someone has to feel it either there is either consumer inflation or profit margin deflation.

The Fed which has played the game since ’98 of toggling back and forth between inflating equity markets and housing – virtually all the assets of the consumer balance sheet BTW

If the consumer doesn’t cooperate with rate cuts becasue the grease that fueled it – the banks – arn;t willing to go down that road againa nd the consuit market is lcosed (read keep it on the balance sheet) then the housihng option just closed. What’s left — the equity market – but wait, those all time record profit margins today which will drive the consensus 11% growth in 2008 eps out of the “mid cycle correction(?” are being squeezed by the not very benign neglect by the Fed and its core mission. Estuimates are coming down next year in a slow bleed – unless the financials are given free liquidity to pump more speculative money into the markets – which is what the fed prays to the Almighty for.

On with the show…

House prices rise and fall elsewhere. and drastically too. Hong Kong and elsewhere in Asia have seen huge swings in real estate prices. Real estate in India is deflating now at 10-20% a year. DO you see any impact on their economies. The difference is that the individuals take the hit. The leverage to buy a house is much lower as people pay all or large part of the house price to buy it. In the US, we pay with zero down, negative amortization loans. And we have banks who are leveraged 20-40 times on their equity on these loans. A 10-20% loss on their loan portfolio will wipe them out. We are saving the banks now isn’t it. Free market my ass.

scott-

“Isn’t the erosion of the dollar a type of deflation?”

it’s actually the complete opposite.

erosion of purchasing power is a result of inflation.

deflation happens when the dollar’s purchasing power increases.

M3,

I was thinking deflation of living standard or deflation of US goods and services (wages) in global market. Example, say two employees (American and Brit) in an international company are hired in 2002 and paid the same wage at time of hire, except one is paid in USD and the other in Pound Sterling. Both employees receive the same % salary increases each year in their perspective currencies. In 2007, has the USD paid employee standard of living changed with respect to the Brit if they live in their home countries? If both employees were livingworking in Nigeria during this time frame, has the American’s standard of living changed (deflated) with respect to the local Nigerians and or Brit?

There are 2 very good reasons to exclude food and energy costs from the measures of inflation used to drive monetary policy.

1) Food and energy costs are driven by global supply & demand levels over which monetary policy has extremely limited impact. Oil prices are high not because interest rates were too low for too long but because of (a) strong demand growth globally, especially from emerging markets; (b) limited supply growth from underinvestment in exploration when oil was cheap and increased difficulties/cost of extracting oil from existing wells; and (c) political risk premiums arising from our intervention in the Middle East. Food inflation has to a large extent been driven by fiscal policy — ethanol subsidies diverted corn from the food supply and land from wheat production to corn production, leading to higher prices for corn & wheat and those foods which use them as feed.

2) A recent Fed study demonstrates that reliance on headline vs core inflation results in increased volatility in rates and consequently increased variability in the level of unemployment, and outcome I think we would all prefer to avoid. Marc Shivers at The Talking Fed gives a great summary at http://talkingfed.blogspot.com/2007/10/mishkin-on-core-vs-headline-inflation.html

I have made it a point to talk to several types of business owners over the last few weeks. The underlying theme:

Razor thin margins that are getting smaller and smaller.

This economy, presented as prosperous by anyone near a TV camera, is such a steaming pile of waste it’s no longer funny to hear the denial at the level (top 1%) that gets affected the least.

And somehow we will be convinced that debasing the currency (again) and allowing the banks more spread protection is good for whatever economy is left.

Sounds like Reagan all over again…..The parallels of 1979-80 are glaringly obvious.

But this time we do not have interest rates in the high teens/low 20’s so we can’t lower them to help stimulate growth (real growth not upwardly adjusted gov’t #’s)

We are so screwed regardless of what the Fed does….the market will rally upwards no matter what the Fed does……you can already tell

Ciao

MS

inflation ex-inflation ex-surcharges!

This idea that the FED doesn’t have control over commodity prices is silly. Of course the FED doesn’t control relative prices. But we should all know by now that they are the primary driver of the price level.

When the returns on your money are negative people will not exchange their hard goods for it. So all else being equal the price level would go up.

Anecdotally, with a chance I’m only imagining this, I have started noticing empty spots on store shelves, goods being sold out (esp. when on sale), and my favorite bread not replaced as often as it used to, in several stores. May they be cutting down on delivery frequency and other essential (one would think) overheads?

BR – “I haven’t been able to figure out how the BLS tracks these surcharges, if at all”

As was pointed out above, surcharges paid by business wouldn’t (and shouldn’t) be tracked in CPI. If and to the extent the surcharge is passed on to the retail level, it gets picked up there.

Here’s what the BLS says about airfares, which tend to be one of the larger consumer level surcharges:

BTW, this AM on CNBC the guest host was a trucking CEO who, if I heard correctly, mentioned that fuel surcharges were currently running ~22% of billings.

FYI

How ’bout the laundromat! 6 months ago, it cost me $3 to clean an oversized comforter (that won’t fit in the wash at home). Today, it cost $4.50.

From this NYT article Barry quoted, I noted this comment:

‘Robert D. Arnott, chairman of Research Affiliates, an investment management firm in Pasadena, Calif., says the Fed is “caught between a rock and a hard place.” If the Fed leaves rates alone, he said, it “risks the markets cratering and the economy going from slowdown to possible recession.” But if it lowers rates again, he said, “the dollar would be at further risk.”

And that could prompt more inflation, which would be just as bad for the economy.’

I thought that inflation is among the worst things that can happen to investors’ capital.

Why not then, let the market take a dive and clean up the place? A healthy dose of pain and fear might help everyone focus on the real problem.

But no one among the privileged and members of the body politic wants the rank and file to get mad to the point of waking up one morning with an irrepressible urge to chop heads for breakfast.

So, the “suggestion” loudly whispered to the Fed is to let’s save the asset-based econ by cutting rates again…and again.

What’s an ordinary dude like moi to do?

Buy stuff, sell securities, reduce your portions, and wear a sweater at all times this winter.

Life is just getting more awesome every day, isn’t it?

Francois

Barry – you might take a look at some the time series cut outs I took. The real aberration is only around 2004 – 2005 which points to Katrina and Iraq rather than a FED that is asleep at the wheel.

2.5 billion Chinese and Indians will inflate much faster than we can ever deflate. It will be a perfect storm for Americans looking to write down all that bad debt. Unlike the Great Depression, where the world deflated because Americans said so, we will now march to the whims of the globalized world our leaders pushed to create.

Barry- Just watch inflation with commodity prices, inflation always redistributes wealth and as Shakespeare said moneylenders don’t make any money unless they have borrowers. Commodities is the new currency.

Does anyone think it’s just a coincidence that Goldman Sachs issues a “research note” to drive the price of oil down the day before the Fed announcement on the Fed funds rate?

Looks like Goldman Sachs and the Plunge Protection Team are firing a suppression barrage against oil (and gold) before the Oct 31 Fed annoucement.

From Hard Times To Halloween

Useful Comments/Quotes and Pointers ‘In the focus groups, we handed people a page of positive facts about the economy….These swing voters — about half non-college and half college graduates — nearly attacked the moderator because many are on the edge…

The easiest way to transfer wealth,is by raising the price of commodites.

Inflation, which is at about 11% and will continue rising, is the vehicle.

Everytime the Fed lows the rates, it is pumping more worthless dollars into the market.

The problem is their is to much liquidity in the market.What does the fed do?It lows the interest rates, which as the affect of pumping in more liquidity.

Go ahead my friends and break a twenty in the grocery store and see what you get for it.

That is where the rubber meets the road.

Core inflation figures are a joke on you and I.

We could take alook at the M3 to see what is going on with the money supply,but wait,the Fed stopped publishing it.