One of the things that people get wrong all the time is the contra meanings of magazine covers. This is a subject we have discussed for quite some time around here.

The assumption is that if something shows up on a mag cover, whatever the subject is must therefore be all over, hence, its time to go the other way. This is a fundamental misunderstanding of what the cover indicator is all about.

The short version is that when a long running trend, well represented by consensus opinion and stock prices, finally bubbles up to the front of a major magazine cover, THATS WHEN its very very late in the cycle. Hence, it is a contrary indicator.

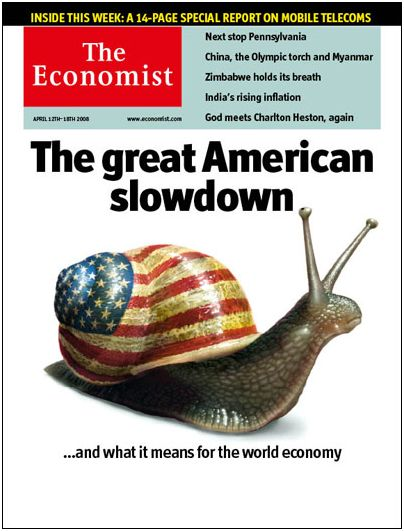

A recent classic cover was the Time Magazine on Housing back in the summer of 2005. The timing was near perfect, as Housing peaked in August ’05. However, when something is relatively new, such as the US economic slowdown (see Economist cover below), it is not a true contrary indicator.

Let’s compare these two examples:

• Housing Boom

– Lasted almost 10 years

– Home prices increased 2 and 3 standard deviations from historical means

– Homebuilder stocks ran 500% to all time highs• US Economic Slowdown

– (Un)Offically going on for less than 6 months; GDP still positive

– S&P 500 and Dow Industrials made all time highs six months ago

– Equities still within 10-15% of highs

– No consensus for a recession

When we compare these two quantitatively, the differences are pretty obvious as to which one is the true contrary indicator . . .

>

>

Previously:

The Magazine Cover Indicator

Big Picture Overview

uh-oh: Time Magazine on Housing http://bigpicture.typepad.com/comments/2005/06/uhoh_time_magaz.html

Source:

The great American slowdown

Apr 10th 2008

The Economist print edition

http://www.economist.com/opinion/displaystory.cfm?story_id=11016333

According to Hussman’s excellent piece this week, he feels we are in the 3rd inning of the mortgage crisis. I recommend reading that. Reggie Middleton’s blog is hammering Lehman and Morgan Stanley. I have to agree with them and Barry, that we are not near the end of this cycle.

Watch oil today too…bullish inventory just out…could see 115 and above.

The greatest Economist cover and story of all time was August 1982, “The Bull Jumped Over The Moon.”

It basically laid out the bull market for the ensueing 18 years.

Well, first of all, it’s not on the cover of one of the Old Media Big Three: Tome, Useless News and World Distort or Newsweak.

So right there, you know it’s not a contrary indicator.

~~~

BR: If you check the Contrary Indicator Report I did in 2003, you will see that the Economist can at times, be just as contra as anyone else.

these oil inventory numbers are either wrong manipulated or credit cards are picking up the slack…maybe a little of all three

Two other seemingly contrary indicators must be ignored right now:

1) Insider Buying…insiders on Wall Street promulgated this mess…why follow their lead? Other insiders are grossly out of touch with the average American’s pain.

2) Small Investor Sentiment…again the small investors are going to be right this time…they have no money to buy stocks and won’t have much, after food and gas, for much else either.

Nothing is picking up the slack, again, HOW IS IT CONFIGED!!!

Economist is a great read, regardless if its top or bottom ticking trends. But I agree that its best not to lump the cover theory on every cycle.

Except if they put Bernanke on the cover of Madden 09 ITS OVER!

A good cover was “It’s A Low Low Low Rate World” in Business Week, Feb 2007. That was the first sign of the troubles coming for all the easy money (first sub-prime problems, first default credit swap problems, the stall in mergers).

http://www.businessweek.com/magazine/content/07_08/b4022001.htm?chan=top+news_top+news+index_businessweek+exclusives

Not to be snarky, but it could be said that you consider it a contrarian indicator when it’s convenient to do so.

Considering the negative slant of this otherwise excellent blog for the past couple of years, any cover that is economically positive is treated as contrarian, and any cover that is economically negative is considered ‘on the money’.

Just to clarify my position here — I agree with Barry and many posters here on topics such as the sub-prime mess, inflated real-estate, fudged government numbers, etc. But I feel that the doom-and-gloom is usually overstated, for reasons that I can only assume are that negativity brings in the readers.

~~~

BR: That’s not true. Here’s why:

1) I specified the differences between the two covers quantitatively: length of time of phenomena, standard deviations, stock performance, relative high or lows — these are all significant datapoints.

Anyone who wants to quantify why they think this cover is a similar contrary indicator, e.g., like the Housing cover, then by all means go for it. (One factor in your favor is media recession mentions — start there).

2) The blog traffic as a Bullish contrary indicator worked well for a longside trade. And, if this cover was a contrary indicator, it would support our Jan 23rd market calls (cover shorts/trade long for a bounce) which was bullish.

I don’t talk our book, I calls ’em as I sees ’em.

I’ll also see if I can get that recent commentary posted.

Barry,

I apologize for the slightly off-topic comment but I had trouble getting an email to you…

I just wanted to say “thanks” for all that you do and let you know that you are still a “core holding” in my “blog portfolio.”

If you read this, please check out my kudos to TBP on my post:

http://financialphilosopher.typepad.com/thefinancialphilosopher/2008/04/blog-portfolio.html

I’ve learned a great deal from you Barry.

Cheers…

Kent (aka The Financial Philosopher)

The weird thing about this crisis is that the fear seems to be moving from the inside to to the outside, rather than vis-versa.

It’s economists and wonks who say things like “worst since the Depression” and the guy on the street says “huh?”

I’d be much more sanguine if this was just a conspiracy theory a-la peak oil or something.

(peak oil has some real foundations, but it is most often driven by the nutters.)

The big diff is that Time is a mag that reports on whatever is in the public eye at the time, whether it be politics, religion, war, sports, music, economics, etc. Whereas, the Economist reports on economics. Also, a bubble is something that very often pops simply because the investment trend or scheme has run out of newcomers to the party. However, an economic downturn has a different life cycle. So, when a magazine like Time reports on an economic trend, it means the trend has reached a wide spectrum of the public eye in order for Time’s editors to deem the story important enough to report on. In other words, the pyramid scheme has reached the greatest fool. Another classic contrary indicator by Time was the cover on dot com entrepreneurs getting rich that was featured in I think 2000. So, if Time magazine does a cover story on folks getting rich trading gold or oil or some other kinds of commodities, that will be a good contrary indicator for the uptrend in commodities. But if the Economist were to do the same, well they’re just reporting on what they’re supposed to report on. And if either mag reports on a recession, I don’t know that would be any kind of contrary indicator at all.

So it’s not the magazine cover at all — still pays to be aware of all the other factors and simply use the magazine covers as inspiration for clever blog posts ;)

-Wayne

You cannot have both ways Barry. I agree with you that this cover doesn’t mean the bottom is in…but it certainly may mean we’re due for a wicked short covering rally before the downtrend resumes.

The news got VERY negative VERY quickly. My wife’s morning talk shows are all talking about how shitty everything is…..

AT

~~~

BR: The contrary call was made on Jan 23rd (Time for the Bounce).

This is now 2 months AFTER that . . .

should be noted that the economist had a cover (After the Fall) in june ’05 calling the housing bust.

10 yr yield breaking up…mortgage rates heading higher = lots more housing pain. Dollar at 71.3 and near all time lows. They can’t save the stock market, dollar, and housing at the same time. The bigger question is can any of the three be saved.

We used to have a game where the kids would collect snails and we would put chalk numbers on their shells, and race them to see which could crawl out of a circle first. The winning snail was tossed into the street first. It was a great way to clear the snails out of my garden.

Silly things never did evolve enough to fly.

Fun to see America, usually represented by the great eagle, as a little snail. Seems about right these days. Not even a slow but steady turtle, but a snail crawling about in a directionless fashion.

Donna “…a snail crawling about in a directionless fashion.”

… and leaving a trail of slime behind it ;-)

Rising prices for slow snails … The magazine’s emphasis should perhaps have been on the price of the escargots going through the roof, together with food in general, rather than on the slowdown per se. Full marks in any event for a fabulous illustration.

Prieur du Plessis

http://www.investmentpostcards.com

A number of magazines had negative housing covers prior to and after August ’05. The Economist springs to mind, but I also remember a very striking issue of Harper’s sometime in 2006. In fact, I remember the Time issue as being very gutsy as it was the only magazine to write about how well housing was doing without mentioning the word “bubble”.

In addition, according to Case-Shiller, the US Housing market peaked in July 2006.

The Economist nailed the housing slowdown about 18 months ago with a cover story about how the world wide housing bubble was about to pop. I remember it being a really interesting, thorough article that has been spot on since published … it saved me a boat load of $$$.

I feel that the doom-and-gloom is usually overstated, for reasons that I can only assume are that negativity brings in the readers.

Posted by: Eddie | Apr 16, 2008 11:19:29 AM

____

If the doom and gloom were based on emotion and prejudice, I would agree with you. Unfortunately, they’re based on mathematics and observable reality.

I think you’re just mad ’cause you can’t find a Kool-aid drinkin’ buddy.

I understand that we’re not supposed to acknowledge the 600 lb. gorilla in the living room, but whoever is feeding him beans needs to stop.

I feel that the doom-and-gloom is usually overstated, for reasons that I can only assume are that negativity brings in the readers.

Posted by: Eddie | Apr 16, 2008 11:19:29 AM

____

If the doom and gloom were based on emotion and prejudice, I would agree with you. Unfortunately, they’re based on mathematics and observable reality.

I think you’re just mad ’cause you can’t find a Kool-aid drinkin’ buddy.

I understand that we’re not supposed to acknowledge the 600 lb. gorilla in the living room, but whoever is feeding him beans needs to stop.

I feel that the doom-and-gloom is usually overstated, for reasons that I can only assume are that negativity brings in the readers.

Posted by: Eddie | Apr 16, 2008 11:19:29 AM

____

If the doom and gloom were based on emotion and prejudice, I would agree with you. Unfortunately, they’re based on mathematics and observable reality.

I think you’re just mad ’cause you can’t find a Kool-aid drinkin’ buddy.

I understand that we’re not supposed to acknowledge the 600 lb. gorilla in the living room, but whoever is feeding him beans needs to stop.

I feel that the doom-and-gloom is usually overstated, for reasons that I can only assume are that negativity brings in the readers.

Posted by: Eddie | Apr 16, 2008 11:19:29 AM

____

If the doom and gloom were based on emotion and prejudice, I would agree with you. Unfortunately, they’re based on mathematics and observable reality.

I think you’re just mad ’cause you can’t find a Kool-aid drinkin’ buddy.

I understand that we’re not supposed to acknowledge the 600 lb. gorilla in the living room, but whoever is feeding him beans needs to stop.

I never did like Escargot. It always seemed to have little bits of sand in it, no matter how well the silly things were cleaned. And definitely overpriced.

Yes, I do like the very weathered look of the flag on the shell. But the stupid snail is still looking to the right for an answer to its problems….

Marcus Aurelius, that is a terribly funny line

Can we safely short escargot futures?

18 months ago? There were blogs 2-3 years ago calling for this to happen.

Just like in 2-3 years we will be in full realization of this slow down.

We have had 20% of clients call in to cancel with inability to pay. Some get off on doom and gloom, I’m just telling you how it is. I can’t spend and make payroll if I don’t get paid,…and on and on and on. I’m sure I’m an isolated case(hook in mouth).

The magazine covers are acedotal and fun but the average joe doesn’t need it to notice the elephant or gorilla in the room.

Marcus, It’s not going to be the gorilla that kills us, it’s going to be the rattle snake we didn’t see while trying to avoid the Gorilla. That’s what will bring this house of cards down.

With the Dow up 200 points on the same day JPMorgan writes-off $5B, I say “Don’t worry, be happy!”

Keep it going guys!! Obviously, you believe in your convictions, right?

Just don’t look for me to bail you out. You bought’em, you own’em!!

Donna, your comment is a classic. I’m tempted to go straight outside with a Sharpie and some electrical tape, and a broad smile on my face. In my revery, I’m lobbing winning snails into oncoming traffic well before today’s close.

Thank you,

dgov

Earnings Slump at J.P. Morgan

J.P. Morgan posted a 50% drop in quarterly net as CEO Jamie Dimon said he expects challenging market conditions to weigh on the bank’s business at least through the rest of the year. Wells Fargo’s profit sank as credit-loss provisions surged.

EU economy has been a snail for years. The US is in a temporary slowdown and the Europeans compare us to a snail. They should look at themselves in a mirror.

I just read a Weimer Republic indicator. The Fed’s percentage of Treasury notes has gone from 92% to 65%. Guess what’s new? Termites in the Fed. Bernake is going to the wall with inflation to keep up market appearances.

So what would have happened to a 401K in Germany in 1923?

Bad Money: Reckless Finance, Failed Politics, and the Global Crisis of American Capitalism

by Kevin Phillips

http://www.amazon.com/o/ASIN/0670019070/groksoup04

In Bad Money, Phillips describes the consequences of our misguided economic policies, our mounting debt, our collapsing housing market, our threatened oil, and the end of American domination of world markets. America’s current challenges (and failures) run striking parallels to the decline of previous leading world economic powers—especially the Dutch and British. Global overreach, worn-out politics, excessive debt, and exhausted energy regimes are all chilling signals that the United States is crumbling as the world superpower.

“Bad money” refers to a new phenomenon in wayward megafinance—the emergence of a U.S. economy that is globally dependent and dominated by hubris-driven financial services. Also “bad” are the risk miscalculations and strategic abuses of new multitrillion-dollar products such as asset-backed securities and the lure of buccaneering vehicles like hedge funds. Finally, the U.S. dollar has been turned into bad money as it has weakened and become vulnerable to the world’s other currencies. In all these ways, “bad” finance has failed the American people and pointed U.S. capitalism toward a global crisis.

Well several have sorta made the point but in general, inspite of exceptions that BR notes, the Economist covers everything and tends to be forward-looking. A classic case in point was there coverage of the worldwide boom in housing which everybody ignored – which they actually did several times. Can’t find my original but believe their first big special was circa ’03 ! In this case they’re pointing at structural factors that are just beginning to work out.

Barry, how do you feel about Mish’s argument about how we’re likely to hit deflation rather than (hyper) inflation? I’m in complete agreement that things are pretty bad and getting worse, but as far as the inflation/deflation argument, it’s still largely up in the air. His main argument is that even though the Fed will print money (probably lots of it) the destruction of credit via writedowns/losses will wind up more than counteracting it, leading to a deflationary recession. This is also possible after a sustained period of inflation/price appreciation. Obviously if/when this happens, it’d really change what sorts of defensive positions you’d take.

Opinion?

This has got to be the world’s most predicted recession. Isn’t a recession supposed to sneak up on you and when you realize it has hit, its half over. This recession was spotted by over the horizon radar. It was feted, heralded and cheered. Its path and its arrival was monitored and covered like some moon shot. That alone makes this environment pretty strange.

If I was the market and wanted to screw everyone over, I’d make sure this bear market rally made a new high on the S&P later this year and drew in every possible buyer. Then I’d have the market decline again and test the bottom side of the multiyear range. That’s my prediction.

The “contrary indicator” argument works only for phenomena with a lifecycle proceeding roughly at the same pace as their coming to widespread awareness. Thus, at the maximal public awareness, the phenomenon transitions into the “over” or “declining” phase.

Not so for longer-lived phenomena. For example, the Great Depression was probably well known to everybody long before it was over, at least on the order of years.

Who remembers in 1999 the great call of The Economist predicts low oil prices for foreseeable future? On August 1982 it was ‘The Bull Jumped over the Moon.’ Now this hyperbole on The Economist Cover: The Great American Slowdown will go down as a new high in the thoughtlessness of the periodical; it is appropriately greeted by IBM rosy predictions.

Credit default swaps have taken the life out of any debt instrument, hardly anything left to short. Forget about corporations just look at Icelandic bonds for a cue. Oil, against actual global demand of 86 million barrel a day, nearly 1 billion barrels daily is traded speculatively. The hypes in ‘commodities’ like excesses in currency trading definitely are part of markets. These very instruments are the reason that market bubbles are pricked with regular frequency. That is the strength of these US markets, kill first ask questions later.

‘The Great American Slowdown’ would be rated as new cover story to late in the game. Perhaps it is no less sensational to their equal idiocy and stupidity when they predicted with identical circus the great call of ‘The Economist predicts low oil prices for foreseeable future.’ They forecasted just before the oil took off like a rocket in 1999 that ‘low prices will gradually put most such areas out of business-especially if cash-strapped Gulf states conclude that the best way to increase revenues is to boost production, which could drive prices from today’s $10 to as little as $5.’ When I see oil hovering around 115$ today, my ‘reservations’ on quality of these front-page fairy-tales get further reinforced.

Your lifestyle or taste determines what the focal point of your living area is. If you have a fireplace, you can rearrange your furniture around it. Or if you have a piano, and this is the focal point of your living area, your furniture could be set around it. When rearranging your furniture, also consider traffic in your Living Room Decoration area. It is always good to arrange furniture in off-square angles. This makes the room warmer and more casual. http://living-room-decoration.blogspot.com