courtesy of NYT

>

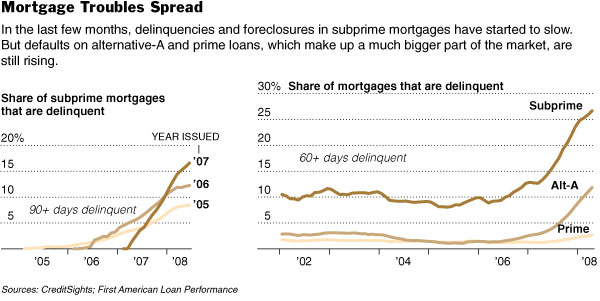

Quite an instructive chart — Its pretty obvious that late 2006 early 2007 was when something unusual began in Sub-prime mortgages. And, not much after that Alt-A followed.

Calls of a bottom in either housing or financials have been premature. Those perennial optimists who keep incorrectly making those erroneous bottom tick attempts need to consider the following:

The first wave of Americans to default on their home mortgages appears to be cresting, but a second, far larger one is quickly building.

Homeowners with good credit are falling behind on their payments in growing numbers, even as the problems with mortgages made to people with weak, or subprime, credit are showing their first, tentative signs of leveling off after two years of spiraling defaults.

The percentage of mortgages in arrears in the category of loans one rung above subprime, so-called alternative-A mortgages, quadrupled to 12 percent in April from a year earlier. Delinquencies among prime loans, which account for most of the $12 trillion market, doubled to 2.7 percent in that time…

While it is difficult to draw precise parallels among various segments of the mortgage market, the arc of the crisis in subprime loans suggests that the problems in the broader market may not peak for another year or two, analysts said.

Defaults are likely to accelerate because many homeowners’ monthly payments are rising rapidly. The higher bills come as home prices continue to decline and banks tighten their lending standards, making it harder for people to refinance loans or sell their homes. Of particular concern are “alt-A” loans, many of which were made to people with good credit scores without proof of their income or assets.

Wishful thinking is never a substitute for reviewing the actual data; thoughtful analysis is better than cheerleading.

I’m just saying . . .

>

Source:

Housing Lenders Fear Bigger Wave of Loan Defaults

VIKAS BAJAJ

NYT, August 4, 2008

http://www.nytimes.com/2008/08/04/business/04lend.html

Thoughtful analysis isn’t better than cheerleading if the cheerleader is a smokin’ hot babe.

Thoughtful analysis isn’t better than cheerleading if the cheerleader is a smokin’ hot babe.

Thoughtful analysis isn’t better than cheerleading if the cheerleader is a smokin’ hot babe.

Thoughtful analysis isn’t better than cheerleading if the cheerleader is a smokin’ hot babe.

Thank you! I’ve been pointing out that this wave is coming for over a year! You are correct in that it has the potential to dwarf the problems that began last year.

To give a brief example in real numbers for a very typical “Prime” Borrower in 2003: they took a $300,000 loan on a 5/1 ARM interest only payment at 4.25%. Payment was $1,062.50 per month.

Those mortgages are resetting, most over the next 3 months. What happens then? Two choices; they reset or refinance.

If they reset it is usually One Year LIBOR plus 2.25% margin, or roughly 5.50%, which doesn’t sound bad compared to current rates with no points on a 5/1 ARM. Problem is most of these people have not realized how their ARM works. Yes, the rate only goes up to 5.50%, however, it’s now a FULLY AMORTIZED payment AND for only the remaining 25 years of the loan term.

Result? Your payment goes up to $1,842.26 per month. That’s a 73% INCREASE in cost of what is likely your biggest household expense. You think consumers are pinched by gas at $4 a gallon? That will look like chump-change compared to this.

Well, the CEO and CFO of JPMorgan have been shouting this to the investment community during their quarterly calls. So, it’s hard to say that this bit of data on increasing delinquency is exactly “news” or an “unconventional viewpoint.”

And this morning’s consumer spending data show a decrease in spending after factoring out inflation.

http://www.marketwatch.com/news/story/real-spending-falls-june-despite/story.aspx?guid=%7B5A153311%2D54CC%2D4AEA%2DA26D%2D09F2B841A4AE%7D

I understand the human condition is to be hopeful, but I just don’t see based on Barry’s post, and continuing data like this morning’s…how we are near the end of this contraction..

‘Splain it to me, Lucy…

This looks consistent with a chart Hussman published in a comment pooh-poohing the 8th inning, or whatever inning, cheerleading that was going on last Spring. It is a chart of cumulative resets of ARM’s. The graph is shifted 180 days into the future (to the right) to take into account the 180 days or so that foreclosure takes. It shows we are still on the steep upslope of losses that will have to be recognized.

Cumulative Resets.

Here’s a link to the whole article:

Which “Inning” of the Mortgage Crisis Are We In?

I don’t remember if it included Alt-A’s. If it didn’t, so much the worse.

Heresy! Soon you’ll be saying that our public policy should be based on actual outcomes, or that the behavior, and actions of governmental personal should be subject to legal limitations.

Oh, wait, they already are, the relevent outcomes are those that benefit the people who put them in power, and the relevent laws are what ever these same people deem important.

My bad.

“Option ARM-ageddon: The Real Reset Risk”

(Barclays Capital research dept.) predicts that a majority of existing loans would reacast in 2010-2011 and mouthly payments would jump 60-80%.

By comparison, most subprime resets should cause only an 8 to 10% payment shock.

Barclays study indicated that between 2008 to 2012, approximately $312 billion in option-ARM loans will recast to become fully amortizing loans.

The majority of these recasts will come in 2010 and 2011, when $109 billion and $118 billion will recast, respectively.

As a result of declining home prices and negative amortization of these loans, most borrowers resetting in 2010-2011 will have loan to values ratios in excess of 100 percent.

This was sourced from an article by Tom Kelly (former real estate editor for the Seattle Times).

I have read that the United States housing problems are a toothache compared to the “hip replacement” that will occur in England once their housing crash happens.

I don’t think the Bulls in wallstreet realize how people are living pay check to pay check. Take that paycheck away and well…

Where is Mr Larry Goldilock?

And then there’s this from the WaPost:

“Turmoil in the housing market has led to fears that home prices will drop precipitously, particularly if foreclosures force large numbers of homes onto the market in the coming year. Recently, these fears have driven financial stocks down and led to the government rescue of Fannie Mae and Freddie Mac. But the projected losses have been wildly exaggerated. Most Americans have not experienced any significant decline in the value of their homes — nor are they likely to.”

I would love to see some reaction to THAT. Heh.

The only thing more amazing than the number of delinquent mortgages is the number of resets on deck.

Remember the reset graph from Credit Suisse? We are only part way thru the subprime bump and Alt-A resets haven’t started in earnest. Graph here:

http://tinyurl.com/6g4bj2

> Most Americans have not experienced any significant decline in the value of their homes — nor are they likely to.

Well, I guess it all depends upon what he calls a “significant decline.”

and now here come the credit card losses:

http://bloomberg.com/apps/news?pid=20601109&sid=ajsTInbxlpHk&refer=home

Alt-A will be worse:

Alt-A borrowers were good credit borrowers. When a shady realtormortgage broker found an Alt-A borrower with good credit who was willing to sign their name with abandon, they found multiple “great deals” for that “investor” and pre-filled out the paper work for them and got them in to as many properties as they could as fast as they could in 2005-2006. Of course, all “owner-occupied” and all “exploding ARMS” and always “don’t worry we will refinance you again when it resets, you can collect the rents and be putting money in your pocket every month.”

That same realtormortgage broker made sure to do the cash out refi 6 months later right up until mid 2007. I know of one deal where a $20,000 cash out refi came with almost $20,000 in fees added on top to the loan!. And, once they found a patsy, they got the brother, the Uncle and the Mother involved in “investing” too…racking up fees at every turn. There was so much money being made on each deal at the broker level, points on the front end, points on the back end, referral fees, etc., it was the moral hazard X games..

Some of these “investors” stopped paying their mortgages months ago and are still collecting rents and banks are very slow to foreclose because they are so hideously upside down.

I think this Alt-A thing is going to be huge, so much fraud involved it boggles the mind. And, it happened mostly in areas that went to insane levels with the biggest write owns per property-yet to be taken: $200,000 to $300,000k per property in many cases and ZERO chance these borrowers ever make a come back on their payments.

It will be very ugly because banks have already gone to the trough for capital, with the acceleration in defaults who is going to want to put capital in to banks now? I just hope the paper is spread so far and wide that the losses are not too big in any one place, but this will surely take down a big player or two me thinks….

Ok…oil drops by 4 dollars per barrel…no hurricane after all…and what is unusual about the market today in view of this? 12:50 pm central time…

I’ll tell you…the market hasn’t exploded to the upside!..Doesn’t this seem to be an awfully muted response to what just a few weeks ago would have caused dancing in the (Wall) street??

Hmmmm…..wonder what people are thinking?

Bruce in Tennessee

“Defaults are likely to accelerate because many homeowners’ monthly payments are rising rapidly.”

Not a problem! The government will keep bailing out the irresponsible and in the process expand the monetary supply. Anyone who doesn’t have at least 25% of their portfolio allocated in monetary metals to offset this inflation is going to be a real loser. My bet is that the FED cuts before they raise rates. Maybe not tomorrow. That will be even more inflationary.

good stuff, as usual. i’m attching, or trying to, a chart of subprime and alt-a and other resets as scheduled over the next couple of years. it’s plain to see that the subprime resets have peaked and will drop sharply by the end of ’08 or so. it’s the other stuff that resets at increasing rates over the next 2 years or so, something to keep an eye on. clipb

http://calculatedrisk.blogspot.com/2007/10/imf-mortgage-reset-chart.html