>

This morning’s guest post comes from long time analyst — and my favorite and MidWest curmudgeon — Bill King. I have been reading Bill’s “Independent View of the News” for years, and always find his insights away from the mainstream and refreshing.

Wednesday

March 11, 2009 – Issue 3465

~~~

With credit markets deteriorating again and stocks hesitant to rally, solons had to do something to divert

attention. So Bernanke, once again picked a bottom, calling for the US economy to bottom in 2009.

Then a memo by Citi CEO Pandrit suspiciously appeared in the WSJ to announce that Citibank turned a

profit in January and February and that its quarterly performance to date, before taxes and special items, was the best since the third quarter of 2007. However Pandit did NOT address the pressing issues of credit losses, toxic paper, derivatives, SIVs, off-balance sheet items and related items.

Profit from operations is not and has not been the problem for financial institutions. It’s the write offs and toxic assets. Mr. Pandit’s dubious memo is a reiteration of what any professional already knows.

Business Week: Strip away the billions of toxic assets and the billions more that the feds have pumped

into Citigroup, and what you have is a dandy little bank that actually makes money. At least that was the upbeat takeaway from Citi’s beleaguered CEO Vikram Pandit, who distributed a memo to employees late on Mar. 9 about the bank’s bright prospects, despite the current $1-a-share price tag.

Pandit’s apparent purposeful leak begs the question: Why did taxpayers have to rescue Citi for a

third time only two weeks ago if Citi is doing so well this year?

Here’s riddle for investors: If Pandit is being less the totally transparent, do you think that regulators

would press him to give a total accounting of credit & toxic paper woes?

We hope Mr. Pandit isn’t doing an Immeltdown. The GE CEO proclaimed GE’s dividend was safe on

February 5. Three weeks later, it was severely cut.

The other main rationale for yesterday’s explosive rally is talk that the uptick rule will be reinstated. As

we have mentioned in the past, and we related to reporter yesterday, any professional trader with a

modicum of guile knows how to circumvent the uptick rule.

We have decades of experience is seeing this done. We used to accommodate hedge funds by buying

from them on an uptick on a regional and then hitting the bid. The hedgie would provide a generous

commission. You can get a counter-party to sell you a stock with a hedging derivative; so you can then

pound the stock. You can do an EFP on baskets. You can sell another trader a deep in the money call

spread, stamp an exercise notice and pound the stock in concert with the other trader. We witnessed this scheme regularly on the CBOE – about 30 years ago!

So when the financial media or traders appear to talk about how the uptick rule will halt abusive short

selling, they really don’t understand the market or the major players. But the uptick rule will impede day traders and fantasy stock traders.

The short-term/relief rally that we anticipated appears to be in bloom, ignited by short-covering in

financial stocks. We noted in yesterday’s missive that a tradable rally could be triggered in one of two

ways: a dramatic purge or a breakout above 700 on the S&P 500 with contained pullbacks.

Obviously the breakout above 700 appeared. But astute traders realize that there have been two robust

rallies in each of the previous two weeks and they did not mark tradable bottoms. This rally has better

technicals and a more benign seasonal setting so the probability of a tradable rally is much higher.

Pullbacks must be contained so traders will now employ a buying dips instead of selling rallies strategy.

This rally could endure for a few weeks, but unless there is some dramatic fundamental change, this rally

is nothing more than a tradable rally.

Looking at the calendar, stocks should form and ‘A-B-C’ corrective rally that lasts into the first day or so

of April. As we mentioned in a previous missive, we are looking for a similar rally that occurred in

December and topped out at the second trading session of 2009.

However, this rally should be shorter in duration because the same rally impediment that appeared in

January, earnings reporting season, will arrive in three and a half weeks.

What could thwart the rally? Any one of the myriad financial landmines or nukes could suddenly

detonate, especially with credit markets worsening. However, the most likely rally killer would be a key

company or companies releasing ugly earnings & guidance earlier than scheduled.

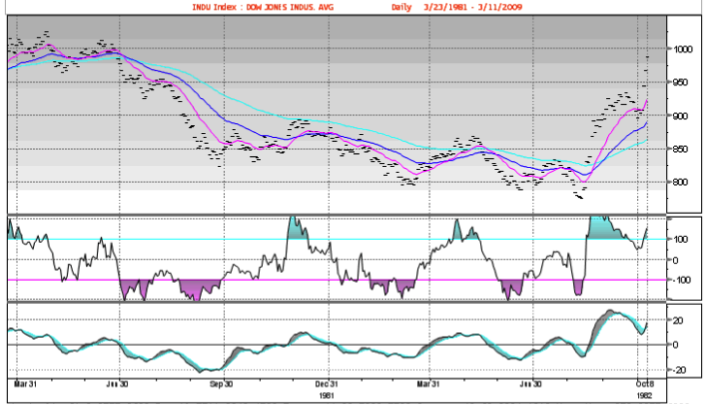

S&P 500 Index with CCI (middle chart) and MACD (bottom chart)

The November 20 low had screaming momentum (CCI – Commodity Channel Index)) and trend

divergences. The divergences present now are with the October panic and they are not nearly as dramatic as what appeared at the November low.

As long as key moving average are downward sloping and the index is far below them, the best one can

hope for is a rally that carries to the short term (55 day) or intermediate term (126 day) moving averages.

Stocks must ‘do some work’ to turn the technicals to a more benign condition. If stocks rally over the

next two to three weeks an April-early May decline, even with new lows, should create screaming

technical divergences. And valuations could be better. Then a very robust rally could appear.

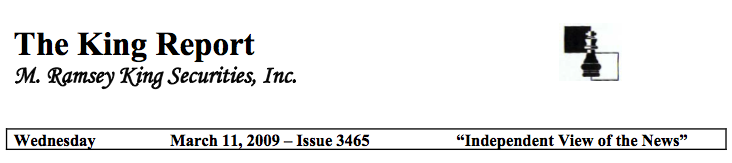

Someone, probably a broken-clock bull, sent around a message yesterday that noted that stocks closed at a 5-day high after making a new low the previous day and the last time this occurred was the bottom in 1982. Ergo “the bottom” is in!

Besides being egregiously spurious, the causation for the rally in 1982 was Paul Volcker abandoning his

quantitative tightening to flood the system with liquidity to keep Mexico and Latam from defaulting.

More importantly, stocks in 1982 were at one of their cheapest levels in history. We were at Jefferies

then and at a firm soiree in the Sears Tower, a few months before “The Bottom”, Ned Davis beat the table about stocks being as cheap, and perhaps cheaper, than at the all-time “Bottom” in 1932.

“The Bottom” in 1982 is technically superior to what current conditions. The ’82 divergences are more

pronounced but more importantly the MACD (trend) and CCI (momentum) kept vacillating around the

zero line as stocks kept trying to commence a bull market. Also, the key moving averages vacillated,

making it easier to turn positive and signal a rally. Current moving averages show no rally signs.

Dow Jones Industrial Average, March 23, 1981 to October 8, 1982

For the past several months, gold tends to rally on Thursday-Friday ahead of anticipated ugly news that

has been appearing from Friday afternoon to Monday morning. Gold tends to fall Monday to Wednesday.

With gold being oversold short-term, there could be a trade opportunity late today or on Thursday.

What's been said:

Discussions found on the web: