I always enjoy fighting my way through the nonsensical press releases from the National Association of Realtors. At one time, it was a bit of a challenge, but its become much easier once I figured out that they are a PR trade group, and not a legitimate source of honest economic commentary. Its as if a really dumb Will Shortz put out crossword puzzles, or made some for those suffering from blunt force head trauma.

This month’s release was especially easy — the data alternates paragraphs with the NAR spin. Strip out the PR bullshit, and what you are actually left with is straight up data.

• Existing-home sales increased 2.9% (seasonally adjusted annual rate of 4.68 million units) in April from a downwardly revised pace of 4.55 million units in March.

• Sales were down a modest 3.5% from April 2008.

• First-time buyers in April declined to 40% of transactions (NAR survey).

• Nationwide, the median existing-home price for all housing types was $170,200 in April, down 15.4% below April 2008.

• Distressed properties accounted for 45% of all sales in April;

• Total housing inventory at the end of April rose 8.8% — about 4 million existing homes — a 10.2. month supply;

• Single-family home sales rose 2.5% from March (seasonally adjusted annual rate of 4.18 million);

• Sales are 2.8% below the March 2008.

• The median price for existing single-family homes was $169,800 in April, which is 14.9% below a year ago.

The increase in inventory is somewhat worrisome, and supports our thesis that any stabilization in sales or prices will bring out more shadow inventory. (I would need to see the data on past inventory increases to see if Lawrence Yun’s statement, “The gain in inventory is largely seasonal from sellers entering the spring market” is remotely accurate.)

Rex Nutting noted that while most of the sales taking place are in the low-end of the market, “sales of homes priced above $750,000 have collapsed . . . The high-end has been decimated by the inability of many homeowners to sell their home in order to trade up. Most don’t have the collateral to get a loan.”

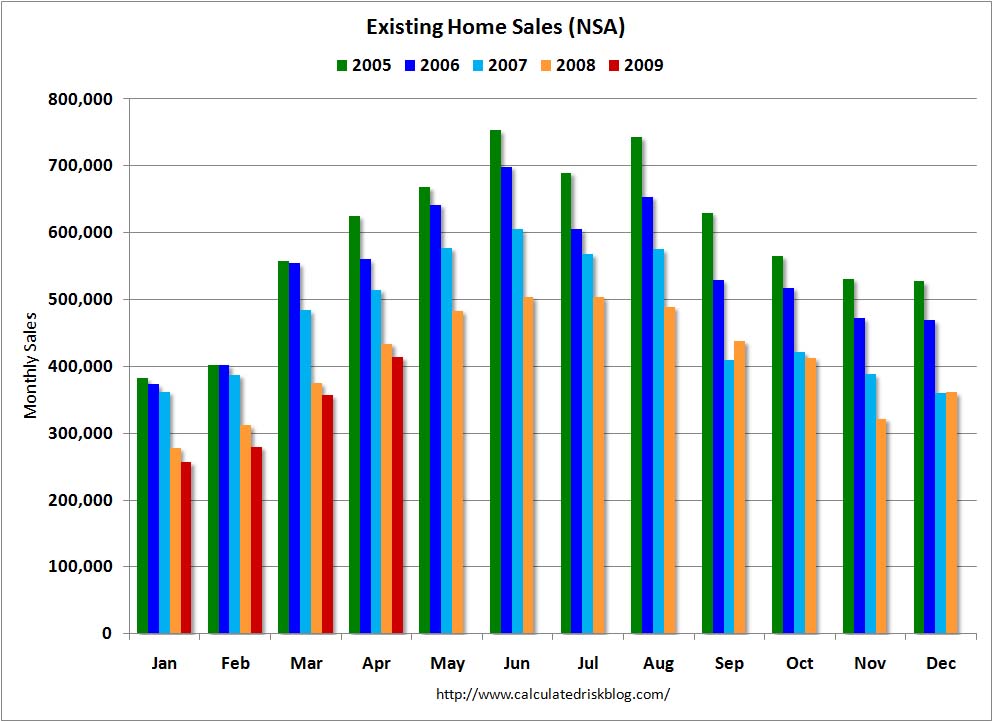

Note the red line — we are still tracking the past few years seasonal trends:

>

Existing Home Sales, NSA

>

•

Sources:

Existing-Home Sales Rise in April

NAR, May 27, 2009

http://www.realtor.org/press_room/news_releases/2009/05/ehs_rise

Home sales rise 2.9%, boosted by foreclosures

Prices drop 15.4% while inventories continue to climb

Rex Nutting

MarketWatch May 27, 2009, 10:00 a.m.

http://www.marketwatch.com/story/home-sales-rise-29-boosted-by-foreclosures-200952710000

See also:

Mortgage applications fell 14.2% last week: MBA

Amy Hoak

MarketWatch, May 27, 2009, 7:07 a.m. EST

http://www.marketwatch.com/story/mortgage-applications-fell-142-last-week-mba

What's been said:

Discussions found on the web: