Good Evening: U.S. stocks today suffered their broadest and deepest retreat since the March lows. That this weakness in equities was confirmed by the action in other parts of the capital markets and was accompanied by rising volume and volatility levels may mean that a correction of the March-June rally is now under way. A gloomy economic outlook issued by the World Bank was the given excuse for today’s decline, but the green shoots crowd has more to worry about than official forecasts. Bullish sentiment reached elevated levels this month, as did the supply of equity sales by corporations and their officers. Whether this pullback in the major averages is mild or something more severe may therefore depend upon the risk appetites of those who’ve been on the sidelines.

Digesting the World Bank’s updated (and more downbeat) economic projections wasn’t much of a problem for Asian markets, but European equities were certainly under pressure last night. Our stock index futures were off less than 0.5% a couple of hours before trading began today, but the post-expiration selling pressure kept building until the major averages were forced to open between 1% and 2% lower this morning. As there was nothing in the way of economic news to contemplate, market participants were forced to consider whether or not to take seriously the prognostications of the World Bank’s many economists. To some, the early downdraft in the major averages suggested a causal link, but I find it hard to believe that investors would suddenly put so much stock in a staff that has heretofore been either wrong, ignored, or both. Should investors now believe the ratings agencies, too?

Equities never did recover from their early sinking spell, and Monday’s few rallies were as weak as they were brief. Once the S&P penetrated the 900 mark in the late morning, it was never able to regain the “9 handle” before the bell. Energy, materials and transportation (read: economically sensitive) names led the swoon, and the only sectors showing any resilience were the defensive ones. Technicians also went home in a bad mood. Once it became apparent just before the closing bell that the widely watched S&P would likely close below its 200 day moving average, the whole tape finished with a closing flush to the downside. By day’s end, the averages were down between 2.35% (Dow) and 4.7% (Dow Transports) on brisk volume. The VIX spiked (as did other measures of volatility — see below) and the other markets seemed to confirm that investors are now afraid the green shoots may wilt. Treasuries were firm all day, as yields fell between 7 and 10 basis points. The dollar also became a perceived safe haven, and commodities received a sharp rap on the knuckles. Weakness in the energy and grain markets pulled down the CRB index by 2.7% today.

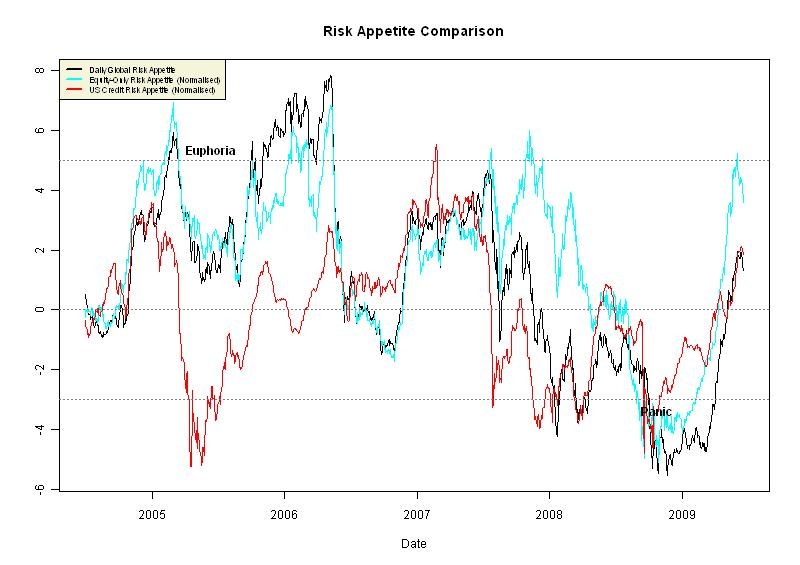

It took less than two trading sessions for me to abandon the “counter-punching” strategy I stated I would employ until the outlook became less murky. Today’s session tells me that other investors are unwilling to be quite as patient, so I’ve reverted back to my usual cautious stance toward the capital markets. One of the factors that I’ve mentioned before — increased supply of shares due to all the secondary issues coming to market since May — has become a bigger cause for concern now that insiders are also rapidly unloading shares (see below). Furthermore, the credit spreads that had been narrowing since March have started to widen again in the last week (see below). And finally, some measures of investor sentiment reached levels that displayed less fear than at almost any time since this bear market began in October of 2007. As can be seen in the Credit Suisse risk appetite charts you will find attached, the “equity only” measure of risk appetite actually touched the euphoria zone earlier this month. Other mid month surveys showed bulls once again outnumbering bears by a 2 to 1 margin.

Given the return of this long lost sense of investor complacency, it is not surprising that the stock market has started to correct its 3 month sprint off its March low. The crucial unknowable for investors is how far this pullback will carry. Wall Street did its level best to create plenty of supply as prices rose, with secondary issues pouring forth in record amounts during the past month or so. Now that investors have requested “no mas” to all this newly minted paper, at what price levels will demand revive? As of today, the S&P is now down more than 5% from its June peak; a 10% drop would take the index just below 860. Below 850 might signal a retest of the bear market lows, so if there is indeed a large mass of sideline money just waiting for a dip, we should soon be seeing it put to work.

Then again, highly correlated moves (stocks and commodities going one way, while the dollar and bonds go the other) like the ones we’ve seen since this bear market began have a way of causing investors to hit “cancel” when their buy tickets are close to getting filled. Perhaps some are waiting to see if Bernanke & Co. whisper sweet nothings into Mr. Market’s ear after this week’s FOMC meeting; others are waiting for a bottom in housing before they jump in. And, of course, existing longs are waiting for new longs to join them, but few may want to be caught holding the bag with banks, insurance companies, and insiders once again selling shares. It will be fascinating to see how all this waiting plays out, but about the only thing any of us knows for sure is that this renewed volatility threatens summer vacation plans for the third year in a row.

— Jack McHugh

U.S., Europe Stocks Fall, Commodities Drop on Recession Concern

VIX, VStoxx Surge as World Bank Report Sends Equities Tumbling

Insiders Exit Shares at the Fastest Pace in Two Years

Wells Fargo Leads Biggest Jump in Company Risk in Three Months

What's been said:

Discussions found on the web: