Good Evening: Yet another afternoon rally after morning weakness allowed the major U.S. stock market averages to finish mixed today. Some earnings misses, along with some so-so economic data set the tone in the early going, but enough buyers showed up by day’s end to turn 1% losses into gains for both the NASDAQ and Russell 2000. That the markets remain resilient even as they are “overbought” shows how much the mood has changed since the turn back in March. With he S&P still looking like it wants to test resistance up at the 1000 level, it’s fair to ask just what forces are pushing stocks higher these days. Yesterday I showed how analysts and technicians were doing their part to get clients to invest at these levels, so today we’ll examine what market strategists, institutional investors, and individual investors are thinking. It is pretty clear that, except among individual investors, risk appetites have been rising at an impressive rate. To many on Wall Street (more than a few of whom had their glasses fogged when peering into 2007, 2008, and the first half of 2009), it’s time to pull out the post-recession script and invest accordingly.

U.S. stock index futures were flat during the wee hours this morning, only to sink with the rising sun. Europe, which had opened to the upside, started weakening after Deutsche Bank reported a disturbing rise in loan loss provisions. U.S. Steel, Coach, and Office Depot then reported disappointments of varying degrees, more than offsetting good news from Amgen and a few others. Index futures were pointing to losses of 1% or so when the Case-Shiller home price data was released 30 minutes prior to the open (see below). Home prices actually rose for the first time in 3 years (on a month over month basis — yoy declines are still in the high teens). This news helped to contain the early selling in New York, and the indexes rallied back to the unchanged mark almost as soon as trading commenced.

At 10 am edt, however, the Conference Board reported that its latest measure of consumer confidence ticked down for the second straight month. Posting 46.6 versus expectations closer to 50, this confidence figure inspired anything but. The averages retreated between 1% and 2% within the next 90 minutes, and the economically sensitive names (materials, miners, energy, etc.) swooned even more. And yet, yet again, the averages were able to grind their way back to unchanged by day’s end (though not so for the aforementioned cyclical companies). The NASDAQ’s 0.4% gain edged ahead of the Russell 2000, showing that managers are trying to capture alpha by adding beta, while the Dow Transports (- 1.3%) finished in the omega spot.

Treasurys were uniformly higher in the morning, only to also finish mixed at the bell. A poor 2 year note auction left yields on shorter maturities higher by 2 to 4 bps, though the long end held firm. An 8 basis point drop in the 30 year bond implied that more than one trader was compelled to reduce curve steepening positions. The dollar was mixed, but mostly finished higher, and the commodity traders were just as surprised as the curve traders. Hurt by falling energy and metals prices, the CRB index declined almost 1% today.

Market strategists are supposed to peer into the future and tell investors what they think lies ahead for the stock market. Mostly, they’re just bullish. The Great Recession and the bear stock market that began in 2007 gave them pause, and some of Wall Street’s finest became cautious. A couple of them were even bearish for a spell, but the rally off the March lows has many of them convinced that both economy will soon recover and that a new bull market is at hand. The London-based strategy team at Credit Suisse was indeed one of the teams that worried openly in 2008, and, like many others, they now view Mr. Market with favor.

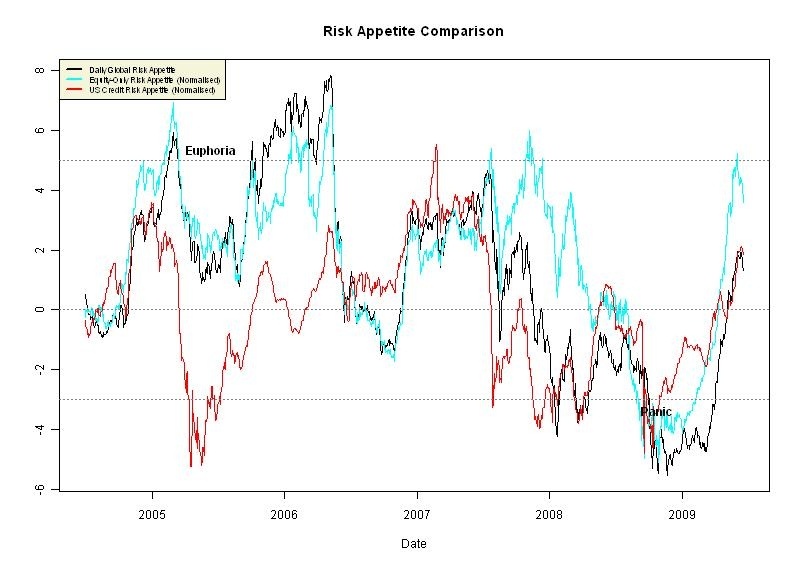

In the attached “Market Focus: Shaping Up”, the CS team argues that a rally to S&P 1000 will likely NOT auger a resumption of the bear market. They think instead that risk assets are poised to climb a thick wall of worries back to “pre-Lehman levels” (above 1200). They cite, among other reasons, a “thundering herd of pessimists”. Since Bank of America-Merrill Lynch months ago dispensed with David Rosenberg and Rich Bernstein in favor of strategists more in keeping with the Merrill logo, I find the allusion puzzling. What’s also interesting is that the CS team seems to be ignoring their own “Risk Appetite Indexes”, which are nearing euphoria territory.

Herds of pessimists, thundering or cowering, are actually pretty hard to find among strategists these days. And, according to State Street’s Investor Confidence Index at least, so, too is it hard to find bearish behavior among the institutional investors they track. I’ve never really given their poll much attention, but at least it is not some bland (and therefore suspect) survey. No, the folks at State Street track actual positions in customer accounts. The following excerpt from today’s press release tells the whole story, but the sound bite take is: Investors are acquiring risk positions (read: equities) at the briskest pace since 2004. It wouldn’t be the first time since the turn of the Millennium that institutional investors spoke like bears but invested like bulls. In addition to CS’s “climbing a wall of worry” cliché, I’ll offer my own — “watch what they do, not what they say”.

“Developed through State Street Global Markets’ research partnership, State Street Associates, by Harvard University professor Ken Froot and State Street Associates Director Paul O’Connell, the State Street Investor Confidence Index measures investor confidence on a quantitative basis by analyzing the actual buying and selling patterns of institutional investors. The index is based on financial theory that assigns precise meaning to changes in investor risk appetite, or the willingness of investors to allocate their portfolios to equities. The more of their portfolio that institutional investors are willing to devote to equities, the greater their risk appetite or confidence.

“The index results strongly reflect increasing investor strategies designed with a view that the global recession will wane more rapidly than many had feared,” commented Froot. “Investors are now adding risk to their portfolios at an impressive rate, faster than we have seen in several years. In fact, this is the highest level the ICI Global index has reached since mid 2004. That is an impressive turnaround over last October, when the ICI Global reached its lowest-ever-recorded level of 82.1.” (source: State Street press release below)

So, if analysts, technicians, strategists, and institutional investors are positively disposed toward equities, who is left to turn bullish? Individual investors, that’s who. More bullish than any other group of investors at the top of the tech bubble in 2000, the 401K crowd has, like their retirement accounts, not fully recovered from what’s transpired since 2007. According to the latest poll by the American Association of Individual Investors (AAII — see below), bears still outnumber bulls among smaller investors. Closer to becoming part of the weekly jobless claims statistics than the average strategist or asset manager, individuals are understandably cautious, in spite of (perhaps because of?) all the bullish advice they are receiving from professionals these days. These poor souls, if one listens to the laments of financial advisors who can’t seem to get their clients to plunge into stocks, don’t understand history. They don’t understand that, according to the perceived wisdom on Wall Street, that stocks have already bottomed and the economy will soon follow. Next stop, Nirvana!

AAII Poll: Results as of July 23, 2009

This week’s survey results saw bullish sentiment rise to 37.60%, below its long-term average of 38.9%. Neutral sentiment fell to 20.00%, below the long-term average of 31.0%. And bearish sentiment fell to 42.40%, above the long-term average of 30.0%. (source: American Association of Individual Investors)

Bullish 37.60%

Neutral 20.00%

Bearish 42.40%

It’s possible the Quants, Strategists, Technicians, and asset managers have built an unassailable consensus this time , but I’ll throw my lot in with the little guy, anyway. With a broken credit bubble that followed a broken housing bubble that followed a broken stock bubble, how can Wall Street be so sure that our capital markets will now follow the script from previous, post-WWII recessions? Is it wrong that individual investors remember how Wall Street analysts and strategists trotted out this same, “stocks bottom 3 to 6 months prior to the bottom of a recession, so you’d better buy now!” rationale back when the economy bottomed in 2001, only to see stocks make much lower lows in 2002? The herd pushing equity products might be right for a spell, and the S&P might even take a peek above 1000. But this is no ordinary time we find ourselves in, and the tremendous forces of credit contraction and money printing are colliding to set fresh history with each passing day. How can anyone claim they know what the future holds in such an uncertain environment? We’re all actors without scripts these days.

— Jack McHugh

U.S. Stocks Drop on Disappointing Consumer Confidence, Earnings

U.S. Economy: Home Prices Rise, Consumer Confidence Declines

What's been said:

Discussions found on the web: