~~~

ECONOMY

As discussed since March, GDP will likely be positive in the fourth quarter and maybe in the third quarter, if inventory restocking kicks into gear. If both the third and fourth quarters are positive, the National Bureau of Economic Research could determine sometime in the first half of 2010 that the recession ended in July or August 2009. Before anyone breaks out the champagne in celebration, it must be noted that in declaring an end to a recession, NBER is only identifying the trough in business activity. In determining the beginning and end of a recession, NBER looks at employment, real personal income minus government transfers, industrial production, retail sales, in addition to GDP. In the last two recessions, NBER decided the trough in activity coincided with an increase in industrial production in April 1991 and December 2001. As a result, NBER determined the 1991 recession ended in March, and in November 2001. If the past is any guide, NBER could determine that the current recession ended, in the month preceding a turn around in industrial production. The next few months could prove interesting in this regard. In June, industrial production fell -.4%, after posting a deep drop of -1.2% in May. For the second quarter as a whole, industrial production fell at an annual rate of -11.6%, after plunging -19.1% in the first quarter.

In my December 2007 letter, I stated that the Federal Reserve was going to have a more difficult time containing the coming credit crisis, since so much credit creation was taking place outside the banking system. Twenty-five years ago, banks provided almost 75% of the credit to the economy. In recent years, it had fallen to 35%, while the securitization of mortgages, home equity loans, auto loans, credit card debt, student debt and company receivables provided more than 40% of the credit. “Since the market place is supplying a greater proportion of credit creation to finance economic growth, the Federal Reserve’s capability to manage the credit creation engine has diminished. This is why this crisis is quite different than the other crisis faced by the Fed in the last 20 years. Most investors really don’t understand the credit creation process, and as a result, don’t comprehend the scope of this crisis, or the Fed’s limited ability to deal with it. It really is different this time.”

As much as the phrase “It really is different this time” applied to the credit crisis we were facing in December 2007, it also is appropriate in assessing the sustainability of the coming recovery. As noted last month, the decline from a growth rate of 2.8% in the second quarter of 2008 to a negative -6.1% in the fourth quarter, and rebound into a positive GDP print by the fourth quarter of 2009 is going to look every bit like a V-shaped recovery.

In tracking the end of a recession, NBER is merely identifying when the economy in aggregate reached its lowest point. It tells us virtually nothing about the quality and strength of the recovery that follows the trough. In the three worst recessions since World War II (1957-1958, 1973-1975, 1981-1982), real GDP (nominal GDP less inflation) averaged 5.6% in the first full calendar year after the recession ended. If measured from the trough of those recessions, real GDP growth averaged 7.8%. The coming recovery will be far weaker than prior recoveries. Those recessions were precipitated by the Federal Reserve increasing rates enough to significantly slow economic growth, causing a buildup of inventories, a reduction in production to pare inventory levels, and an increase in unemployment. Since the higher cost of money negatively impacted demand for homes and cars, pent up demand was unleashed as soon as the Federal Reserve lowered interest rates, which launched a strong self sustaining recovery.

The current recession was precipitated by the largest global financial crisis in history, not by a large increase in interest rates. The collapse in credit creation has resulted in the deepest synchronized contraction in global trade and economic growth since the 1930’s. The depth of this recession, and commensurate increase in unemployment, and declines in business investment and trade, has made this financial crisis worse and more protracted. The magic elixir of lower rates, which spurred the strong recoveries after the 1957-1958, 1973-1975, and 1981-1982 recessions, has proven a placebo. Lower rates have helped, but the demand for housing and cars has collapsed, so there is no pent up demand for the recovery to draw upon. The banking system remains crippled. Lending standards are very high for most forms of credit, credit availability remains restrained, and the volume of securitized credit is still off by more than 80%.

When the Fed lowered interest rates in 2001 and 2002, it sparked a pick up in demand for cars and trucks. But the main reason the assembly lines kept humming was that every car and truck loan could be securitized. Between 2002 and 2006, more than 90% of the Detroit automaker’s profit came from financing, not from manufacturing cars and trucks. On the surface, the car business looked healthy, but under the hood the decay was plain to see, and exposed once the securitization market vaporized. And despite all the Fed’s efforts, the securitization markets remain moribund.

Before the housing bubble became a bubble, lower rates in 2001 and 2002 made it possible for millions of home owners to refinance their mortgage. This increased their disposable income and spending, helping to offset the decline in business investment in 2002. Household debt as a percent of disposable income actually rose 6% during the 2001 recession, which had never happened before during a recession. Lower mortgage rates are helping rejuvenate refinancing activity again. But for the 20% to 25% of homeowners whose mortgage exceeds the value of their home, refinancing is often off the table. And for the 16.5% who are unemployed or underemployed, refinancing is almost out of the question.

As the economy emerged from the 1973-1975, 1981-1982, and 1991 recessions, the savings rate had been 8% to 10% for decades. This provided consumers the wherewithal to increase their spending after the Fed lowered interest rates. Between 1993 and early 2008, the savings rate plunged to less than 1%. According to Christianson Capital Advisors, Americans saved $57.4 billion in 2007, and spent $92.3 billion on legalized gambling. One of the secular changes I forecast in the April 2008 letter was an increase in the savings rate, as consumers confronted the reality of lower home values and stock prices. As I noted then, an increase in the savings rate of just 1% would shave .7% off annual GDP growth since consumer spending is 70% of GDP. This suggested that GDP growth would be lower in coming years, as consumers gradually increased their savings back toward 8% to 10%. According to the Bureau of Economic Analysis, the savings rate soared to 6.9% in May. However, that grossly overstates the reality. Of the $167.1 billion increase in personal income in May, $157.6 billion came from The American Recovery and Reinvestment Act of 2009, in the form of a $250 one-time check to social security recipients. Wage and salary income actually fell $12.4 billion. If the impact of the one-time income transfer is excluded, personal income grew just .2%, rather than the headline grabbing 1.4%. In coming months, the savings rate will fall back under 3%, since real income growth is likely to remain weak well into next year.

State spending represents 12% of GDP, and has averaged an annual increase of 6% over the last 30 years, adding almost .7% to annual GDP. Unlike the Federal government, states by law cannot run fiscal deficits, but that certainly hasn’t inhibited spending! However, the worst recession since the 1930’s is forcing state governments to change. According to the Rockefeller Institute of Government, 47 of the 50 states experienced a decline in tax revenue in the first quarter. Overall, state tax collections dropped 11.7% versus March 31, 2008. The decline in tax revenue was the steepest in the 46 years quarterly data has been available. Importantly, the decline in tax revenue appeared to worsen in the second quarter with tax revenues down 20% from last year. In the first quarter, personal income tax collections fell 17.5%, weak retail sales sent sales tax collections down 8.3%, while corporate taxes fell 18.8%. In aggregate, states face a budget short fall that could approach $350 billion over the next 2 years. According to the Rockefeller Institute, it could take five years before state tax collections recover to their pre-recession levels.

In the first quarter state tax revenues were down to 2005 levels, erasing 3 years of gains that paid for new programs and salary increases. Although some states are actually cutting jobs, many states are enacting furloughs for employees that amount to pay cuts of 5% to 14%, as in Hawaii. Across the country, 15,000 school districts have reduced or eliminated summer school programs. But many states are also raising taxes and fees to close their budget gaps. These tax increases will reduce consumer’s take home pay, weaken spending, and offset some of the Federal stimulus. Since states are on the frontline in delivering services to the American people, higher taxes and fees, along with a reduction in services are going to make millions of citizens unhappy. There will be marches on state capitals before the end of 2010.

Exports represent about 12% of GDP, very similar to the contribution made by state spending. Over the last year, exports have fallen 21%, while imports have plunged 32%. As a result, the trade deficit is the lowest since 1999. In May, exports grew 1.6%, driven in part by an order for 20 Boeing airplanes. As I discussed in the May letter, in the quirky world of GDP accounting, a decline in imports adds to GDP, since imports represent production outside the U.S. This methodology is used even if the decline in imports is the result of economic weakness, as it surely was in the first quarter. A 34.1% decline in imports added +6.05% to first quarter GDP, while the 30% decline in exports subtracted -4.06%. As a result, GDP was boosted by 2% in the first quarter. Since imports declined and exports grew in the second quarter, this methodology will add more than 2% to the second quarter GDP report, and suggest the economy is in better shape than it really is.

Since the credit crisis first broke in August 2007, the European Central Bank has been behind the curve by 6 to 9 months. In June 2008, the ECB raised rates to fight inflation, which even at the time seemed terribly misguided. On June 25, the ECB pumped a record $622 billion into Euro-zone money markets at 1%. These funds will replace prior short term loans, extending maturities out a full year, and increase the total amount of ECB support. Lending in the Euro-zone has collapsed from 10% in mid-2008 to just 1.8% in May, the lowest since records began in 1992. European banks have been slower than their U.S. counterparts to write down the value of impaired assets, and they were leveraged 40 to 1, versus the leverage of 30 to 1 used by U.S. banks. Standard & Poor’s estimates that bad loan write-offs at Europe’s 50 largest banks will double next year. This could curb lending even more and weaken growth in the E.U., which represents 28% of world GDP. The IMF estimates that the EU will only grow .6% in 2010. Weak growth in Europe and Great Britain will not help the U.S. materially increase its exports in 2010.

As I discussed in the January letter, the sharp decline in sales and production has created a global economy awash in excess capacity. “When sales are falling, every dollar of revenue becomes more important, so many companies will increasingly compete on price to boost revenue. Companies will also move to lower costs, and millions of workers around the world will lose their job.” Over the last 30 years, capacity utilization in the U.S. has averaged 81. In June, the overall operating rate fell to 68, a record low dating to 1967. The operating rate for manufacturing fell to 64.6, the lowest ever since 1948. There is more excess capacity now than in the deep recessions in 1957-1958, 1973-1975, and 1981-1982. This means most companies can delay any increase in business investment, since they have so much unused capacity. The July survey by the National Association of Business Economics confirms this, as 62% of the respondents are not increasing capital spending. This is not likely to significantly change until companies experience a meaningful increase in demand. Even then, it will take time to use up the massive overhang of excess capacity.

In June, another 467,000 jobs were lost, and that was after the Labor Department added 185,000 jobs based on its birth/death model. A total of 6.5 million jobs have been lost since December 2007. Average hourly earnings rose just three cents between April and June, the smallest quarterly increase since at least 1964. The average work week fell to 33.0 hours, the lowest level ever recorded, and from 33.8 hours in December 2007. The 48 minute decline in the work week since December 2007 represents 3.3 million jobs that may have been lost had employers not reduced the hours worked so aggressively. The unemployment rate climbed to 9.5%, almost double the 4.8% rate in December 2007, and the under employment rate reached 16.5%. The average length of official unemployment increased to 24.5 weeks, the longest since 1948. In May, there were 5.7 unemployed workers for every job opening. According to Manpower Inc., hiring plans for the third quarter were the lowest since their data began in 1989. As Federal Reserve Chairman Bernanke stated in his “Semiannual Monetary Policy Report to the Congress “Job insecurity, together with declines in home values and tight credit, is likely to limit gains in consumer spending. The possibility that the recent stabilization in household spending will prove transient is an important downside risk to the outlook.”

Most economists consider unemployment a lagging indicator. But in a recession precipitated by a credit crisis, the usual rules don’t apply. The magnitude of 6.5 million lost jobs has been a leading contributor to the depth and duration of this recession, since job losses and underemployment have caused default rates on every type of consumer loan to soar. According to the American Bankers Association, late payments on 8 loan types rose to a record 3.23% as of March 31. Since another 1.2 million jobs have been lost in the second quarter, more record loan losses are coming.

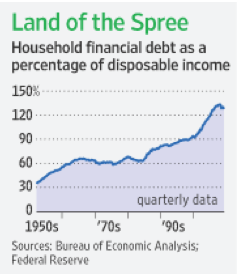

Over the last two years, I’ve often cited the following statistic, since consumer spending is integral to changes in demand in our economy. Household debt as a percent of GDP rose from 44% in 1982 to 98% in 2007. As all this debt was accumulating, consumer demand was goosing GDP growth. Consumers could carry more debt without a huge increase in their monthly payments, since interest rates fell from 15% to 20% in 1982 to generational lows in recent years. With short term rates near zero, this mountainous debt burden cannot be eased with lower rates. It will have to be paid off the old fashioned way – hard work over time. It’s not going to be easy. Since 1982, household debt as a percent of disposable income (income after taxes) has risen from 60%, to 133% at the end of 2007. It has since eased to 128%. In May, the San Francisco Fed determined it would take 10 years to get the ratio down to 100%, and shave .75% off consumption growth every year. If consumers increase savings .7% a year, and pay down household debt, GDP growth will be 1% less annually for a decade.

Over the last two years, I’ve often cited the following statistic, since consumer spending is integral to changes in demand in our economy. Household debt as a percent of GDP rose from 44% in 1982 to 98% in 2007. As all this debt was accumulating, consumer demand was goosing GDP growth. Consumers could carry more debt without a huge increase in their monthly payments, since interest rates fell from 15% to 20% in 1982 to generational lows in recent years. With short term rates near zero, this mountainous debt burden cannot be eased with lower rates. It will have to be paid off the old fashioned way – hard work over time. It’s not going to be easy. Since 1982, household debt as a percent of disposable income (income after taxes) has risen from 60%, to 133% at the end of 2007. It has since eased to 128%. In May, the San Francisco Fed determined it would take 10 years to get the ratio down to 100%, and shave .75% off consumption growth every year. If consumers increase savings .7% a year, and pay down household debt, GDP growth will be 1% less annually for a decade.

Over the last week, a number of prominent companies have reported earnings, which have exceeded depressed expectations. Analysts have dismissed the conspicuous weakness in revenue from year ago levels. Here’s a short list: IBM -13.3%, Intel -15.3%, Cisco -16.6%, CSX -24.8%, GE -9.0%, Caterpillar -21.8%, Dupont -19.1%. Most of the companies were able to exceed earnings estimates by aggressively cutting costs, and in most cases, laying off thousands of employees. That’s like getting fat by eating your own leg. Most analysts are excited, since earnings are expected to soar in coming quarters, as revenue growth returns, with most of it dropping to the bottom line. If this was a normal recession, it would be reasonable to expect a normal recovery in demand. Although government stimulus spending will give the economy a lift into the first half of 2010, consumer spending will remain weak, as the unemployment rate breaches 10%, and the underemployment rate flirts with 20%. Business investment will be retarded by excess capacity, and a cost control mindset by executives. Spending by states is going to be weak certainly by historical standards. And the global nature of this recession is going to restrain export growth. Where’s the beef?

We’re going to get what looks like a V-shaped recovery in GDP, and it will pack the nutritional value of a Twinkee.

CALIFORNIA DREAMING BLUES

California has long been considered a trendsetter for the rest of the country and its budget woes and push toward renewable energy are noteworthy. Unusually generous retirement benefits are and will continue to cost many cities, counties, and school districts in California dearly. For instance, a retired administrator for Vernon, California receives $499,675 per year. A retired fire chief from the Morage Orinda Fire District collects $241,000 annually. A retired professor from UCLA gets $296,556 each year. Pension funds collectively lost $1 trillion last year, but the guaranteed payouts to retirees are ultimately backed by the taxpayers. These examples are extreme, but many public pension funds throughout the country are going to face severe funding issues in coming years. The generosity of public pension funds and the future liability they will impose on taxpayers is sure to ignite a backlash.

Last November, California enacted a law that will require California utilities to garner 33% of their power from renewable sources by 2020. State energy agencies estimate the cost at $114 billion, and consumers will pay for most of it. In addition, new environmental laws could force 19 power plans that produce 15% of California’s energy to shut down. Recently, the California Energy Commission warned that California could find itself uncomfortably tight on power supplies by 2011, which could lead to power outages. Just what the 7th largest economy in the world needs to jump start growth. On June 26, Congress passed the Waxman-Markey Climate Change bill that requires states to obtain 15% of their electricity from renewable sources by 2020. Excluding hydropower, about 4% of U.S. electricity currently comes from renewables. I have no idea what this will cost, and I’m sure members of Congress don’t either. Whatever it costs, it will come out of our pockets, and ultimately increase the cost of energy for everyone.

From an economic standpoint only, the higher taxes coming after 2010, the higher taxes for Medicare, the higher taxes for Social Security, the higher taxes for health care, the higher taxes for cap and trade, and to push alternative energy sources are guaranteed to be a boon for economic activity. By the time taxes represent 100% of GDP, the economy is going to be in an unprecedented boom! Obviously, somewhere between 0% taxation and 100% taxation there is a tipping point. We’re going to find out what it is in the next decade, unfortunately after the fact.

DOLLAR

In recent years, there has been a negative correlation between the Dollar, and gold and oil. For instance, starting in November 2005 the Dollar began a lengthy descent from 92.60 that ended in July 2008 just above 70. During this decline, gold rallied from under $450 to $1,000 and oil from $60 a barrel to $147. Most of the action really kicked in though, after the Dollar’s decline accelerated from 85.00 in early 2007, when gold was $650 and oil was just over $50 a barrel. Last year, the Dollar soared from 71 in mid July to 87.70 in late October, and to a slightly lower peak of 87.40 in early December. Gold declined from $980 in mid July last year to under $700 in late October, as the Dollar made its initial high. Oil plunged from $147 in mid July last year to $50 in early December, as the Dollar made its secondary high.

There has also been a negative correlation between the Dollar and stocks. After the low in the Dollar in mid July 2008, the S&P plunged from 1220. The high in the Dollar’s rally occurred on November 21, which is when the S&P made a low at 741. As the Dollar fell from 88.46 on November 21 to 81.15 on December 31, the S&P climbed to 943 on January 6. Between December 31 and March 4, the Dollar jumped from 81.15 to 89.63, and the S&P fell from 943 to its low of 666 on March 6. The Dollar subsequently dropped from March 4 to June 2, when it bottomed at 78.33. The S&P soared from 666 on March 4 to 949 on June 2, just under its high of 956 on June 11.

In a June 5 Special Update and the June letter, I thought the Dollar had either made an intermediate low on June 2, or would do so after a wave 4 bounce. In my July 9 Special Update, I concluded that the Dollar was going to drop below the June 2 low, which suggested that gold and the stock market would rally. Since that Update, the Dollar has dipped from 79.94 to 78.80, gold has jumped from $912 to $951, oil has climbed from under $59 to over $65, and the S&P has popped from 882 to 954. Per the July 9 Update, the long dollar position at 79.79 was stopped at 79.15 on July 20. If the Dollar is in wave 5, the up coming low will be significant, not only for the Dollar, but for gold, oil, and the stock market. In terms of sentiment, just 7% of traders were bullish on the Dollar in a recent survey.

The price target for the Dollar low is a range between 76.76, based on the width of the wave 4 triangle from the June 2 low, and 77.48. The 77.48 level is the .618 retracement of the rally from 70.70 in March 2008, and the November high at 88.46. The minimum requirement is a drop below the June 2 low at 78.33. For now, buy the Dollar if the cash drops to 76.80.

STOCKS

In the June letter, I thought the S&P would pull back to initial support between 875 and 885. In my July 9 Special Update, I noted that the S&P had dipped to 869 on July 6, before closing at 879. I pointed out that the head and shoulders pattern that had formed in the S&P had gotten a lot of attention, even from non-technicians. This suggested that the S&P would bounce to 900-910. As discussed in the June letter, “I still believe that the rally from the March low will take an up, down, up form, which means that the odds still favor a rally above 956 after this correction.” However, I did not expect the market to run up to the June 11 high this quickly. This suggests that the down portion of the up, down, up pattern probably finished on July 8, and the market has started the final up move from the March low. Short term the market is overbought and near the resistance at 956, so a pull back to 920-930 is likely. After this pullback, the next rally should break above 960 and carry the S&P up to 1007, which was the November 4, 2008 high. However, once the Dollar puts in its intermediate low, the risk of a larger correction in the stock market will increase. And if I’m right about the strength of the recovery in 2010, the stock market will be vulnerable to a significant decline. We’ll cross that bridge when we get there.

GOLD

The Dollar has fallen from 89.62 in March to 78.80, a decline of 12%. It is noteworthy that Gold has not been able to break out above $1,000 since the Dollar peaked in March. Plus, all the talk about the coming wave of inflation from Fed money printing was supposed to boost Gold. The moment of truth is approaching. If the dollar does establish an intermediate low, Gold will be particularly vulnerable. In the short term, Gold should get a lift from additional Dollar weakness. Per the July 9 Update, the stop on the Gold short at $960 was lowered from $984 to $947.50, which was triggered on July 20. Short December Gold at $975, using $991.50 as a stop. Per the Update, the stop on the GLD short at $94.00 was lowered from $96.60 to $93.00, which was triggered on July 20. Short GLD at $95.20, using $96.30 as a stop. Per the Update, the long DZZ short gold ETF from $20.69 was stopped at $20.69.

BONDS

Last month, I recommended buying the 20-year Treasury ETF TLT at 91.00, which was triggered on July 20. If the Dollar continues to weaken, bond yields could rise. Use a stop of $89.50, which is the .786 retracement of the rally from $87.56 to $96.81. Raise the stop to $93.30, if TLT exceeds $96.81, and sell if it reaches $97.80.

E. James Welsh

What's been said:

Discussions found on the web: