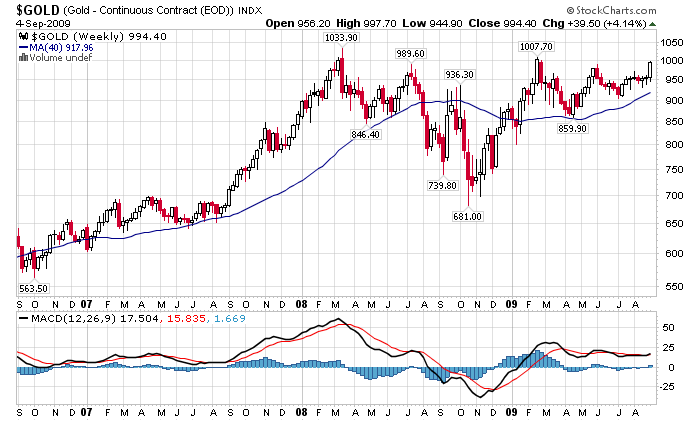

Everyone seems to be all atwitter over Gold breaking a $1,000 (again). This is the third time in 18 months that Gold has breached that level, failing the prior two times.

There seems to be an obsession with base 10 numerals, an evolutionary coincidence of the fact we Humans have 10 fingers and 10 toes. Dow 10,000, S&P 1,000, Gold 1,000, Top 10, Hot One Hundred.

Its rather meaningless.

The $1,000 mark is much ado about nothing — or very little. The more significant number is $1033.90 — the recent high set in March 2008. A solid breakthrough of that price level to a new high on a closing basis will be significant from a technical perspective.

As to the macro view relating to Gold, consider these various theories:

• Buying Gold is an implicit Bet against the USD (LA Times)

• Historically, September has been the best month for Gold (Kitco)

• Weakening Dollar is Spurring Demand (Bloomberg)

• Diversification from major US Treasury holders, especially China (Telegraph)

• Middle Eastern Oil Producers are Diversifying (Dubai City)

Then there is this Ambrose Evans-Pritchard theory: China has issued what amounts to the “Beijing Put” on gold. You can make a lot of money, but you really can’t lose.

Excerpt:

“I happened to see quite a bit of Cheng Siwei at the Ambrosetti Workshop, a gathering of politicians and global strategists at Lake Como, including a dinner at Villa d’Este last night at which he listened very attentively as a number of American guests tore President Obama’s economic and health policy to shreds.

Mr Cheng was until recently Vice-Chairman of the Communist Party’s Standing Committee, and is now a sort of economic ambassador for China around the world — a charming man, by the way, who left Hong Kong for mainland China in 1950 at the age of 16, as young idealist eager to serve the revolution. Sixty years later, he calls himself simply “a survivior”.

What he said about US monetary policy and gold – this bit on the record – would appear to validate the long-held belief of gold bugs that China has fundamentally lost confidence in the US dollar and is going to shift to a partial gold standard through reserve accumulation.”

I would be more inclined to buy a close over 1040, as proof that Gold has broken out for real . . . .

>

What's been said:

Discussions found on the web: