All too often, pundits, financial writers and commentators look at markers, they try to create an “If Then” causation narrative.

This typically creates a false impression that X caused Y. It is difficult to disprove, because we lack the counter-factual, i.e., where the X event did not occur under the exact same circumstances, and whether Y subsequently occurred anyway.

Bloomberg has a perfect example this morning:

“Federal Reserve Chairman Ben S. Bernanke has succeeded in returning the U.S. economy to growth after the longest contraction in more than six decades. So far Wall Street, not Main Street, has been the primary beneficiary.

Bernanke . . . has helped spark a 62 percent rally in the stock market since March 9 by pledging to keep borrowing costs “exceptionally low” for “an extended period.” His efforts haven’t stopped unemployment from reaching a 26-year high of 10.2 percent in October.

The Fed’s benchmark rate is already near zero and its balance sheet is just below a record at $2.14 trillion, leaving Bernanke, 55, with little room to maneuver. He may be faced with growth that doesn’t generate many new jobs, while stocks keep rising because companies including Caterpillar Inc. and Home Depot Inc. are cutting costs and meeting demand by improving productivity.”

There is no doubt that the Fed chair is a significant player, but to credit him exclusively with an economic recovery and a 62% rally is to fundamentally misunderstand the complexity inherent in these systems.

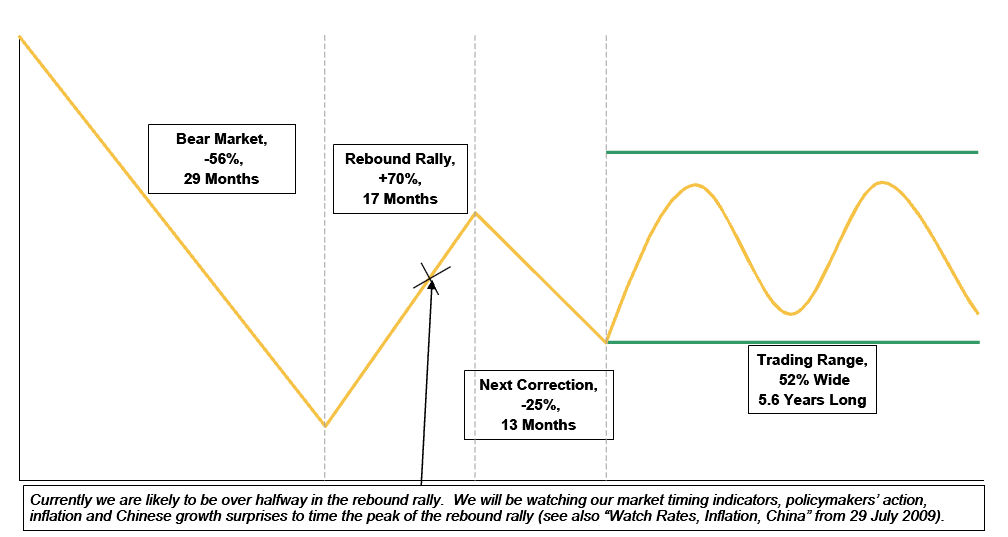

Further, it denigrates even the possibility, much less the likelihood of an eventual economic recovery and market snapback — regardless of Fed action (See Four Stages of Secular Bear Markets).

Further, it denigrates even the possibility, much less the likelihood of an eventual economic recovery and market snapback — regardless of Fed action (See Four Stages of Secular Bear Markets).

We monkeys prefer to find concrete ways to conceptualize what occurs in the economy and the markets, but . . .

>

>

Previously

Confusing Cause & Effect: Elections and Markets (January 9th, 2008)

http://www.ritholtz.com/blog/2008/01/confusing-cause-effect-elections-and-markets/

Correlation (March 9th, 2008)

http://www.ritholtz.com/blog/2009/03/correlation/

Four Stages of Secular Bear Markets

http://www.ritholtz.com/blog/2009/08/aftermath-of-secular-bear-markets/

Source:

Bernanke Lunches on Wall Street as Jobless Rebound Buoys Stocks

Michael McKee and Rich Miller

Nov. 16 (Bloomberg

http://www.bloomberg.com/apps/news?pid=20601109&sid=atHiMqxlVsZY&pos=10

What's been said:

Discussions found on the web: