~~~

Investment Newsletter – November 24, 2009

HAPPY THANKSGIVING! I hope you are surrounded by family and friends on Thanksgiving. We have much to be thankful for.

The Real Elephant in the Room

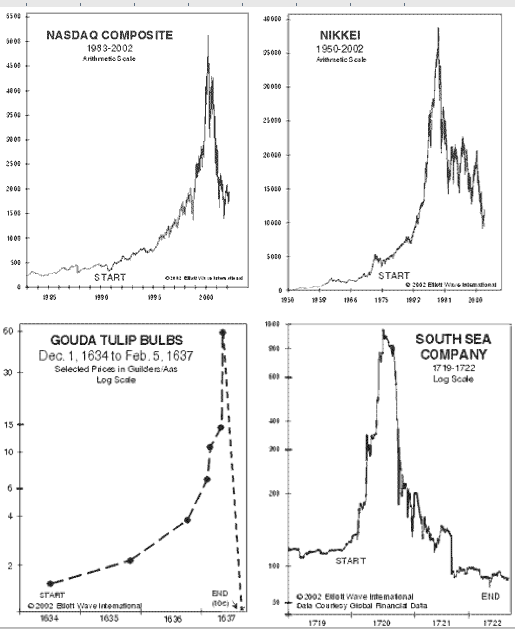

Throughout history, there have been a numerous investment manias, covering a wide range of ‘investments’. One of the more fascinating aspects of each mania is how similar the price pattern has been. In each case, a gradual price increase over a number of years, accelerates, until the rise appreciates into an almost vertical trajectory. Like a pilot who takes off and then aims the nose of the plane toward the sky, until there isn’t enough lift under the wings and the plane stalls. At that point, the nose of the plane rolls over, and a harrowing descent toward earth begins. This flight pattern is evident in the wake of every investment mania. For instance, between 2004 and early 2007, crude oil rose from $30 to $60, then soared to $147 in July 2008, before crashing 77% to $33 in November 2008. In early 1995, the Nasdaq Composite was trading under 800, rose to 1400 by October 1998, then almost tripled as it jumped to 5,100 in March 2000.

After that meteoric rise, the NASDAQ lost 66% in just 13 months! During the 1980’s, the Japanese Nikkei rose from 5,000 to 39,000 at the end of 1989, only to collapse 75% to under 10,000 within a few years. I could cite other examples going as far back as the tulip bulb craze in 1637, which all sport a similar parabolic signature price pattern.

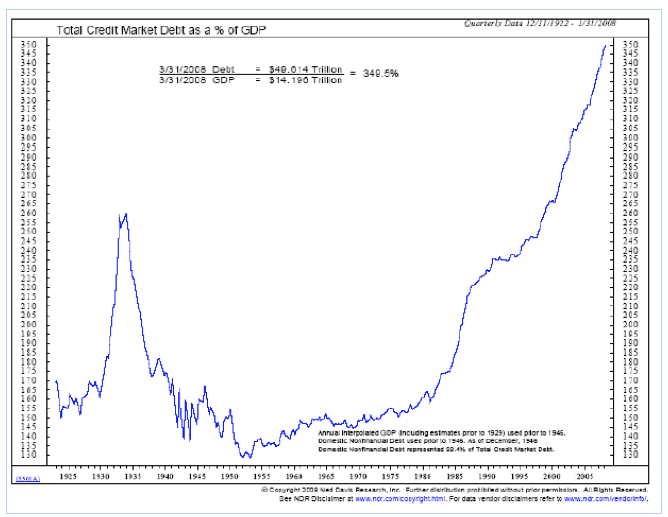

The key point is that after a parabolic increase stalls, the price has collapsed, whether it was oil, stocks, silver, soybeans, the South Sea Company (1720), or Tulip Bulbs. If you compare the charts of the NASDAQ, Nikkei, South Sea Company and Tulip Bulbs to the following chart, the parabolic increase is clearly evident. The only difference is that the collapse in price after the parabolic stalls has not begun. The Federal Reserve has and will continue to do everything it can to prevent a collapse, since this chart is the ratio of total debt to GDP. Since 1982, this ratio has soared from $1.65 of debt to $3.70 of debt for each $1.00 of GDP. Over the last 12 months, as consumer borrowing has declined, Federal government debt spending has expanded rapidly, which has pushed the ratio even higher. This is unsustainable. But there is no easy or painless solution.

In order for the ratio of debt to GDP to stabilize, GDP must grow faster than the growth in debt. This has not happened in the last 30 years. A good portion of GDP growth since 1982 came from the increase in debt, which means GDP growth will on average be lower, without the debt steroids of the past 25 years. Slower economic growth in coming years will generate less tax revenue for all levels of government, which will force most states to raise taxes. The Federal government is expected to run $1 trillion deficits for a number of years, which will cause the debt to GDP ratio to continue to rise. At some point, the Federal government will be forced to increase taxes on anything that moves, including the middle class. Higher state and Federal taxes will reduce disposable personal income, which will already be growing more slowly due to weaker overall GDP growth. Shrinking disposable income will make it more difficult for stretched consumers to service and pay down existing debt, resulting in an increase in the number of consumers who are forced to default on their debts.

As glum as the preceding scenario sounds, it beats the alternative. Rather than an orderly paying down of consumer debt over an extended time from disposable income in a slow growth environment, the ratio of debt to GDP falls through debt liquidation. In this scenario, the combination of a weak economy and higher taxes forces an increasing number of consumers to default on their mortgage, credit card debt, and auto loans. As more foreclosed properties are dumped by stressed banks, home prices fall further. Already, nearly 25% of homeowners owe more on their mortgage than their home is worth, and another 5% have less than 5% equity left. As debt liquidation progresses, bank balance sheets and future lending contracts causing money supply and the velocity of money to decline, which leads to more asset deflation. Ironically, widespread debt liquidation would create a shortage of dollars, and lead to a significant rally in the dollar. Over the last six months bank lending has contracted by 6%, bank balance sheets required an infusion of almost $1 trillion so they wouldn’t shrink, and the velocity of money has declined. This has occurred even as the Federal Reserve has expanded its balance sheet from $900 billion to $2.2 trillion.

In the aftermath of the financial crisis, it is remarkable that the majority of economists assume the Federal Reserve has pushed all the right buttons. Their primary concern is that the Fed will succeed too well, causing a burst of inflation as economic growth rebounds. But this is the same Federal Reserve that failed to recognize a developing housing bubble, even as 125% loan to value loans were being hawked Barnum and Bailey style on TV in 2004. The same Fed that forecast an economic strengthening in the second half of 2007 “as the drag from housing waned”. Since the Fed underestimated the magnitude of the financial crisis, the Fed was habitually behind the curve. The net result is that the financial crisis became a full blown economic crisis, causing unemployment to increase more than at any other time since the 1930’s. This made the financial crisis deeper and more protracted. Despite the Fed’s appalling record, Wall Street economists believe a self sustaining is right around the corner. On one hand this is surprising, since we’ve just experienced the largest synchronized worldwide financial crisis in history. On the other hand, in the summer of 2008, most Wall Street economists believed there would be no recession. Only to a bevy of Wall Street economists would the elephant in the room be invisible.

FEDERAL RESERVE

The FOMC statement on November 4, stated, “The Committee will maintain the target range for the Federal funds rate at 0 to .25% and continues to anticipate that economic conditions are likely to warrant exceptionally low levels of the Federal funds rate for an extended period.” The phrase ‘extended period’ is a subjective phrase that can mean many different things. In early November, the Federal funds futures market was expecting a rate hike by next July. Of course, there are those who felt the Federal Reserve should have raised rates at their November 4 meeting.

At some point the Federal Reserve may very well raise the Federal funds rate to .25% to .50%, if for no other reason than to appease the peanut gallery and a few editorial boards who have been steadfast in their criticism of the Fed’s zero rate policy. What these armchair quarterbacks have not understood is that for the last two years, the Federal Reserve has been forced to adopt policy measures that would have been unthinkable only a short time ago. The alphabet soup of systemic intervention was driven by necessity, not by choice, since the Fed was consistently behind the curve as the crisis developed. The assumption by most economists and financial market kibitzers is that the economy’s health has been restored sufficiently to allow the Federal Reserve to conduct policy going forward by choice, rather than necessity. Starting last March, I forecast that the economy, as measured by GDP, would give the appearance of a V-shaped recovery. But just as a traveler in the desert sees an oasis in the distance, the many cyclical and secular headwinds discussed in the September and October letters are likely to make a self sustaining recovery a mirage that remains on the horizon. The Federal Reserve will maintain the exceptionally low level in the Federal funds rate for an extended period out of necessity, since the banking system and securitization markets remain on life support provided by the Federal Reserve.

In recent months, purchases of mortgage backed securities by the Federal Reserve have amounted to 80% to 85% of the total. As noted last month, the Fed is the market. The Federal Reserve has said it expects to complete its buying of $1.25 trillion of agency mortgage-backed securities by March 31, 2010. Is it realistic to expect demand for agency MBS to match the Fed’s buying, so that mortgage rates don’t rise? I don’t think so. The Fed’s buying has succeeded in keeping mortgage rates low. Low mortgage rates and improved affordability, have led some economists to say housing has bottomed, and the Case Schiller 20-city index of home values has risen. The modest increase is the first since early 2006, after declining more than 30%, and was certainly helped by the $8,000 first time home buying tax credit. In addition, the significant increase in unemployment is pushing a greater number of prime borrowers into foreclosure, and the prices of those homes is higher than those of sub prime borrowers, which dominated the first phase of housing deflation. This makes it appear home prices are rising, which they are, but the reason is hardly a positive. Although the first time home buyers credit has been extended, home prices are likely to fall further in 2010.

According to the Mortgage Bankers Association, 9.64% of all mortgages were delinquent with at least one late payment at the end of September, and another 4.47% of mortgages were in foreclosure. In total, 7.5 million households are in trouble. As forecast several months ago, the sharp increase in unemployment is affecting a greater number of prime mortgages. Initially, sub-prime mortgages comprised more than 60% of all foreclosures, with prime mortgages only representing around 10%. Now, prime mortgages account for 33% of new foreclosures, and more than sub prime foreclosures. This figure is going to increase further, since prime fixed rate mortgages were 54% of the homeowners that were more than 3 months behind on their payments, but not yet in foreclosure.

At the end of September, there were 3.5 million homes for sale, according to the National Association of Realtors. In total, about 52 million homes have mortgages, with almost 10% of homeowners now delinquent on their mortgage payments, upwards of 5 million more homes will likely enter foreclosure process and be dumped on the market over the next two years. The amount of stressed ‘shadow’ inventory is almost 50% larger than the stated inventory. The coming volume of forced selling will surely pressure home prices, and cause more home prices to drop below their outstanding mortgage balance. In 2008, 580,000 homeowners defaulted even though they could afford to pay, double the number in 2007 according to Experian.

In 2007, the Federal Housing Authority made 3% of all home loans. Today, FHA is making 25% of all home loans. Since FHA only requires a 3.5% down payment, a first time home buyer can buy a $200,000 home, use $7,000 of the $8,000 tax credit for the down payment, and get $1,000 back. Although the FHA has increased necessary credit scores from 630 in 2007 to 681, the default rate on FHA loans is soaring. According to the Mortgage Bankers Association, 14.3% of FHA loans are delinquent, versus 9.64% for all mortgages. Almost 20% of the loans made in 2007 are more than 90 days delinquent. Congress has mandated that the FHA maintain a 2% capital ratio, which represents leverage of 50 to 1. FHA has $3.6 billion in capital, versus $685 billion of total insured loans, or a capital ratio of .53%, or leverage of 188 to 1.

In the next six months, another 500,000 jobs or more will be lost, which will push the unemployment rate further above 10%, and the underemployment rate to near 18%. Even if job growth resumes by the end of the first quarter, it will offer scant support for the almost 25 million people who are scraping to make ends meet. This suggests that more homeowners will be pushed into foreclosure, and more consumers will default on their credit card debt and auto loans.

If mortgage rates trend higher as the Federal Reserve withdraws its support, the Fed will be faced with a tough choice. Should they extend their support beyond March 31, 2010, or risk even more weakness in home prices? I doubt demand from institutions will be strong enough to prevent mortgagerates from climbing, especially if they conclude home prices will fall further as I expect. This is just one reason why it is necessary for the Federal Reserve to maintain the exceptionally low Federal funds rate for an extended period.

In its November 4 statement, the FOMC spelled out the conditions that warrant the exceptionally low Federal funds rate. By definition, changes in these factors will provide the basis for when the Fed will begin increasing the funds rate. When the Fed says low rates of resource utilization, they are referring to labor market conditions and production capacity utilization.

Labor represents roughly 65% of the cost of goods sold, so labor costs have a significant bearing on inflation. Since December 2007, employers have cut payrolls for 22 straight months, eliminating 7.3 million jobs in the process. The unemployment rate rose to 10.2% in October, but the underemployment rate, which includes discouraged workers and involuntary part-time staff, climbed to 17.5%. The work week remained at a record low of 33 hours, and weekly wages have risen less than 1% over the last year. Even though they have continued to look for work, a record 5.6 million Americans have been out of work for more than half a year. The 5.8% increase in the unemployment rate during this recession is the largest since the Great Depression.

A September Business Roundtable survey of large firms found that 13% expected to increasing hiring, but 40% planned more cuts in the next six months. According to a preliminary survey of consumer confidence in early November by Reuters/University of Michigan, only 10% of consumers reported an increase in income, the lowest since data collection began in 1946. No surprise then that consumers borrowed less for a record eighth consecutive month in September as borrowing fell $14.8 billion.

Between 1993 and 2008, small businesses generated 65% of job growth, and represent about half of private sector employment, according to the Small Business Administration. The National Federation of Independent Business reports that 86% of small businesses surveyed reported flat or lower earnings over the last three months, and 82% posted flat or lower sales. More importantly, capital spending and inventory investment plans are at 35 year lows, as 21% plan to cut staff and 32% expect to reduce inventory. As noted in prior months, many small businesses rely heavily on credit card lines for operating credit. During the last year, banks have lowered credit card limits, or pulled credit cards completely, so credit availability is a problem for many small businesses.

In October, temporary employment rose by 33,700 jobs. Changes in temporary jobs provide companies a lower cost option of increasing staff. As such, changes in temporary jobs are a leading indicator, and suggest actual job growth could resume within the next 4 to 7 months. However, job growth will be weak, and the unemployment rate will remain high throughout 2010.

Over the last 30 years, capacity utilization has averaged 81%. In November, the overall utilization rate was 70.7%, while manufacturing utilization was 67.6%. Over the last year, industrial production has declined 7.1%, even after the bump it received from the ‘Cash for Clunker’ increase in production. In the third quarter, only 32% of the non-financial companies in the S&P 500 beat revenue estimates by a significant margin. According to Goldman-Sachs, the long term average is 40%, which underscores how tough it is for companies to grow their revenue. The combination of low capacity utilization rates and soft sales growth suggests companies will have little pricing power in coming quarters.

The slack in the labor market and production capacity will keep the existing subdued inflation trends in tact. Over the last twelve months, the core rate of inflation as measured by the producer price index and consumer price index, have been .7% and 1.7% respectively.

The Federal Reserve also wants inflation expectations to remain stable, and this is where it gets interesting. Since March, the price of oil has run up from $47 to $80, a gain of more than 70%. Higher energy prices are inflationary as they push the cost of living higher. But higher energy costs are also deflationary, as they squeeze an already stretched consumer. The price of gold has also soared since the Federal Reserve announced its quantitative easing in March, jumping to $1,150 from $750. The run up in gold has garnered headlines and fostered the view that it is foretelling a rise in inflation. This view can be debated, since total loans at commercial banks have fallen 6% in the past six months, despite the expansion in the Fed’s balance sheet. Consumer borrowing has contracted a record eight consecutive months. The velocity of money has clearly slowed, and the banking system has several hundred billion in losses to work through. Given the slack in the labor market and production utilization, the odds of a meaningful increase in inflation over the next six to nine months are virtually nil.

However, there are times when perception outweighs reality, and the rally in gold and oil have caused inflation expectations to creep higher. Undoubtedly, some of the buying in oil and gold has been financed by the dollar carry trade. Traders can borrow money in the U.S. at very low rates, sell the dollar and buy any number of stronger currencies, and then buy just about anything. As the dollar falls, and everything else rallies, this has been a one-way win win. There are signs that a change may be afoot. After seeing its currency surge by 35%, Brazil established a 2% tax on foreign inflows, and a few weeks ago, Taiwan said it was limiting foreign deposit holdings. China has been criticized by Brazil, Russia and several other nations for not allowing the Chinese Yuan to appreciate against the dollar. The Chinese response was to point a finger at the U.S. and say “Don’t blame us, blame them.” I suspect the Japanese are not happy with the yen’s appreciation, nor the ECB with Euro pressing 1.50, since both depend on exports.

As discussed, the Federal Reserve’s needs to keep interest rates exceptionally low for a long time. In the short run, it will facilitate the Fed’s withdrawal from the mortgage backed securities market. In order for credit market participants to feel comfortable buying mortgage backed securities, they must be reassured that the Fed will not blindside them with a rate increase for a long time. In the long run, low rates will generate much needed profits from the steep yield curve for banks. But the surge in gold and attendant headlines complicates the Fed’s job to the extent they raise inflation expectations, and they are creeping higher. The success of the dollar carry trade has emboldened traders, who feel the Fed’s stated intention to hold the funds rate at an exceptionally low level for an extended period is tantamount to a green light to add to their positions. If I’m on the Fed, I would be sorely tempted to remind them that there are no risk free trades, especially the dollar carry trade.

I think the Fed would welcome a partial unwinding of the dollar carry trade that would start with a rally in the dollar and result in a decline in gold, oil, stocks, and everything else that has benefited. It wasn’t an accident that Chairman Bernanke included the following comment about the dollar in a speech last week. “We are attentive to the implications of changes in the value of the dollar and will continue to formulate policy to guard against risks to our dual mandate to foster both maximum employment and price stability.” A rally in the dollar could be the result of spontaneous combustion, as traders choose to cut exposure to the dollar carry trade, or by central bank jawboning. I would also not be surprised by a coordinated intervention by the major central banks, given the actions taken by a number of central banks over the past few weeks.

BONDS

Last month, the Fidelity Capital Income fund, Value Aggressive Income fund, and the Nicholas High Yield fund were sold, after being recommended in March. Since high yield funds trade as a stock surrogate, they haven’t done much over the last month. If the economy falters in 2010 as I expect, high yield bonds will sell off. The yield on the 10-year Treasury bond has traded in a very narrow range of 3.3% and 3.6% since August. If I’m right about a rally in the dollar, and sell off in stocks, oil, gold, and just about everything else, the 10-year yield should trade down to 3.1% to 3.0%. At that level, it may be a short. A close above 3.6%, would suggest I’m wrong, not only about Treasury bonds, but everything else as well.

STOCKS

Since peaking in mid October, the internal strength of the market continues to weaken. On October 14, 462 stocks made a new high. That dropped to 318 on November 16, and 190 on November 23, even as the DJIA has pushed almost 4% above its mid October high. The Russell 2000 has made a series of lower peaks, and is 5% below its October high. These statistics show that fewer stocks are participating in the advance, which is often a fairly reliable precursor of a market decline. A close below 1080 on the S&P should confirm that a short term top is in, with a decline to 1030 likely to follow. Given the technical deterioration in the market, the largest decline since the March low is likely. The only caveat is that seasonality is a positive going into year end. In my Special Update on November 13, I recommended shorting the Russell 2000 since it is weaker than either the DJIA or the S&P. The ETF TWM, which trades inversely to the Russell 2000 was bought that day under $29.35, and again once the S&P traded above 1105.37, which it did on November 16. TWM was trading between $28.10 and $27.90. Cover half of this position, if the Russell trades above 606.00. For those who prefer the S&P, I recommended buying the inverse S&P ETF SDS @ $35.90, when the S&P moved above 1105.37, and to add above 1115. So far the high in the S&P is 1112.38. Use 1130 as a stop.

GOLD

Ten years ago, technology bulls knew all the reasons that justified their faith in the ‘New Paradigm’. Over the last few weeks, gold has made a series of new highs, and the percent of bulls has exceeded 90% for almost 3 weeks. In terms of market phenomena, this is a rare event. Needless to say, I did not think gold would find this level of sponsorship. Per instructions in the Special Updates on November 5 and November 13, “DZZ – Buy 33% now ($15.20), 33% below $14.95, and 33% if it trades down to $14.65 – $14.35.(Avg.$14.88) GLD – Short 33% now ($106.82), 33% above $107.50, and 33% if it trades up to $108.50 to $110.50.(Avg $107.94) On November 11, December gold closed at $1,114.60. If I’m right about stocks having one more push to a higher high on the DJIA and S&P, gold will likely make a higher high. For now, cancel the stop at $1,115.00.” Although I expected gold to surpass $1,115, I did not anticipate it would run to over $1,165. This run looks like a mini blow off. I will provide an update as warranted.

DOLLAR

We are long the December futures from under 76.40, and will roll to the March 2010 contract. We are also long the dollar ETF UUP at $22.60. In the November 13 Special Update, we added to this position at $22.20, when the December dollar traded below 74.85. Maintain the stop at 74.00.

-E. James Welsh

What's been said:

Discussions found on the web: