Dylan Grice put out an informative piece this morning, titled Government hedonism and the next policy mistake.

A a few charts — and a quote — is what caught my eye. First, the quote:

“What you as the City of London have done for financial services, we as a government intend to do for the economy as a whole”

-Gordon Brown, Chancellor of the Exchequer, speech to bankers, Mansion House June 2002.

Truer words were never spoken. (Insert old joke here about political leader doing the same thing to country that he was doing to his mistress).

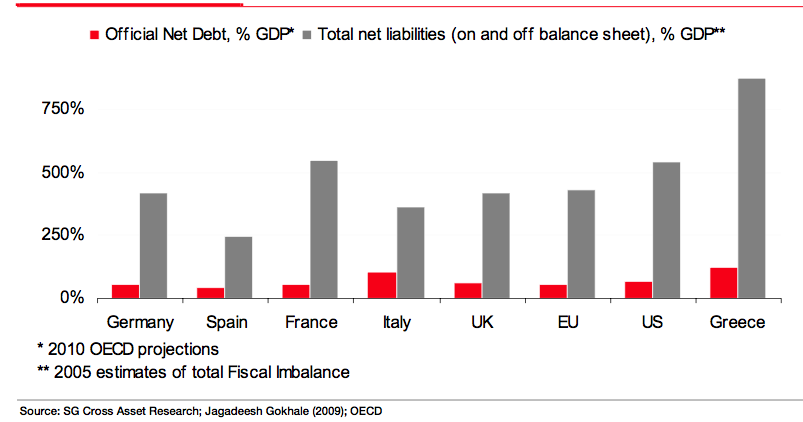

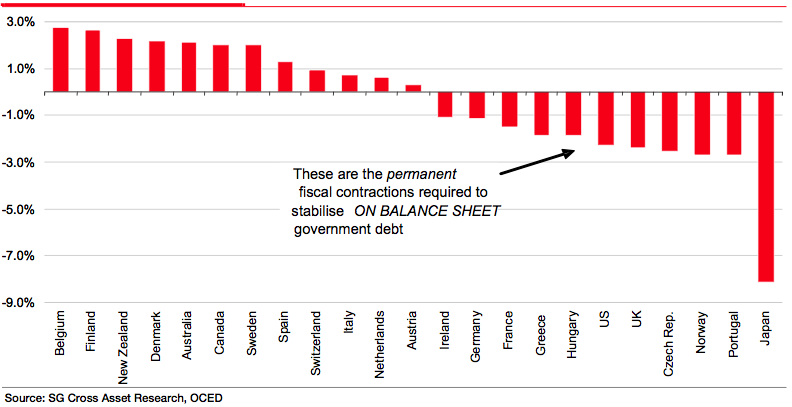

As to the charts, these two show the degree of indebtedness of various governments, as well as the gap between what these sovereigns need to stabilize their balance sheets:

>

Government off-balance sheet dwarfs on-balance sheet

Difference between required and actual primary surplus (% of GDP)

>

Source:

Government hedonism and the next policy mistake

Dylan Grice, Global Strategy Team

Société Générale 11 February 2010

http://www.sgresearch.com/publication/en/19C05683D1CC9042C12576C7003152D1.pub

See also:

Niall Ferguson: A Greek crisis is coming to America (FT)

http://www.ft.com/cms/s/0/f90bca10-1679-11df-bf44-00144feab49a.html

BN: Germany, France Demand Greek Budget Cuts in Talks Over EU Aid (Bloomberg)

http://www.bloomberg.com/apps/news?pid=20601087&sid=aEdRTib5Yo6U&

FT: Anger in Athens over tax rises (FT)

http://www.ft.com/cms/s/0/310d0c2e-166d-11df-bf44-00144feab49a.html

Aid Is Tough Sell in Germany (WSJ)

http://online.wsj.com/article/SB10001424052748703455804575057670849236994.html

Markets fragile amid confusion over Greek rescue deal (Telegraph)

http://www.telegraph.co.uk/finance/financetopics/financialcrisis/7208232/Markets-fragile-amid-confusion-over-Greek-rescue-deal.html

What's been said:

Discussions found on the web: