~~~

As noted in the January letter, a close below 1,080 in the S&P would be negative, and it did yesterday, closing at 1073.87. Before getting into the ‘technical’ aspects, let’s look at what has driven the decline since the S&P made a new recovery high on January 19.

In the December letter, I wrote, “My guess is that the U.S. economy will hit a soft patch by mid-year, for all the reasons cited above. However, the biggest surprises are likely to come from overseas.” On January 20, the China Banking Regulatory Commission announced that it expected banks to reduce their 2009 lending of $1.1 trillion by 22% in 2010. As discussed in the December letter, “One of the most widely accepted investment themes is that China will continue to grow far faster than every other country in the world for decades to come. While this is likely to be true, that doesn’t mean there won’t be a few speed bumps along the way. China, with $4 trillion in GDP, represents less than 10% of world GDP and derives 35% of its GDP from exports. After being prodded by the government, Chinese banks have increased lending by more than $1 trillion in 2009, or by more than 25% of GDP. In addition, the Chinese government launched a $585 billion economic stimulus package. Most of the stimulus and lending went into fueling a surge in their stock market, and commodities, property and land prices. Through October, the total floor space of housing sold rose 50% above year earlier levels. Some developers have warned that land prices in some cities have already risen so far that it will be hard to make money on future developments, without large price increases.” The January 20 announcement represents the first step of pulling back on the extraordinary stimulus China unleashed in 2009. I think their intent is not to step on the brakes, but to tap the brakes periodically to gradually slow credit growth and real estate speculation. In coming months, there will be more small increases in interest rates and reserve requirements.

Since Chinese demand has been perceived as the little engine that could ignite a global recovery and the primary driver behind the run up in commodity prices, this announcement started a selling wave in resource based stocks, and stock markets around the world. In the U.S., investors were given more reasons to sell, when President Obama unveiled his plan to overhaul the banking system, doubts on Chairman Bernanke’s reconfirmation surfaced, and some suggestions within President Obama’s State of the Union speech that weren’t entirely well received. However, there are rumblings from overseas that are more important.

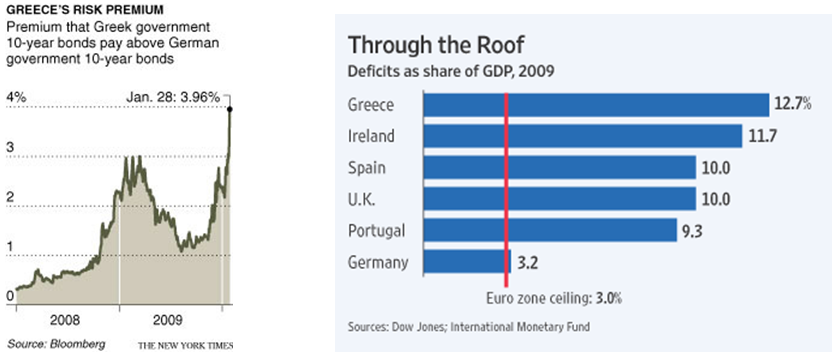

On January 26, S&P changed its assessment of Japan’s debt rating from stable to negative, and warned it might lower its sovereign debt grating from AA. The real story is what is happening in Greece and how it may affect banks within the European Union. I also discussed this potential in the December letter. “Banks in Europe employed leverage of 40 to 1, versus the merely ridiculous 30 to 1 leverage of their U.S. counterparts. European banks have also been slower to acknowledge losses. As we all know, major banks in the U.S. were brought to their knees by sub-prime mortgage loans and the overall decline in home prices. Most of the European banks were affected by the same malady. Where they differ is their large loan exposure to Eastern Europe, Russia, Dubai, and Greece. This exposure is their version of sub-prime lending, and it has the potential to be as unsettling.” Over the last few weeks, the developments in Greece have certainly been unsettling, as concern over Greece’s ability to deal with its 12.7% budget deficit have caused Greek bond yields to soar. As I noted in the December letter, the Greek situation poses a thorny problem for the European Union and the banks within Europe. “On December 19, Ewald Nowotny, who is an ECB governing council member and head of the Austrian central bank, said the ECB would not bail out debt-stricken member states, such as Greece, which must repair its public finances on its own. Greece will have a fiscal deficit of 12.7% of its GDP in 2009, far above the European Union mandated ceiling of 3%. If push comes to shove, it will be interesting if the ECB allows one of the countries in the EU to default. If we have learned any lesson in the last two years it is that in a global economy any misstep is very quickly spread throughout the global financial system.”

As we can see, Greece is far from alone in exceeding the 3% deficit of GDP speed limit of countries in the European Union. The U.K is not in the EU, but their budgetary problems led S&P to place their sovereign debt on warning in May 2009. If the EU makes an exception for Greece, what will they do for the other countries that have the same problem? Although Greece represents less than 3% of total EU GDP, does letting them collapse risk another domino style credit crisis that could quickly spread to European banks and beyond? This could be the canary in the coal mine.

As discussed in recent months, there are many secular and cyclical reasons why a smooth transition form a statistically driven rebound in GDP to a self sustaining recovery in the economy is unlikely. And that is assuming, another phase of the financial crisis does not emerge. As I reviewed in the October letter, “The next potential challenge within the current period of instability will develop in the next six to nine months, as the U.S. economy will: A) smoothly transition into a self sustaining economic expansion, B) experience a modest dip, with GDP growth sagging to around 1% to 1.5% before reaccelerating, C) experience a more pronounced dip lasting up to two quarters with one quarter of GDP near 0% before rebounding, D) perform a flawless one and one-half gainer after the V-shape recovery stalls and go to hell in a hand basket. The correct answer to this question is important since the financial markets will obviously respond accordingly. Experts suggest that when confronted with a multiple choice question, and a distinct lack of certainty, go with C. If for no other reason, correct does begin with C. However, since forecasting and investing involves a high degree of probability, I would assign the following odds: A 5%, B 30%, C 45%, D 20%.” The problems in Greece and the issues they raise, and the fact that China will take additional steps to curb their 2009 lending binge, do not lower the probabilities of choice D.

Since last summer, I have continually noted the lack of selling by large institutional money managers as being the back bone of the stock market’s rally, since these managers believe a sustainable recovery is on the way. It doesn’t take much buying pressure to boost the stock market if there is very little selling pressure to overcome. In the last 8 days, there have been a number of reasons to sell, and they have, and in the process pushed the S&P below 1,080. This is clearly a short term negative. However, the more important level for the intermediate and long term is 1,030. Since the March 2009 bottom, the S&P has marched progressively higher with each ‘technically oversold’ low (July, November) being higher than the previous low. Based on a number of momentum indicators, the market has reached an oversold level, comparable to readings at the July and November lows. Any additional weakness will get the market even more oversold, and stretched, laying the foundation for a rally. The odds favor the S&P bottoming above 1,030, and sometime in the coming week. It is interesting that the three prior lows have been on September 2, October 2, and November 2. Closing below 1,080 should bring in more selling on Monday, which could set Tuesday, February 2 for a reversal day.

There are a lot of important data points being released next week, not least of which, is the jobs report for January next Friday. Recent events have shifted the focus away from the recovery story, and a batch of decent numbers next week could refocus large institutional investors on the earnings rebound they have been expecting. No matter what, the quality of the next rally is very important. Although the chances of a move above 1,150 have diminished as the result of this pullback, they have not been eliminated. Two pieces will have to fall into place for new highs. The overseas issues will have to settle down. China is not likely to make additional tightening steps in coming weeks, and the problems with Greece and the EU will also have to recede. And the economic data points in the U.S. must continue to support the recovery story. If so, large institutions will shift back to the buy side, after it becomes apparent the correction has run its course. A self sustaining recovery is far from a sure thing, but that doesn’t mean the illusion of one can’t be sustained for another 2 or 3 months.

If the S&P does close below 1,030, investors should sell into any ensuing rally. If the S&P bottoms above 1,030 and reverses higher, that new higher low will be important. Even if the top is in, and it might be, the next rally should retrace 33% to 50% of the decline from 1,150. A close above 1,105 will be good.

Jim Welsh

What's been said:

Discussions found on the web: