I am having a hard time reconciling the claims of excess sentiment with lots of other data and anecdotal evidence. Consider for example this Bloomberg article, with the telling title Americans Say They Missed 73% Rise in S&P 500 as Economy Surged.

O f course they missed it! They were either a) listening to Wall Street analysts and strategists; 2) were watching financial TV coverage of the crisis; III) were normal emotional Human Beings unable to detach themselves from their own neurobiology.

f course they missed it! They were either a) listening to Wall Street analysts and strategists; 2) were watching financial TV coverage of the crisis; III) were normal emotional Human Beings unable to detach themselves from their own neurobiology.

In all three examples above, the related thread was the behavior of organic matter. When it comes to investment, Carbon based goo tends to be a poor element in the decision making process.

Here is an excerpt:

“Americans are down on the economy and the markets even as stocks and growth indicators are up.

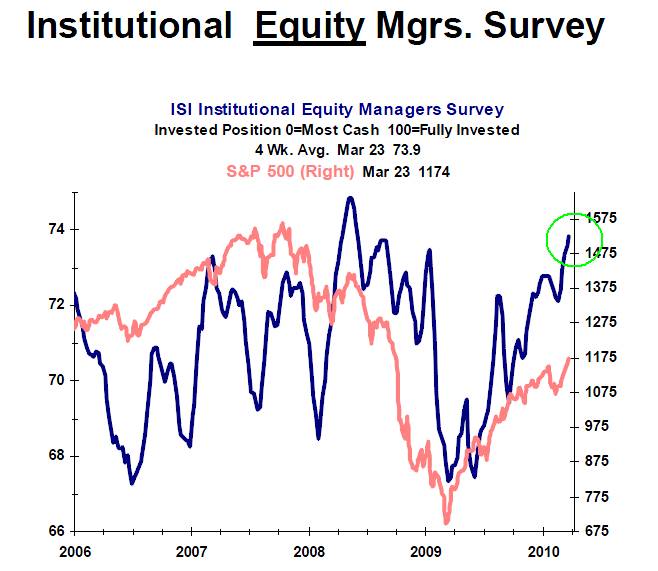

By an almost 2-to-1 margin Americans believe the economy has worsened rather than improved during the past year, according to a Bloomberg National Poll conducted March 19-22. Among those who own stocks, bonds or mutual funds, only three of 10 people say the value of their portfolio has risen since a year ago.

During that period, a bull market has driven up the benchmark Standard & Poor’s 500 Index more than 73 percent since its low on March 9, 2009. The economy grew at a 5.9 percent annual pace during last year’s fourth quarter.”

The most intriguing data point to me is the belief that the economy has worsened over the past 12 months. The public is technically correct; much of the data is modestly lower than it was 12 months ago. However, the rate of change is far, far less than it was. The parachute has opened, and the free fall is over.

However, unlike Phil Gramm, I cannot dismiss the public’s concern as a mere mental recession. The obvious missing element is job creation, and that is the most likely reason for the negative sentiment.

Public sentiment is a very important factor impacting spending decisions. I suspect that if we were to get three or four months of 100k plus job creation, that would go a long way towards moving the sentiment needle.

Until then, we meed to closely watch retail sales data for evidence people are coming out of their bunkers. I see it already in Manhattan, but we have lots of Wall Street bonus cash sloshing around. When the rest of the country feels better about the economy, it might create a virtuous cycle of hiring and spending . . . Or, hiring and spending will make the rest of the country feel better about the economy.

Either way, retail sales might be the early signal . . .

>

Source:

Americans Say They Missed 73% Rise in S&P 500 as Economy Surged

Mike Dorning

Bloomberg, March 24 2010

http://www.bloomberg.com/apps/news?pid=20603037&sid=aTp.Sf7cvYvU

See also:

New York Helicopter Commute for $200 a Day Signals Revival

Esmé E. Deprez

Bloomberg, March 26 2010

http://www.bloomberg.com/apps/news?pid=20601109&sid=aWz55bmEsxa8&

What's been said:

Discussions found on the web: