I mentioned the Elizabeth Warren presentation on consumer protection at the Make Markets Be Markets.

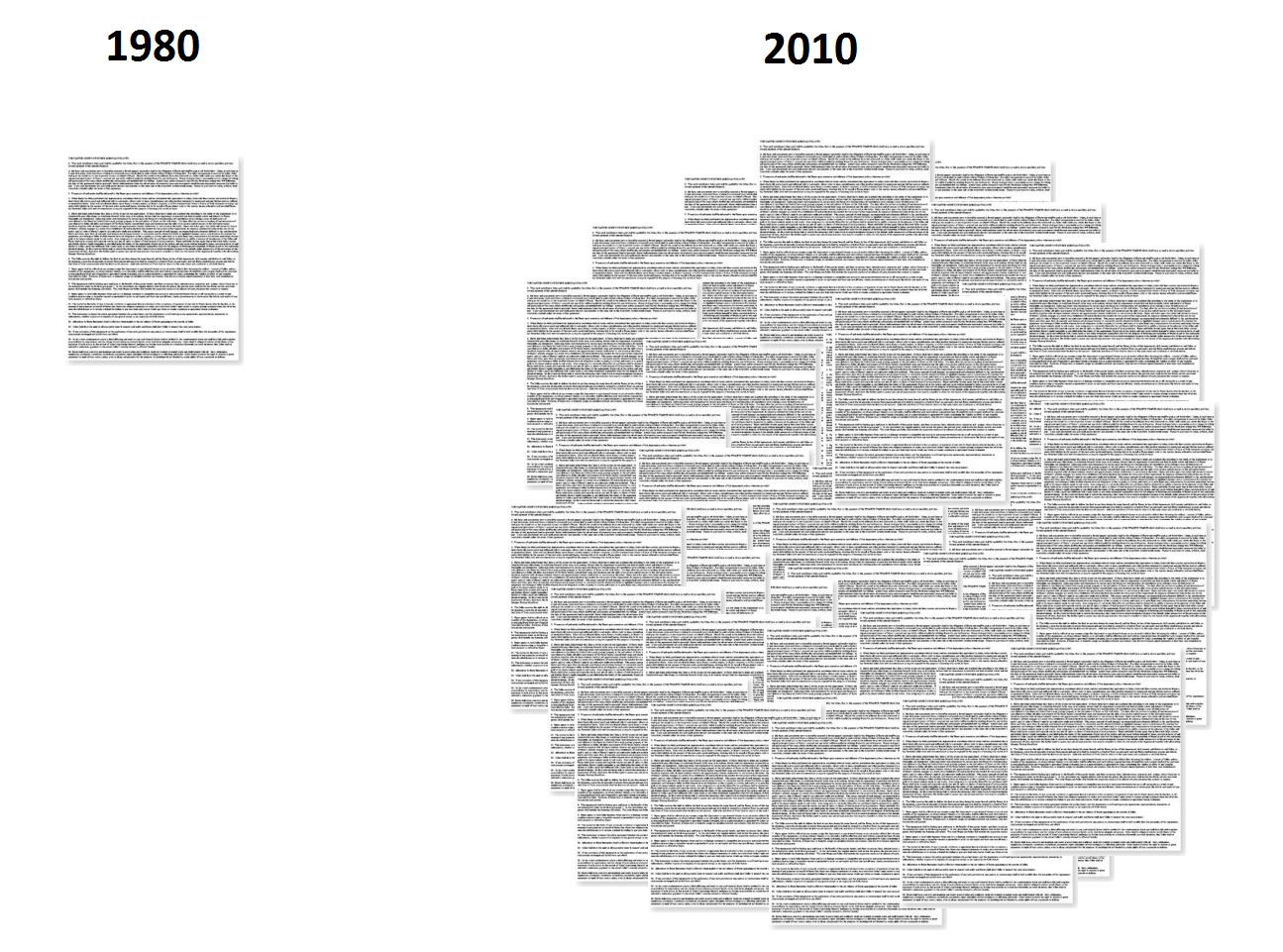

She was on Charlie Rose last week — here is a small excerpt of the appearance, with a related graphic:

“Credit cards, mortgages, car loans, check overdraft fees. This is all the stuff that you have to do in your daily life to survive economically.

And what’s happened is this is an industry where the business model itself has fundamentally changed. The way the game used to work — let’s start with credit cards. It’s the easiest way to see it. Back in 1980, the credit card agreement for Bank of America, 700 words, would have fit on that one sheet of paper that you’ve got in front of you.

Terms are clear. They kind of figure out well here’s your creditworthiness and here’s how much we have to charge, we’re a little worried about inflation, how much it will cost us to monitor it, we’ll make a little profit. It works. Mortgages are set up pretty much the same way, car loans set up pretty much the same way.

And what happened over time — we got rid of usury laws right at this same point in time — is that the credit card folks, they were the real innovators here. They said we could hold up one or two things in front of you — low, low financing, 7.9 percent. We could hold up free gifts. We could hold up a warm and fuzzy relationship. We’re just the people to do business with.

And then put what are called in the trade “revenue enhancers” back in the fine print, and we can make a lot of money because you won’t figure out what this product costs.

So that one page credit card agreement in 1980 has now grown to about 30 pages. And it’s not just 30 pages, it’s 30 pages of incomprehensible text. The fine print, the “whereas,” the heretofores.”

>

What's been said:

Discussions found on the web: