“Crucifixion can be discussed philosophically until they start driving the nails.”[1]

-Wallace Stegner

>

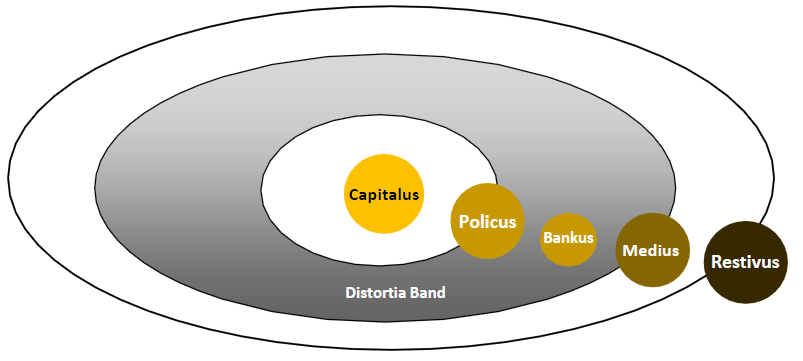

A short fable: There is a galaxy not too far away called Galaxy Economia. The four planets that comprise it are Capitalus, Policus, Medius and Restivus. Capitalus is at the center of the galaxy and emits light. Restivus is furthest away from Capitalus and its orbit is heavily influenced by Policus and Medius, which comprise the Distortia Band. All four planets are inhabited by similar life forms; however, each behaves very differently.

>

>

Capitalus: The inhabitants of Capitalus mostly behave objectively, valuing natural and human resources based on their barter values to society. Capitalian production and productivity have grown over time with a generally increasing population and because every now and then there is a technological breakthrough. Increasing productivity, economies-of-scale and innovation continually drive wages lower on Capitalus, along with the prices of goods, services and most assets. Capitalians do not mind declining wages and prices, however, because affordability remains relatively constant while leisure time increases. Capitalian wealth naturally flows toward societal utility and so hard workers and innovators tend to become wealthier than others. Capitalians do not care about money per se, only how it will be valued in exchange for future consumption. So, Capitalians tend to consume what they need and desire, are able to save most of what remains of their wages, and invest and donate the balance. Capitalians allow politicians to oversee services that must be executed in the public domain and they fund government accordingly.

Policus: There are very few inhabitants of Policus, (Pollutants), yet the planet has significant gravitational pull. Policus and its moon, Bankus, transform the light emitted from Capitalus into hot air, and together they emit pollution outward towards Medius and Restivus (e.g. “the values of natural and human resources are based on complex models that, theoretically, promise to perpetually improve conditions for all galaxy inhabitants”). From time to time the pollution from Policus overwhelms the galaxy. Then, all planets except Capitalus begin to revolve around Bankus. Bankus then morphs into a Black Hole and ultimately explodes, leaving only Capitalus unaffected.

Medius: The inhabitants of Medius are extremely sophisticated; however, they seem incapable of original thought. Medians are unaware of Capitalus and so they record and analyze data emitted only from Policus and Bankus, and then transcribe that data for the inhabitants of Restivus. When Policus explodes, bewildered Medians investigate.

Restivus: Restivus is in the dark. Accordingly, “Restivuse Guys” think productivity and sustainable wealth rise or fall based on sophisticated-looking analyses emitted from Policus and Bankus and transcribed by Medius. Money is thus worshiped on Restivus and so it is created continually without limit (by Bankus). Restivuse Guys earn credits, (called “wages”) for their work, and they amass more credit over time so their children can inherit their debts. They fight over resources because no one is sure who really owns them. When Policus explodes, Restivuse Guys get angry.

This little Fable has a moral, again borrowed out of context from Wallace Stegner: “You can’t trust optics but you can depend on appetite.”[2] Private incentives do not die regardless of how much some at the top may want them to, and these private incentives will ultimately distribute wealth back to the factors of production wherever they are and regardless of how hard powerful men acting together try to stop it.

Meet Our Little Friend

Investors may like finding consensus around which values may congeal but life makes no promises. November’s remarkable events were very much anticipated and feared by the markets. Some came and went without immediate consequence (US mid-term elections); others did not (European sovereign bailouts). Did investors know more at month’s end then at its beginning? Yes, but many investors were stunned by what they learned, which is why we think they clung desperately to dubious policy strategies being touted by unarmed sentries guarding the gatehouse.

Watching some public policy arguments among highly regarded policy makers, economists, media members and investors makes water boarding seem like a walk in the park. The second- and third-order theoretical public discussions about QE, inflation and deflation dance around what all investors know (or should know) to be the main point – the gloomy math behind global debt service. It won’t matter soon. The general level of topical analysis, tortured logic and blatant misinformation is being reconciled in real time by natural economic behavior. Anyone with a sense of time and fairness, from billionaires to the unemployed, should be pleased.

Unsustainable economic distortions that emanate from a flawed and unfair global monetary system and from misguided public policies that perpetuate that system can only be exposed and challenged once it becomes apparent to all that balance cannot be restored using the same means. That time has arrived. As the New York Times recently acknowledged; “we’re not going to shop our way out of this mess.”[3]

A transformation to a new global monetary system has begun and will only be popularly recognized once those most helped by the old order stop accruing benefits from it. This has started in European countries forced into austerity or default by ostensibly more solvent members of the EU. Germany either has to refinance peripheral economies or admit its largest banks are insolvent. Such is the current phase of the Great Credit Unwinding, wherein the process of refinancing overwhelming debt is popularly scrutinized. We think this process will become more apparent in all debtor economies including the US, where an abundance of outstanding credit is meeting a dearth of outstanding money with which to repay it. US states and homeowners will soon be as stressed as Greece and Ireland.

The biggest beneficiaries of the current system have been large banks and unproductive members of societies. Banks have been able to effectively lend money into existence, which placed them at the center of power. Unproductive members of society (including us and probably you) have been given incentives to stay unproductive.

Centrist politics, including that of most established political parties representing the vast majority of G7 nations, has been executed for a generation based upon theory unsupportable by logic. Those calling themselves “conservative” or “liberal” support virtually identical economic policies. Most progressive Keynesians seeking to use government as an honest broker that ensures safety nets and balanced opportunities for all should blame themselves for driving the wealth gap wider, not narrower. Most thinking of themselves as laissez faire free market conservatives should blame themselves for defining their free market as one in which governments continually print money so they can then amass it without risk of failure. There is very little difference, in our view, that separates those operating in the established political class across established nations. This is proven repeatedly when they circle their wagons to defend their exorbitant privilege by gutting financial reforms and then, ultimately and despite their loud and often emotional rhetoric against it, continue manufacturing and throwing more money at flashpoints.

You there, sipping Chardonnay in your second home as you vote Democrat/Labour to balance your moral electrolytes, the less individuals have and the longer they are unemployed, the more hardship they and their children will incur from printing more money. As it stands, a line worker cannot save his wages AND maintain his standard of living. So then why on Earth would you argue in favor of banks and bondholders and against letting credit and wages find their own clearing price? The working class would find work sooner on a competitive global wage scale once credit is fully collateralized. Are you ignorant or scared?

And you there, pounding on your stock and bond portfolios or standing in your 5,000 square foot home, voting Republican/Tory and demanding that government get out of your pocket! Don’t you realize you have been the biggest beneficiary of the government’s perverse and selfish policy of allowing banks to manufacture and distribute unreserved credit without limit and then stepping in when necessary so the prices of your assets won’t decline? You are luckier than a four-leafed horseshoe. Sit down, shut up and teach your children that yes, they should learn the value of money, but no, the stuff in your bank isn’t it.

The debt distribution system practiced by all established governments is morally reprehensible, as is borrowing money that can never be paid back to creditors in currency with the same purchasing power. But this is the system of incentives as constructed in the West. Are we immoral for doing what it takes to provide for our families in this system? Are we patriots for borrowing too much today so that we can consume too much and maybe let retailers and global manufacturers hire more people? Or, is it time to acknowledge that a system that promotes constant and increasing public indenture is worthy of failure?

But we digress. We were arguing that large banks and unproductive members of society have been the biggest beneficiaries of the bank-centric monetary system practiced by established economies. It is our contention that the most unproductive members of societies have been those that do not produce capital, we included. Banks are at the top of the worthless list. They systemically short “money” as they issue claims on it that are not reserved. So, when banks in the aggregate stop producing more “money” (via unreserved lending), the system goes in reverse (all measures of money naturally tend to revert to the quantity of reserves or base money). Central banks exist to create reserves when the lending cycle goes in reverse. This provides a dangerous, unsustainable social structure.

Though QBAMCO does not create capital you should not be surprised that we do not consider ourselves worthless. Our particular raison d’être is to seek to provide capital holders with the benefit that banks should provide, but don’t — a means to maintain and increase wealth in the true sense. As it stands, if it wants to retain its purchasing power, amassed wealth cannot deposit money in banking systems or in the currencies that banking systems conjure. This great distortion is at the center of a delusional G7 economic infrastructure, populated with institutionalized apologists working each day to stay in business by perpetuating this flawed system.

We allowed a moral tone to invade a discussion about money, markets and economies — usually a sign of weakness, laziness, ignorance or investment ineptitude. Get over it. Morality is the foundation of money and markets, especially in a fractionally reserved economic system that demands self-delusion, especially in a global economy defined by handicapping the impact of credit on asset values across all markets. Money has no soul; credit must.

The only people living on Capitalus in the real world today are those producing capital assets and reinvesting their wages back into them. It is a small percentage, especially in the West. Most investors living on Restivus do not see that the Western credit pendulum has swung as far as it can go and will soon swing back hard towards true capital production. Some investors have begun to move their wealth off the paper money grid or are investing it with unlevered capital producers. They should live to spend, or even to lever their wealth with paper money, another day. So meet our little friend, Mr. smooth-talking, highly-regarded professional world improver. It is common sense.

Global Economic Tensions

There should be no room for emotion or patriotism at the thought of the G7 asking its creditors for more time. The essence of the relationship between surplus and debtor economies is as creditor and debtor, and as we are all learning in Europe presently, trying to extend payment is natural behavior for distressed debtors and creditors alike. As we have been long discussing, it is likely that global debtors will default to global creditors — the only question is whether it will be in real or nominal terms. We continue to bet that it will be in real terms. Greek and Irish bailouts so far continue to confirm the merits of that wager. The solvency of German banks is at the center of that calculus.

China and other creditor economies know their currency reserves will be toast in real terms. China’s public response to the most recent round of official USD debasement was predictable. Last month, Dagong, a Chinese rating agency largely controlled by official channels, downgraded the creditworthiness of the US Treasury:

“Dagong believes that the occurrence and development process of the credit crisis in the U.S. resulted from the long-standing accumulation of the contradictions in its economic system; the U.S. debt burden can be relieved only to a certain extent through large-scale printing and issuance of the U.S. dollar; however the consequent decline of the U.S. dollar status and national credit will block the debt revenue channel which is vital to the existence of the United States to a greater extent. The potential overall crisis in the world resulting from the U.S. dollar depreciation will increase the uncertainty of the U.S. economic recovery. Under the circumstances that none of the economic factors influencing the U.S. economy has turned better explicitly it is possible that the U.S. will continue to expand the use of its loose monetary policy, damaging the interests (of) creditors. Therefore, given the current situation, the United States may face much unpredictable risks in solvency in the coming one to two years. Accordingly, Dagong assigns negative outlook on both local and foreign currency sovereign credit ratings of the United States.”[4]

Of course it is impossible for an entity with a printing press to become insolvent in nominal terms, (see Zimbabwe), and in that Dagong is wrong – US credit is nominally sound. However, it is very clear that there is significant risk of purchasing power loss from holding dollars and US Treasuries; risk that attendant interest rates are not accurately pricing because the largest buyer and owner of Treasuries is now the same entity with the printing press. In fact, on November 30 in the Fed’s Permanent Open Market Operations (POMO), the second most monetized note was an issue Treasury issued just a week before (1.375 of 11/30/15). The Fed has become THE bid for Treasuries. Despite Ben Bernanke’s declaration accompanying QE2 that the Fed is not monetizing Treasury debt, the Fed is monetizing Treasury debt. The same is occurring in Europe where private investors are backing away. Official bodies are fast becoming THE bid for sovereign debt of established economies. They are the only bodies left standing between Capitalus and Restivus.

Those of us in the G7 may care more about retaining our general quality of life than whether there is any merit to not-so-veiled threats by potential trade antagonists. We may only want to hear the merits of our side’s argument. But that does not change global economics, which may be summarized as follows: The G7 has been receiving cheap labor and goods from emerging economies in return for potentially worthless claims (USDs). China and other creditor nations have been playing along with this for years so they could build out and nurture their economies. Now that mature, debtor nations must print and debase more currency with which to pay their debts, reserve holders would like to convert that paper into resources. There are huge sellers of paper money at and even below current exchange rates.

One of the biggest diplomatic problems China faces today is that everyone knows their USD reserves are worth much less on a forward basis than securing a future stream of scarce resources. If the West were to let China convert their USD reserves to abundant natural resources today, then it would create a security risk or a resource imbalance in China’s favor. (Was anyone surprised that the close commercial relationship linking BHP revenues to China’s demand for resources played into Canada’s denial of the Potash takeover?)

It should come as no surprise that China and Russia signed a pact in November in which Russia will supply China with energy and will accept Yuan in return. Russia clearly does not mind holding Yuan, especially if it intends to purchase goods from China with it. The importance of this news could not be overstated: it is the first time since World War II that two superpowers cut out the middleman (shhh, don’t tell the Western financial press).

We should also be mindful that China has a printing press too. It can print renminbi and exchange them for other currencies or resources as it wishes. So if the world comes to hate the USD or if Tim Geithner is “successful” at getting China to let the Yuan float higher (highly unlikely), then China could buy even more resources with their own paper. So, with the possible exception of Chuck Schumer, we seriously doubt anyone is taking official US monetary rhetoric towards China seriously, including the Chinese.

Western policy makers have run out of ideas that would satisfy both domestic and trade objectives. Geithner and Bernanke went abroad following the QE2 announcement in November to argue that China and Germany should stop dissing USD money dilution because the whole global system relies on whether US consumers can be baited to go even further into debt. Really? US policy has come down to threatening friendly trade partners that if they stop buying US debt and accepting USDs then the US will shoot itself in the head? We all laughed when Mel Brooks had his sheriff in “Blazing Saddles” threaten to shoot himself if the bad guys didn’t let the girl go. Are the best policy minds in America corrupt or stupid? Neither, we think. They are merely trying to buy time.

Writing in the latest issue of Foreign Affairs, Harvard’s Joseph S. Nye seems to speak for all centrist policy makers when he admits the hegemonic decline of the US is upon us but argues it will be replaced by power sharing among economic powers.[5] We agree that the US retains economic, diplomatic (and military) leverage and that it will remain a global power, but the stage is clearly being set to accommodate a new world order. US policy makers know the gig is up. We think they are actively negotiating valuations, alliances and trade treaties that will include a new global monetary regime.

It was no surprise then when World Bank President and former US Trade Representative Robert Zoellick wrote an editorial in the Financial Times November 8 suggesting the G20 should “consider employing gold as an international reference point of market expectations about inflation, deflation and future currency values,” and noted; “although textbooks may view gold as the old money, markets are using gold as an alternative monetary asset today.” [6] No doubt it was released the week following the QE2 announcement to quell fears among USD reserve holders. The public firestorm following Zoellick’s column was immediate and created a reflexive public echo chamber that affected asset prices.

The price of gold bullion, which represents anti-dollar sentiment, ran higher for a few days and then settled back after all the usual extrapolating chatterers weighed in. Mainstream media provided space for reasonable discussion. A week after Zoellick’s column Jim Grant forcefully argued the merits of Austrian economics in the New York Times and for the return to a gold-exchange standard in whole or in part. Even US stock-centric CNBC gave time to Jim Rickards to frame contemporary markets in nominal versus real terms and to argue for a new gold-based monetary order. (We must take this time to disagree with those that argue it is possible to have a global currency partially backed by gold. We don’t see how this would be possible when we go through the iterations. For example, we have a $100 bill and we decide that we prefer to hold gold. Let’s say dollars were to be “50% backed” by gold and so we exchange our $100 bill and receive $50 of gold and, we presume, a $50 dollar bill. We then get back in line and exchange our $50 bill for $25 of gold and a $5 bill and a $20 dollar bill. And so on. Clearly, “partial backing” is a concept lacking any foundation in logic or practicality. A precondition of a gold standard must be redeemability. Anything less than 100% redeemable is easily gamed.)

As November continued and as the opening bell continued ringing each day, the markets and their professional observers began focusing on more immediate matters: rising corporate earnings => economic data that didn’t get obviously worse => stock and bond markets that didn’t get noticeably worse => the potential for building broad economic confidence => the potential for consumers to begin borrowing and spending again => the potential that if consumption were to rise then it might be possible to delay detonation of the debt bomb => and finally in November, the good prospects for holiday shopping. A tough news month without a crash. Good going, gents.

But the reflexive nature of hard data and its consensus public interpretation has its limits. Views and news do not define ongoing currency and real asset values and they certainly do not persuade others across the globe to forgo their economic incentives. Such is the risk investors take in not appreciating the fundamentals — the downside of indebtedness; the importance of the ongoing transformation from G7 hegemony to global power sharing; and the risk in not appreciating the connection between the two or the speed with which the transformation is progressing.

Time is an asset Western policy makers are very short. On November 19, Ben Bernanke, the man himself, made a point of stepping to the microphone and saying clearly: “As currently constituted, the international monetary system has a structural flaw: It lacks a mechanism, market based or otherwise, to induce needed adjustments by surplus countries, which can result in persistent imbalances.”

There it is. Ultimately there is nothing to counter bond math. Western policies that have supported the markets for decades are failing. The confederation of Western central banks is splintering because it is not equipped to provide solace to their indebted populations, unless they inflate away the burden of public and private sector debt. The Fed, as the manufacturer of the product that has been the benchmark for all global value, is out of bullets. Policy makers are quickly reaching the point at which they will either have to declare they are all-in (abandon any pretense of austerity), or let their economies’ credit begin to fail.

Although we would like to see the US grab the bull by the horns — formally devalue the Dollar, inflate away the burden of debt repayment, and then make the USD a hard currency again — neither policy makers, the press, nor we would be able to influence those capable of making it happen as much as global wealth holders would. Fiscal and trade policies merely shift wealth. Only workers and true capitalists in an economy can create it. So even if prevailing Western sentiment remains intact to the bitter end; and even if, by some twisted logic, politicians with printing presses think they provide a better and more sustainable economic system than people at all levels being able to work and save their wages; it would not matter. The current floating rate, whack-a-mole paper money regime is already in the process of failing and being replaced.

Shooting Wayward Messengers

The established Western media, so cynical and ambitious when it comes to exposing personal and public policy failings in the political world, continued sitting on its collective thumb in November, nodding dutifully like bobble heads, not questioning the tortured logic (or fairness) of policy that seeks to get US consumers to go deeper into debt. The “liberal media” did not understand that the biggest losers from central bank policy actions are the unemployed and the “right-wing media” did not understand that it is already too late for austerity measures.

The established media deserves criticism. To be clear, we would agree that the press should enjoy full rights of free speech without limitation, and further should not be forced or even expected to serve the public good. Against this backdrop, we believe that through abundant incuriosity, risk aversion that comes with corporatism, and/or an undisclosed willingness to appeal to certain constituencies over others, left- and right-leaning established media is collectively demonstrating willful negligence towards the public it claims to serve. It is either guilty of conspiracy with the political dimension, guilty of utter ignorance, or guilty of exercising its right to act in its best interest at the expense of its readers. As investors, it matters not to us which. We only judge its product.

Our view is based on personal experience and observation. We have occasionally shared our macroeconomic opinions and suggestions privately with several well-known centers of influence in the press. Our purpose has not been to be quoted, but to provide a credible outlook not widely known. For example, this past July, at the request of a highly regarded economic analyst for a top daily publication, (let’s call him “John Smith”), we wrote a piece about the dangers of trying to perpetuate an economic system that promotes unreserved credit, and how we thought a gold-exchange standard would eventually replace it. Ultimately, he agreed with his editor that our arguments were not “comprehensible enough for our readers”.

He was probably right that our piece would not be understood by his audience — not because it would be over anyone’s head — but because it was an argument to which his readers had not yet been exposed. We don’t know why he did not choose to make the argument comprehensible by educating readers about another economic discipline some argue explains current economic cause and effect more elegantly than that being theorized and accepted by most economists and practiced by policy makers. Nevertheless, he graciously pledged to return to the subject at a later date.

Our next interaction with “John Smith” was in October following our praise of a recent column:

QB, October 14: “…we think the Fed (or the markets) will ultimately revalue the USD/Gold exchange rate. Were the Fed to do it, (which it should to gain control over timing and pricing), it could maintain authority over the global monetary system by conducting open-market monetary operations at a market-based exchange price. In fact this would actually be monetary policy, as opposed to credit policy (interest rates) it and other central banks have been employing. We have been modeling a “Shadow Gold Price” that uses the Bretton Woods equation (Monetary Base divided by official gold holdings). The SGP puts the USD at about $8,000/oz. presently.”

JS: “We are not going back on gold.”

QB: “I respect your conviction. I’ve rarely been that sure of anything.”

JS: “You seem to be quite sure of many things. I know of no serious academic economist who takes the return to gold seriously, with the possible exception of Bob Mundell. You would also have to close the Fed down first. Anything is possible, in the long run. But a return to gold in the near term seems to me inconceivable.”

QB: “”…Was it Peter Ustinov who said “if the world should blow itself up the last audible voice would be that of an expert saying it can’t be done?” I see your serious academic economists and raise you a 35:1 debt to money gap and the only strategy your experts are coming up with is to transfer or issue more debt. As you say, I suppose anything is possible — we could grow in real terms enough to overcome that gap and trend. I’m betting against it. And I don’t think the pressure to perform is on me or other wealth holders in the West and in emerging economies migrating towards harder money. It’s on policy makers holding burning matches. Economics, not political economics, must prevail.””

We suspect that exchange, along with others arguing our same points, prompted him to write publicly two weeks later about why there will not be a return to the gold standard. You should not be surprised that we felt his piece was loaded with false choices and sensational leaps in logic. Some samples along with our comments, below:

JS: “One obvious objection (to a fiat currency devaluation vis-à-vis gold) is that this would generate huge windfall gains to holders of gold.”

QB: So what? Is it okay for ongoing windfall gains to accrue to the fractionally-reserved banks at the expense of the factors of production?

JS: “A peg to gold may prove radically destabilising for any currency if other significant countries failed to sustain domestic monetary and financial stability.”

QB: Precisely. If your country endorses stable monetary and financial systems and other countries do not, a rational person would expect the former to eventually assume the wealth of the latter.

JS: “…there could then be floods of gold into or out of a currency that is well managed.”

QB: And that is the point: under a gold standard, currencies are neither well nor poorly managed. They are not managed at all. The people that form the economy determine the value of their currency.

Mr. Smith and most all other notable economic columnists in established media may disagree with us about how an economy should operate, which would be fine. However, we take exception to the implication they put forth each day that the established economic construct is based on good science. It is ultimately based on subjective, self-serving politics that requires constant intervention and the purposeful distortion of economic equilibria. We don’t need better economic managers or econometric models. We don’t need bank apologists like Mr. Smith. We need a system that allocates capital and resources more fairly.

This columnist is surely finished with QBAMCO, as it should be. After all, most Medians are unaware of Capitalus. But it seems Capitalus is not finished with Mr. Smith. Three weeks after he declared to us that the world would “not go back to gold” and only a week after he publicly asked and answered speculation of such heresy to his satisfaction, Bob Zoellick decided to run his opinion piece about a new monetary construct that should consider gold.

Harrumph! went Mr. Smith and other “experts” as they argued Zoellick never called for a gold standard, which of course was true but not the point. Zoellick has spent the last twenty years as a high level diplomat interacting and negotiating among and on behalf of G7 interests. He is very precise with his words and his timing. We interpret his piece as a public admission by G7 economies that they know the USD-centric global monetary order must be changed. To admit so publicly was to move that inevitability further down the timeline. To be blunt: we think the US asked China for more time. His very specific public acknowledgment that the current monetary order is worthy of alteration should not have been summarily dismissed by the financial press.

…Or by reasonable investors. In 21st century investing, wherein current perception is the only definable reality (efficient market theory anyone?), there is no room to extrapolate an event that hasn’t occurred already from a reasonable sample set, and no room to imagine an event that has not yet been declared. The shift to a new monetary order would (will) be a fat tail event. Like Taleb’s Black Swan, it doesn’t exist yet in the consensus mind, but unlike his Black Swan it is possible to know that it actually does exist.

Whether the subject at hand is the ultimate resolution of public and private debt or more immediate options facing distressed European sovereigns, the established financial press is off point. Whether or not it collectively believes it has no place inserting itself into public opinion that might be disruptive to government policies, (to paraphrase Gold Meir, it shouldn’t be so modest, it’s not that influential), it is obvious to us that mainstream media does not seem to recognize that without public pressure to act proactively, G7 policy makers will not have the final say about economic outcomes; their creditors will. Whether they know it or not, (we presume not), Western media have been serving the interests of foreign and domestic creditors and undermining the interests of their governments and domestic debtors.

All is not lost. We have noticed journalists struggling with what must be a constant barrage of cogent logic coming from people like QBAMCO and we assume they must be asking themselves why some of the world’s most successful investors like Soros and Paulson are exchanging their paper currencies for gold. On November 25, New York Times columnist Floyd Norris published a dialectic that attempted to uncover the attraction to gold.[7] Norris seemed to genuinely try to walk laymen readers through some of the (oversimplified) points and history that would tempt people to buy gold. He discussed a general “distrust of elites that feeds the current gold fever” and even threw G. Gordon Liddy of Watergate fame into the mix, perhaps to invoke a sense of crazy goldbuggery (“It is part religion, part politics”). Norris did not include the very unemotional global fundamentals driving the gold price higher and thus his conclusion (and sentiment) did not make sense. But that is not our point. What matters is that the media has no choice but to become acquainted with macroeconomic fundamentals driving economics, trade, asset values and politics. It will get there soon.

The egos and ambition of national journalists are no different from those of politicians, asset managers or investment bankers. Whether the financial media finally get it before or after “unforeseen events” occur does not, in the end matter to investors. Such events will occur anyway. But with each gash exploding in the dyke that holds back natural economic law, the financial media is getting closer to asking policy makers a follow-up question or two. When this begins, it won’t be long before economic reconciliation begins.

Paul Brodsky Lee Quaintance

pbrodsky@qbamco.com lquaint@qbamco.com

[1] Wallace Stegner; “The Spectator Bird”; 1976; page 23; Penguin Books.

[2] Wallace Stegner; “The Spectator Bird”; 1976; page 40; Penguin Books.

[3] The New York Times; November 28, 2010; Week in Review; “Economic Fix-Its”; David Segal; page 1.

[4] Dagong; Surveillance Report for Sovereign Credit Rating – The United States of America; November 2010.

[5] Foreign Affairs; The Future of American Power – Dominance and Decline in Perspective; Joseph S. Nye, Jr.; November/December 2010.

[6] Robert Zoellick; Financial Times; November 8, 2010

[7] New York Times; November 25, 2010; Gold Fever: Pondering the Causes; Floyd Norris.

What's been said:

Discussions found on the web: