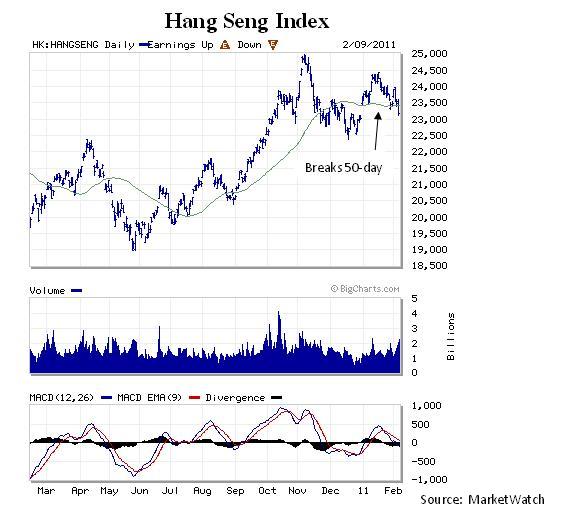

You know our schtick by now that we view the Hang Seng Index as the indicator species for global risk appetite and a signal as to whether the Mainland’s economy will land hard or soft. Since returning from the Lunar holiday the Hang Seng is down 3.1 percent and has broken its 50-day moving average. We sense a growing concern about China’s economic situation as they continue to tighten monetary policy.

We’ve lightened up a little and monitoring the Hang Seng closely and a break of 22,600 would lead us to reduce risk across the board and get short certain commodities. A break in China would almost instantly turn all the market chatter about inflation into deflation, in our opinion. We are not certain where the Hang Seng and China are headed but we do know our action plan if certain support is broken.

By the way, have you been watching the bloodbath in Brazil and India, and today’s flop in the Korean ETF? Also watch carefully the response of the British Pound if the BoE raises rates tomorrow. (click here if chart is not observable)

What's been said:

Discussions found on the web: