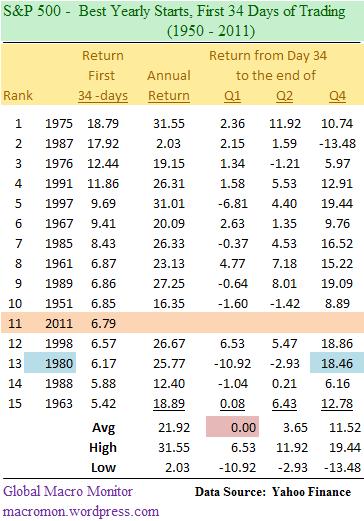

The S&P 500 is off to its best start of the year since 1997 and ranks 11th with respect to the highest return for the first 34 days of trading in all years from 1950-2011. This is, surprisingly, only the fourth year since the start of the new millennium where the index has had a positive return in the first 34 days of trading.

The table ranks the Top 15 best yearly starts since 1950 and shows that every year the S&P 500 has finished with a positive return, averaging 21.92 percent with a high of 31.55 percent in 1975 and 1987’s low of 2.03 percent, even including the record October crash. We found 1980 interesting , starting up 6.17 percent, then falling 10.92 percent through the end of Q1 only to rally 18.46 percent in Q4 on the election of Ronald Reagan.

The table ranks the Top 15 best yearly starts since 1950 and shows that every year the S&P 500 has finished with a positive return, averaging 21.92 percent with a high of 31.55 percent in 1975 and 1987’s low of 2.03 percent, even including the record October crash. We found 1980 interesting , starting up 6.17 percent, then falling 10.92 percent through the end of Q1 only to rally 18.46 percent in Q4 on the election of Ronald Reagan.

There are so many uncertainties this year, especially given the recent increase in geopolitical risk, the path to year end is impossible even to guess, much less project. The table does show, however, that the average return for the Top 15 from Day 34 to the end Q1 is flat. We’re willing to bet history will at least rhyme in the next five weeks and that market momentum takes a rest to digest recent gains and price in the higher geopolitical and inflation risks. It does feel the market is, and, should be heading into to some choppy trading. Watch carefully how the market reacts after the first bounce. ( click here if table and chart are not observable)

This

What's been said:

Discussions found on the web: