Good Thursday morning.

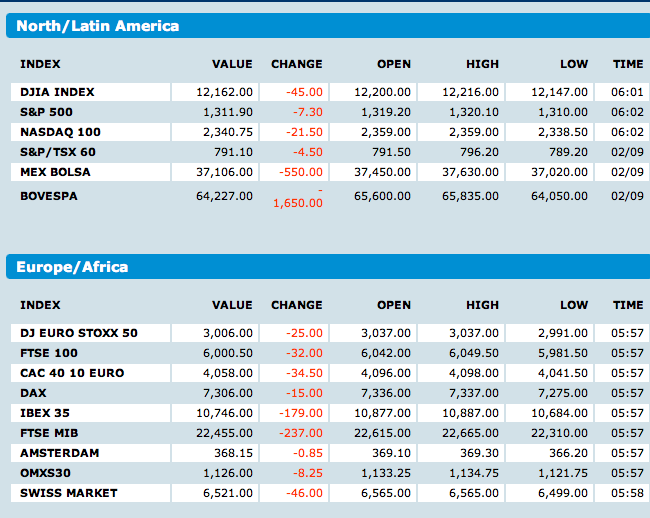

We woke up in the states to see Futures under pressure, but off their worst levels of the morning. Following a day of 1-2% losses in Asia, European bourses gave up less than 1%, losing 50-75bps.

US stocks are looking to open lower, as the bears make another attempt at some downward pressure. It has thus far been a losing battle. These days, opening indications and actual closing prices are two very different animals.

In the face of massive liquidity of QE2, there remains a firm bid beneath this market. So far, losses have been modest to miniscule, with selling pressure well contained. M&A, share buybacks, anything but disappointing earnings are an excuse to put on the rally caps. Even dips are an excuse to buy. (We are running 53% cash on specifc name selling, not overall market calls).

The bears are bloody but unbowed — they know a correction is imminent. But the bulls have heard this line for nigh on two years, and yet still the market still powers higher. The Dow, S&P and Nasdaq are all at multi-year highs. There is a different between being early — a matter of days or weeks — and wrong. So far, the bears have been wrong.

Eventually, the grizzlies must be fed. They have their champions, including various Fed Hawks, who are terrified of an inflationary spiral. Lacker, Plosser and Fisher may be mortal enemies of price instability, but they are friends of Yogi and Boo-Boo and Baloo, well known amongst ursines for their opposition to easy money. And easy money is a bull’s best friend.

Even the most ardent bull knows that this too, will pass. The bears will have their day, before their next bout of hibernation.

The 64 trillion question: When?

What's been said:

Discussions found on the web: