Pardon our belated look at Existing Home Sales (but we’ve been busy).

For this post, we will look at our favorite chart — Existing Home Sales (NSA) — and also teach you how to read a National Association of Realtors news release.

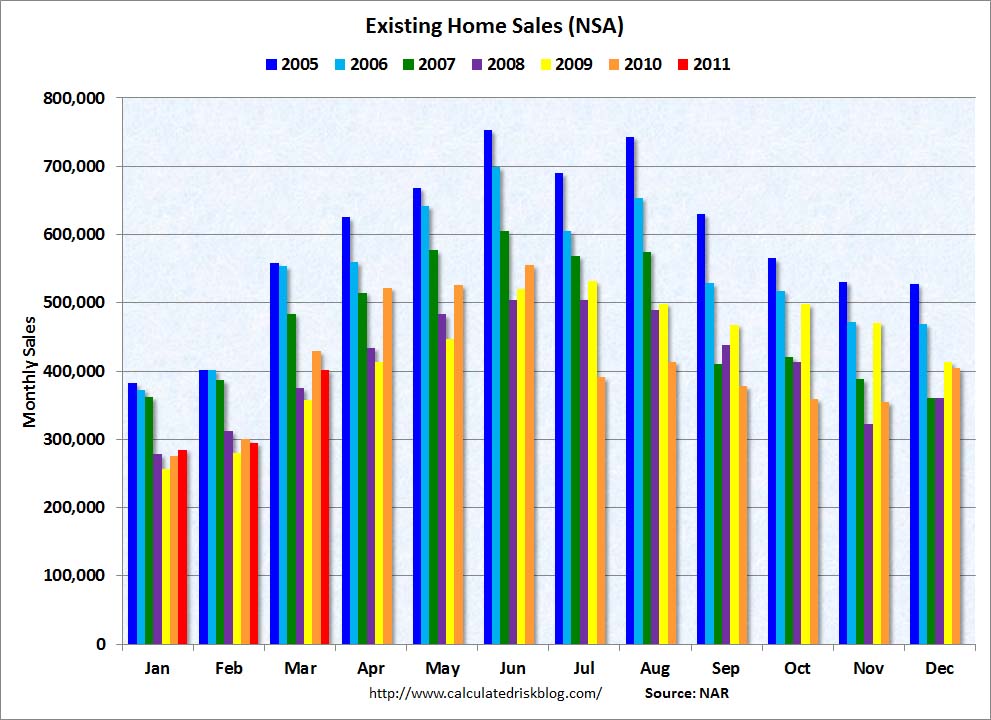

Our favorite chart, courtesy of Calculated Risk, is below. It shows the Existing Home Sales BEFORE they get seasonably adjusted. The pattern you see is the home sales pattern — bottoming in December January, and peaking in June/July/August. Note the ongoing weakness — until the tax credit kicked in. Now, in 2011, we see more signs of weakness.

As to the National Association of Realtors, there is a small secret to reading their news eelease: You need to ignore every other paragraph. It typically looks like this:

Data data data Data data data Data data data Data data data Data data data Data data data Data data data Data data data Data data data Data data data Data data data

Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit

Data data data Data data data Data data data Data data data Data data data Data data data Data data data Data data data Data data data Data data data Data data data

Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit

The secret is to focus on the data, and ignore the spin.

For example:

Sales of existing-home sales rose in March, continuing an uneven recovery that began after sales bottomed last July, according to the National Association of Realtors.

Lawrence Yun, NAR chief economist, expects the improving sales pattern to continue. “Existing-home sales have risen in six of the past eight months, so we’re clearly on a recovery path,” he said. “With rising jobs and excellent affordability conditions, we project moderate improvements into 2012, but not every month will show a gain – primarily because some buyers are finding it too difficult to obtain a mortgage. For those fortunate enough to qualify for financing, monthly mortgage payments as a percent of income have been at record lows.”

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, increased 3.7 percent to a seasonally adjusted annual rate of 5.10 million in March from an upwardly revised 4.92 million in February, but are 6.3 percent below the 5.44 million pace in March 2010. Sales were at elevated levels from March through June of 2010 in response to the home buyer tax credit.

NAR’s housing affordability index shows the typical monthly mortgage principal and interest payment for the purchase of a median-priced existing home is only 13 percent of gross household income, the lowest since records began in 1970.

According to Freddie Mac, the national average commitment rate for a 30-year, conventional, fixed-rate mortgage was 4.84 percent in March, down from 4.95 percent in February; the rate was 4.97 percent in March 2010. Data from Freddie Mac and Fannie Mae show requirements to obtain conventional mortgages have been tightened, with the average credit score rising to about 760 in the current market from nearly 720 in 2007; for FHA loans the average credit score is around 700, up from just over 630 in 2007.

“Although home sales are coming back without a federal stimulus, sales would be notably stronger if mortgage lending would return to the normal, safe standards that were in place a decade ago – before the loose lending practices that created the unprecedented boom and bust cycle,” Yun explained.

OK, I cheated — I moved a paragraph to make this funnier. But the idea is that you look at the data and ignore whatever it is they are spinning about it.

>

Existing Home Sales (NSA)

Chart courtesy of Calculated Risk

>

Source:

Existing-Home Sales Rise in March

NAR, April 20, 2011

http://www.realtor.org/press_room/news_releases/2011/04/rise_march

What's been said:

Discussions found on the web: