From the Q&A portion only, with extraneous words (the date, the time, Bernanke’s name, page number on the transcript, etc., all removed).

It was Greg Ip who questioned Bernanke about the part of the FOMC statement that referenced the slowdown “in part” being caused by certain temporary factors. Here’s that exchange:

Greg Ip: Mr. Chairman, the Committee lowered not just this year’s central tendency forecast but also 2012. And, yet, the statement of the Committee attributes most of the revision forecast to temporary factors. So I was wondering if you could explain what seems to be persisting in terms of holding the recovery back. I did see the statement says in part to factors that are likely to be temporary. Are there more permanent factors that are producing a worse outlook than three months ago?

Chairman Bernanke: Well, as you — as you point out, what we say is that the temporary factors are in part the reason for the slowdown. In other words, part of the slowdown is temporary, and part of it may be longer lasting. We do believe that growth is going to pick up going into 2012 but at a somewhat slower pace from — than we had anticipated in April. We don’t have a precise read on why this slower pace of growth is persisting.

One way to think about it is that maybe some of the headwinds that have been concerning us like, you know, weakness in the financial sector, problems in the housing sector, balance sheet and deleveraging issues, some of these headwinds may be stronger and more persistent than we thought. And I think it’s an appropriate balance to attribute the slowdown partly to these identifiable temporary factors but to acknowledge a possibility that some of the slowdown is due to factors which are longer lived and which will be still operative by next year. You note that, in 2013, we have growth at about the same rate that we anticipated in April.

Mr. Ip recently pointed out that the Fed has done little but repeatedly downgrade its economic forecasts, doing so time and again.

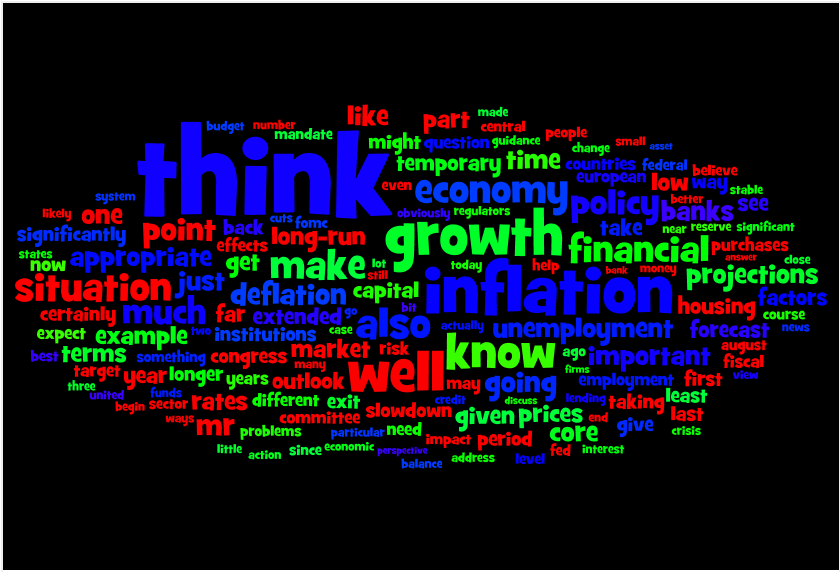

Adding, in response to BR’s inquiry: “Think” was uttered almost exclusively by Bernanke, and the overwhelming context was “I think…”.

What's been said:

Discussions found on the web: