Mike Santoli disusses valuation in this weeks Barron’s:

“With those earnings coming, the question is whether the market has already paid for good results in returning to the upper end of its 2011 range. That’s another way of asking how stocks are valued here. The answer probably is fairly at best, and thus the market has at least put a generous down payment on imminent earnings.

Sure, the S&P 500 multiple on the next 12 months’ forecast earnings is below 13, thus seemingly cheap. Yet the biggest 30 mega-cap stocks are so inexpensive and scorned that the other 470 together trade right at their long-term average, notes Morgan Stanley strategist Adam Parker. And Ned Davis Research notes that the median stock has a trailing multiple above 18, above the 42-year median and “neutral at best.” (emphasis added)

Santoli notes the positive: Fed money is still free, corporate deal-making is “percolating” and investors are not yet excessively sanguine (i.e., too bullish).

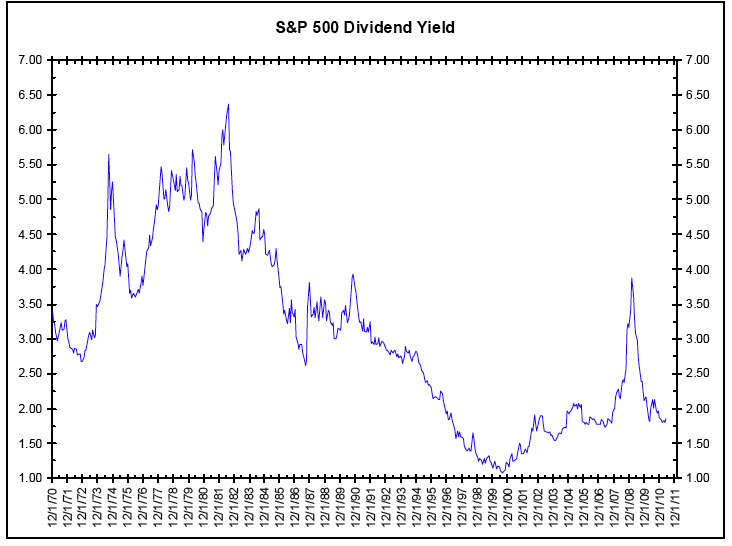

But the fact that “Traders have built up calluses” to this year’s bad economic news is a negative, not a positive in my book. It means they are ignoring risk and potential downside. And while stocks ain’t terribly pricey, they ain’t cheap either. Have a look at Jim Bianco’s long term dividend chart; its more supportive of a cyclical rather than secular rally.

>

What's been said:

Discussions found on the web: