The table below shows the results of Bloomberg’s survey of economists. It details economists’ expectations for 10-year Treasury yields over the next six months. For those familiar with this survey, we use the quarter-end results closest to six months into the future. See the bottom of the table. Since December 2002 Bloomberg has conducted 104 monthly surveys. Of these, an incredible 100 surveys (96%) have forecasted higher rates over the next six months. To repeat, only four times since 2002 (4%) have economists forecasted lower rates. Those instances are highlighted in red. Even these bullish forecasts can be explained in a bearish light.

In all these cases (highlighted in red, June 2007, June 2008, June 2009 and December 2010), interest rates spiked dramatically higher during the survey period, which can be a week to 10 days long and cover the payroll report, causing some economists’ forecasts that were bearish when given to look bullish when they were finally published (We use the yield on the survey’s release date to grade these results). We do not have the data to adjust for this reporting quirk, but it could very well mean that 100% of these forecasts actually expected higher rates.

Further, as also shown at the bottom of the table, an average of 79% of the respondents in these surveys expect higher rates. In 40 of the 104 (38%) monthly surveys, more than 90% of the respondents were looking for higher interest rates. This includes seven of the last nine surveys back to March 2011. These instances are bold on the table below. To repeat, over one-third of the time a strong consensus of 90+% was looking for higher rates. This includes two months (February 2004 and May 2005) where 100% of the respondents were looking for higher rates.

Do They Even Know Stocks Beat Bonds?

In our latest Total Return Review, we said:

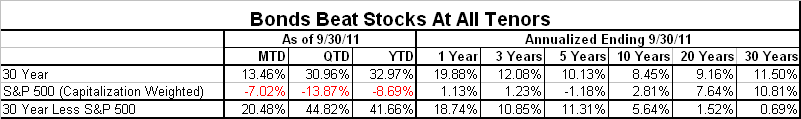

However, as the next table shows, this trend has drastically changed in the wake of the financial crisis. Bonds have completely dominated stocks over every tenor from one-month to 30 years. According to Dr. Siegel’s book, this has not happened in hundreds of years and was never supposed to happen.

Back in November 2010 we noted that bonds had outperformed stocks over the previous 30-year period for the first time since the 19th century. At that time, the outperformance was only a few basis points. Now, thanks to the calendar quirk of bond yields peaking on the last day of the third quarter in 1981, the 30-year total return of bonds has topped stock’s 30-year total return by 69 basis points (10.81% versus 11.50%).

We have called the generation outperformance of bonds over stocks the biggest investment theme everyone has gotten wrong. Over the years, when we note this, many say this is the most bullish argument they have ever heard for stocks. However, as the table above highlights, this argument has been made for years and been wrong for years. Why?

Do Bond Buyers Care About Their Price?

In an August post we asked Who Is Buying Treasuries? In it, we noted that bonds have had a series of “price insensitive” buyers. This began with the Bank of Japan from the late 1990s to 2003. Then it was the Bank of China from 2003 to 2008. Finally the Federal Reserve stepped in with its QE “money printing” from 2008 to present. Those arguing that bonds have little value (an argument we are sympathetic with) assume that the bond market is bought by investors who care about value. Since the dominant player has been central banks, this has not been the case. Add to this the fact that bonds offer a place to hide in the midst of great volatility and the poor returns of “risk-on” markets. Add this all up and the standard bearish bond market forecast has not worked.

These bearish forecasts will only prove to be correct once the dominant buyer of bonds is someone who cares about value. That means no Federal Reserve printing money, no Bank of China and no scared money hiding from a potential loss in risky markets. That is not happening anytime soon. So while we agree that bonds offer little value relative to stocks, we do not look for the markets to correct this anytime soon.

To borrow a phrase from John Meynard Keynes, the Federal Reserve’s printing press can run longer than most can remain solvent in waiting for yields to go up.

Source:

Bianco Research, October 18, 2011