Peter Tchir started TF Market Advisors in 2011 as a platform to trade marketable securities as well as provide expert market information. He is a regular guest on Bloomberg TV and radio, and is often quoted in the Wall Street Journal, the Associated Press, and Fox Business News. Peters clients include top hedge funds, money managers, and asset allocators.

Pete Tchir tries to explain the EFSF.

~~~

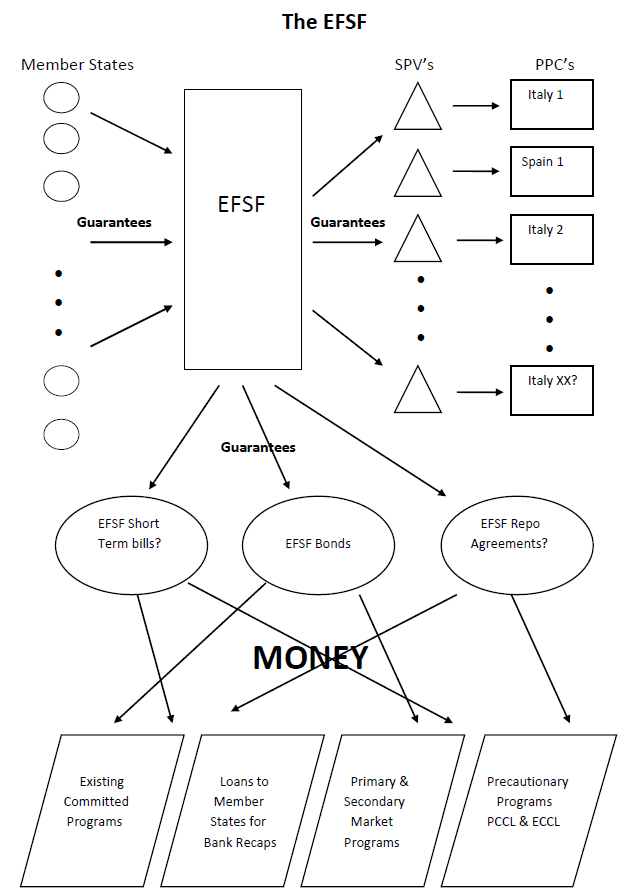

Here is our best attempt at a flow chart for the EFSF that tries to capture everything it does. If it looks complicated, that is because it is complicated.

>

>

Member States

There are 17 Member States who provide Guarantees to the EFSF. Ireland, Portugal, and Greece have “stepped out” and are actually not providing guarantees. Italy and Spain are likely to use funds so it is unclear if they will remain Member States providing Guarantees. There are 6 AAA Member States, their guarantees are just over €440 billion. Their guarantees limit the maximum amount of guarantees that the EFSF can issue and still achieve a AAA rating.

EFSF Fund Raising

The EFSF has been issuing notes or bonds that rely on guarantees from the EFSF (and its Member States) to raise money. This program would continue. The EFSF has contemplated issuing short dated bills and possibly utilizing repo agreements. All of these money raising efforts will count against the maximum of €440 billion AAA guarantees at its disposal.

EFSF SPV’s and PPC’s

The EFSF is planning on creating a unique SPV for each bond that it provides a PPC for. So each Italian bond that is issued under the PPC program would have a unique SPV and tradable PPC. The list of possible PPC’s reminds me a little bit of a bobsled race at the Olympics. In the current draft, the EFSF hopes to use guarantees rather than cash to provide “credit support” to the SPV’s that then issue the PPC’s. Those guarantees would also count against the €440 billion capacity of AAA guarantees. I think this structure has several problems, but we will look at the PPC’s more closely later today in a separate article.

EFSF Use of Proceeds

Assuming the EFSF gets away with its plans to only use guarantees for the PPC’s, then the proceeds from their fund raising has four outlets. They have to fund existing commitments made to Greece, Ireland, and Portugal. It appears that the EFSF will not recapitalize banks directly, but will instead make loans to countries so they can recapitalize their own banks. In any case, this will use up cash raised from either bond sales or bill sales (this cannot use the repo market). The EFSF would also launch the Primary Market Purchase program (PMP) and would be able to intervene in the secondary markets. Both of these programs would rely on advice from the ECB, particularly for the secondary market activity. The proceeds for this could come from bond sales, but may also be able to use the repo market (details and how that impacts the EFSF’s ratings need to be determined). The EFSF also plans to launch some Precautionary Programs. These programs would provide relatively short term funding, with rollover provisions, and would be based on similar IMF facilities. It is contemplated that the IMF would be involved in management of these programs.

CIF’s

I did not show the co-investment approach since it is too vague to even guess how the flows would look, but can be clearly added later.

Stretching the guarantees

The EFSF has many mandates and lots of potential demands for money in serving those goals. Only the PPC shows an obvious attempt to get some leverage from the proceeds. With the markets remaining weak for German and French paper, and existing EFSF paper, it is unclear how much money can be raised, or how much they can leverage their AAA guarantees. The AAA would track any changes to any of the 5 largest AAA guarantors.

Source: TF Market Advisors

By Pete Tchir

What's been said:

Discussions found on the web: