As I have long said, there is no such thing as toxic assets, only toxic prices:

“Investors’ belief that the worst is over for the U.S. housing market is fueling renewed interest in once-toxic mortgage bonds that were at the heart of the financial crisis.

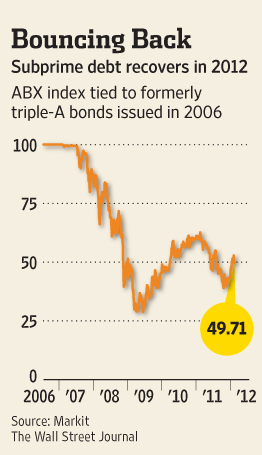

Prices of some distressed bonds backed by subprime home loans—those issued before the crisis to borrowers with sketchy credit histories—have chalked up double-digit percentage gains this year, with one prominent market index rising 14%.

The rally has drawn investors back to a corner of the credit markets that was pummeled from 2007 to 2009 and has been volatile since . . .

The recent resurgence in battered mortgage bonds that were left for dead during the crisis reflects how investors’ appetite for risk is returning, even after many banks and hedge funds lost money last year on similar assets.

But this time around, investors say many subprime bonds are looking attractive because their prices reflect a doomsday scenario that may not materialize, even though the housing sector remains in the doldrums.

Bonds that yielding 7% to 9% are attractive if you can buy them at a price that appropriately reflects the risk of loss.

>

Source:

Toxic? Says Who? Taste For ‘Subprime’ Returns

SERENA NG

WSJ, FEBRUARY 16, 2012

http://online.wsj.com/article/SB10001424052970204062704577223473258237102.html

What's been said:

Discussions found on the web: