Click to enlarge:

Reuters – BHP Billiton sees China iron ore demand flattening

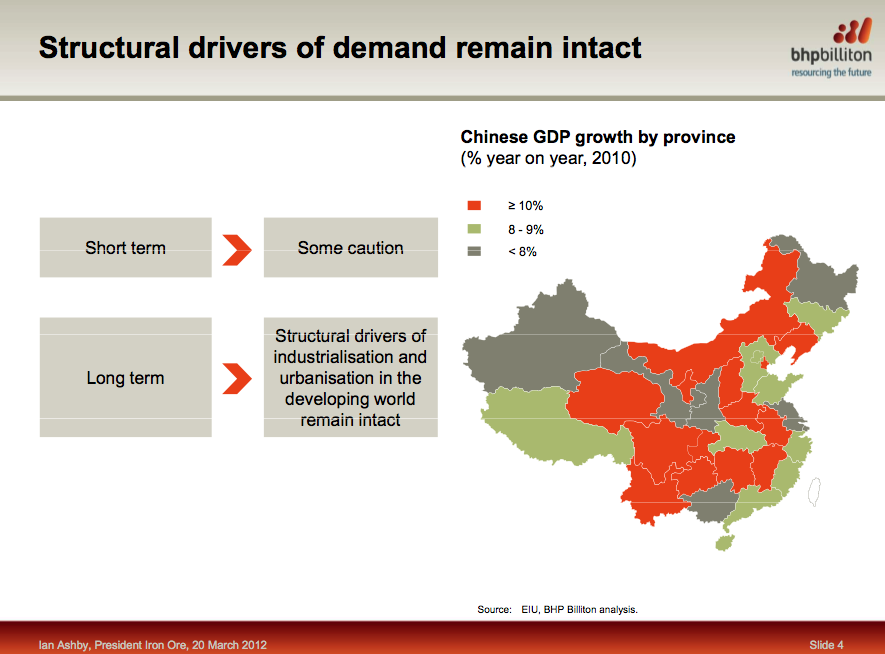

Australian iron ore miners, key beneficiaries of China’s modern-day industrial revolution, on Tuesday signaled demand growth was finally slowing in response to Beijing’s moves to cool its economy. BHP Billiton, the world’s biggest miner, said it was seeing signs of “flattening” iron ore demand from China, though for now it was pushing ahead with ambitious plans to expand production. Rival Rio Tinto said it too was sticking with plans to raise capacity from its huge mines in Western Australia’s Pilbara iron ore belt, betting on a soft landing for the Chinese economy. “The (Chinese) economy is shifting, it’s changing. Steel growth rates will flatten and they have flattened,” Ian Ashby, president of BHP’s iron ore division, said ahead of the Global Iron Ore & Steel Forecast Conference in Perth. China’s demand for iron ore, a key steelmaking ingredient, will slow to single digit growth, but the country’s annual steel output will still rise by some 60 percent by 2025, Ashby said.

FT Alphaville (FT Blog) – The supercycle is so over, iron ore edition

The country can’t keep building airports, railway lines and apartment buildings at its recent run rate, forever. Even the Communist Party has openly acknowledged that the economy is imbalanced, with too high a proportion of capital investment versus consumption. Party leaders may even become pro-active about changing that in the new five-year plan, but either way, eventually things will change…So, about this supercycle. Credit Suisse’s analysts published a view of their internal debates over the China outlook, after Dong Tao, their chief regional economist for Asia ex-Japan, came out with a rather bearish take on the China outlook, stating that the commodities supercycle is over.

Source: Bianco Research

What's been said:

Discussions found on the web: