The predictable “bull trap” of new-highs false breakouts continues to set up and it will whipsaw unsophisticated bullish trend followers creating the extremely attractive opportunity to both short equities and commodities and buy bonds.

The SPX at its 1414 Monday intraday high exceeded by 1% the top end of our long- standing target following silly multiple round number breakouts, golden crosses and other pop-technical signals that suggest to the least sophisticated trend followers that the over five-month-old trend is breaking out with a new bull market up leg to higher highs in the weeks and months, if not quarters, ahead.

See our table below listing the “bull traps” that occurred at the beginning of every Supercycle Stock Bear Market during the past 83 years since the 1929 high that preceded the previous ultimately deflationary economic Supercycle Winter Period.

Although we track dozens of timing indicators over nine time horizons in four-paired factor groups – monetary-economic, social-political, valuation-sentiment and inter- and intra-market technical (see summary tabulation table attached) – here’s a sample of currently interesting ones with more details on some of them further below.

VIX bottomed and SPX÷VIX essentially peaked six days ago (adjusting for contract roll-over flukes in VIX option contracts) and they are only making a double bottom and double top, respectively with their 11-months ago highs while broad market stock market indexes have made higher highs.

At the same time, all-important leadership is critically narrowing with the percentage of stocks above all moving average metrics having peaked six weeks ago, as well as new 52-week highs in common stocks also peaked seven days ago, and importantly also on a 10-day moving average basis for the NYSE and NASDAQ Composite Indexes where they peaked five weeks ago.

Also, capitalization-weighted market indexes are unsustainably outperforming Value Line’s equally-weighted (aka unweighted) market index(es). Relative (ratio) weakness is now showing up in both the heretofore outperforming retail and housing stocks compared to the rest of the stock market, even though RTH made new highs today.

Be sure to catch the rollover peak in Eliades New 10 Trin for the likely final very short term top in days, as is being led by the NYSE ARMS 4- and 10-day moving averages that peaked four days ago and yesterday, respectively.

The stock market appears to have completed an nine-day ABC zigzag pattern with both the A and C uptrends Growth Cycle 12345 patterns, which was confirmed two days ago by a peak in the all-important advancing minus declining volume line.

A spike top probably occurred today in the tech-laden Nasdaq compared to the non- overlapping NYSE Composite index and a two-week flattening in the NDX (100 largest Nasdaq companies) compared to the Nasdaq, which includes AAPL (see discussion

below) which is especially driving the capitalization-weighted NDX index). Notwith- standing its two-week 50% retracement rally in its relative strength ratio with the SPX, the semiconductor index, SOX, is in its fifth week of negative divergence along with several other leading indexes and industries.

Many multi-week bearish asset class divergences have set up for a major stock market top such with the U.S. dollar (e.g., DXY) commodities (e.g., CRB), growth vs. value stocks along with the RYDEX asset ratio, McClellan volume oscillators and the bearish divergence in the RYDEX Asset and Cash Flow Ratios (the inverse ratio of their bear mutual fund assets-cash flow divided by the sum of their money market assets-cash flow plus their bull fund assets-cash flow).

Global equities, ex U.S. (VEU), commodities (CRB), the important leading London Stock Exchange (FTSE) and business-cycle-sensitive transportation indexes (e.g., DJT, or $TRANS), and the financially sensitive SPX ÷ gold bullion (relative strength) ratio are negatively diverging by nowhere near making 52-week highs, which would otherwise bullishly confirm those new highs in various broad, capitalization-weighted equity market indexes. Also SPX ÷ gold bullion (relative strength) appears to be peaking on a very short term (days) basis.

Insiders are persistent net sellers similar to their similar huge net selling at the ’07 highs at the start of the Great Recession.

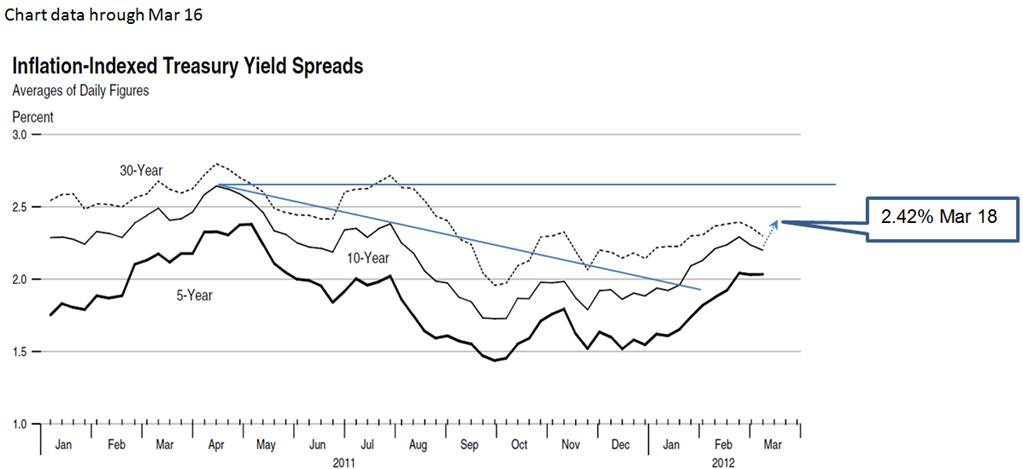

And there are important longer term bearish divergences in both corporate earnings growth rates and their profit margin, the TIPS spread (discussed in our 3/1/12 email

report) and in the implied volatility metrics (see VIX above).

Although the stock market championed the latest job (payroll) gains report, they are clearly overstated, which even a non-economist recognizes

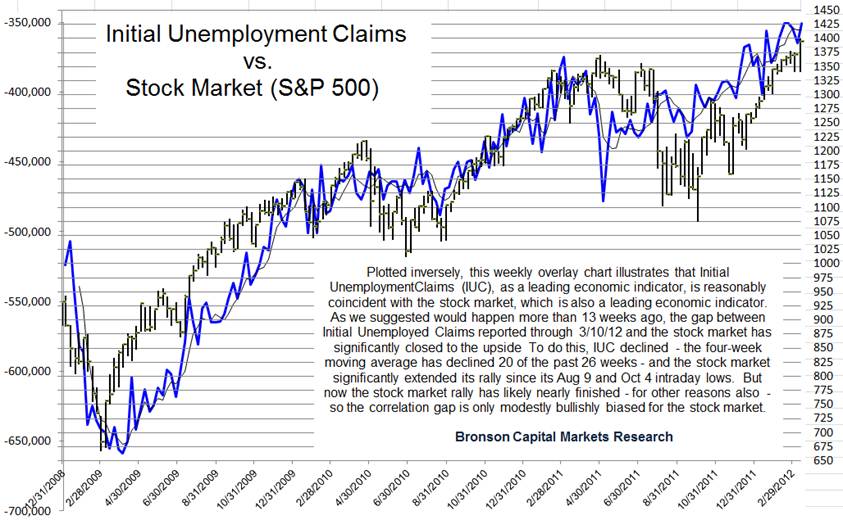

This weekly fundamental timing indicator is slowing while the stock market’s uptrend recently accelerated suggesting the bullish gap is probably reaching its minimum.

Data Suggest Job-Market Gains Leveling Off

See our previous emails about the coming 5% to 10%, multi-week correction and early Strong Season major stock market high.

About Our Partial Positioning Recommendations

Our preliminary estimate for the period over which to partial position (aka scaling in, staging in, averaging in) is the next five to ten days, but we let the market(s) “tell us”

rather than acting exclusively on our preliminary estimated period that doesn’t yet know the follow-on pricing and other determinative timing information, which can suggest a shorter, or possibly, but less likely, longer period.

Also the new information sometimes causes us to reduce an original plan of executing in three or four partial positions to two or three. The first execution is usually a little early and the last one is usually a little late, so their combined average cost is usually quite satisfactory under the condition of higher uncertainty that exists in the extremely short term (hours) and very short term (days).

The trick is avoid poor executions.

We try to send emails at the most attractive execution times, but you need to set up your own methodology to get your personalized reallocation job done.

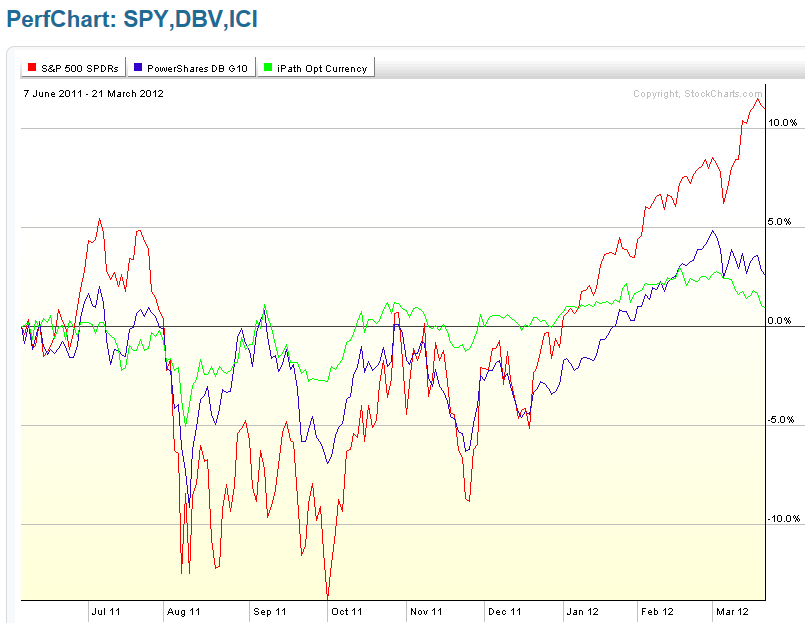

Carry Trade Indexes

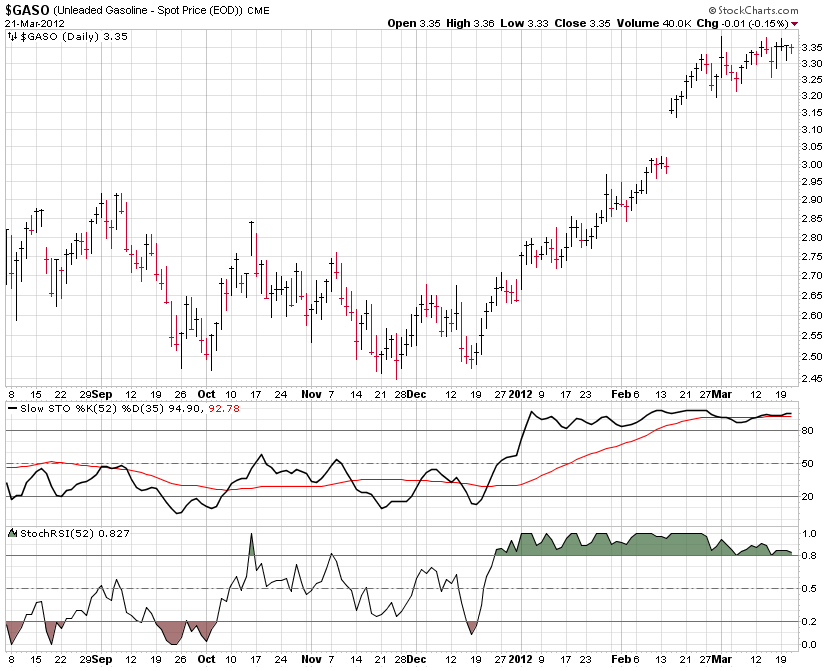

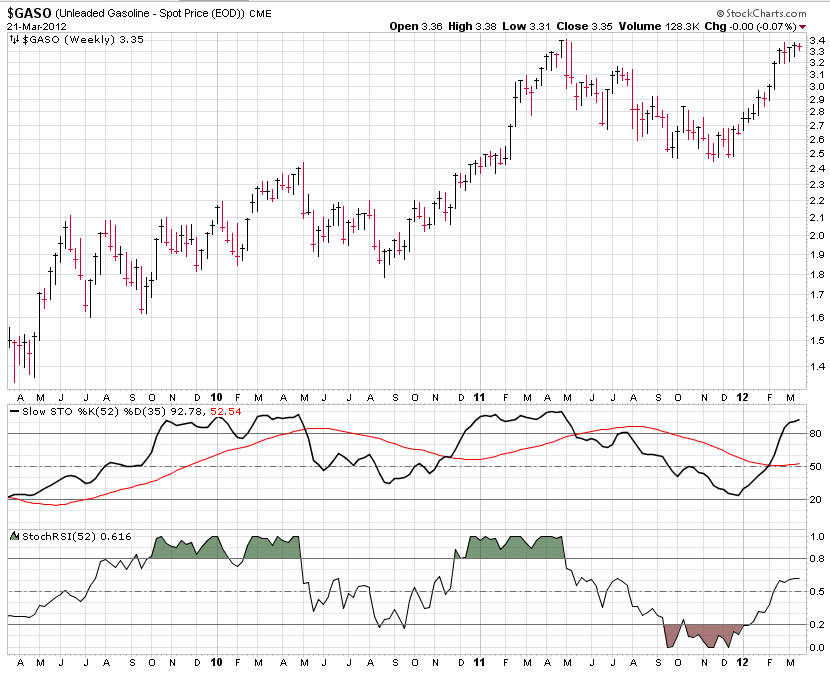

Gasoline Prices

The taxing effect of higher gasoline prices on U.S. consumer spending has fundamental timing significance to the U.S. joining the Eurozone-leg global recession, which started seven months ago and is accelerating. The preliminary March report from the University of Michigan in their Consumer Sentiment Index was down from the prior month, instead of high as was expected, largely because of higher gasoline prices. And this index is well below its last-year high diverging from the stock market adding to list of

The U.S. average price for gasoline is $3.35 (depending on how it’s measured – see the chart below), and still rising with probably its last very short term (days) gasp just underway.

It’s very close to the $3.40 highs that occurred just before the risk-adjusted high (see that explanation further below) 10.5 months ago at the beginning of the incipient third Supercycle Stock Bear Market on May 2 ’11, the day that Osama bin Laden was killed.

Toy Story 5 rather than QE 3, At Least At This Time

There is a repeating tradeoff between quantity and quality of life that is reflected and measured on a Supercycle basis. Consumers have vigorously pursued leisure innovations when economic growth and labor productivity diminishes during Supercycle Winters like during the Great Depression with movies, radios and dance marathons (gaming today).

This Supercycle Winter’s hottest consumer gadget, really just a dazzling toy for the vast majority of users, is the third generation of Apple’s iPad (toy #5), whose crazed introduction not so-coincidentally led to AAPL’s seven-day crescendo to $600 with typical “sell on the news” timing.

This was followed with their announcing a long anticipated dividend and share buyback plan (not execution), and then pre-mature short sellers were squeezed driving pre-market trading to a higher high at $608.37 three days ago, which today it tested.

˜˜˜

APPL is the largest stock in the NDX, leading to a whopping more than one-third of its capitalization-weighted year-to-date gain, which has been the leading index of the predictably strongest sector, technology, as we forecasted at both the Aug 9 and Oct 4 stock market lows. The QLD, which was our sole recommendation, has gained 79% from its Oct 4 intraday low at $66.37 to its high today at $118.84. (Hopefully you captured a significant portion of that.) Therefore, this social-financial event has significance as another signal of a major stock market top.

(Note the irony that with the incipient global trade war, the iPad is a manufacturing innovation from Asia. So if you can’t fight them, join them?)

iPad analogies: The World’s Tallest Building Race and DOW 15,000 Headline Indicators.

TIPS Spread Divergence From The SPX

Supercycle Bear Market “Bull Traps”

(Details will be provide later)

1929

1938

1965

1968

1973

2000

2007

2012?

Risk-adjusted Highs Are More Important Than Nominal Highs

Explanation will follow with the next “bull trap” update, meanwhile here’s an example”

AAPL from $600 declined -2.9% to $585 and then rallied + 1.3% to modestly higher high at $608.37 in overnight trading on Mar 19, for a negative reward-to-risk ratio of 1 to 2.

About Our Partial Positioning Recommendations

Our preliminary estimate for the period over which to partial position (aka scaling in, staging in, averaging in) is the next five to ten days, but we let the market(s) “tell us”

rather than acting exclusively on our preliminary estimated period that doesn’t yet know the follow-on pricing and other determinative timing information, which can suggest a more propitious shorter, or possibly, but less likely, longer period.

Also the new information sometimes causes us to reduce an original plan of executing in three or four partial positions to two or three. The first execution is usually a little early and the last one is usually a little late, so their combined average cost is usually quite satisfactory under the condition of higher uncertainty that exists in the extremely short term (hours) and very short term (days).

The trick is avoid poor executions.

We try to send emails at the most attractive execution times, but you need to set up your own methodology to get your personalized reallocation job done for yourself and/or your managed account clients.

What's been said:

Discussions found on the web: