Some good news and some bad news about the past few days of rallies:

The big rally on Wednesday saw a 92% Up/Down Volume on moderately expanding volume (modestly above the 30 day average). It offset Friday’s NFP sell off (which was also a 90% down day).

Choose your technical poison: 200 day moving average for S&P 500, 14-day Stochastic indicator, and other short-term indicators were all deeply oversold. Watch the percentage of stocks trading above 10-day moving averages to determine when this condition is abated.

For this snapback to have staying power, a rise in volume as the rally progresses is significant. The key resistance will be the May 29th highs. Note also that option traders are not believers in this move.

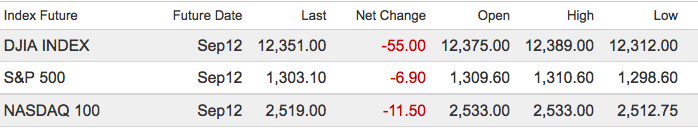

Now for the bad news: Yesterday stunk the joint up. Worse than a down day is a strong open that fades. Yesterday saw the Dow up 140 points, the Nasdaq up nearly 30 points. The Dow gave up 100 points, the S&)500 flipped negative, and the Nasdaq got clocked.

As markets got closer to those May 29th highs, the buying interest collapsed. That is a classic failed test of prior highs. Lowry’s reports that market internals were negative, with “57% of Up/Down Volume to the downside. NASDAQ internals were worse, with Down Volume 69% of total Up/Down Volume and 414 more declines than advances.“

What's been said:

Discussions found on the web: