>

My Sunday Washington Post Business Section column is out. This morning, we look at how the Foreclosure machinery is creaking back to life.

The basic concept is that after a year plus of voluntary foreclosure abatements, the banks are now returning to normal foreclosure processing.

Here’s an excerpt from the column:

“With all that legal unpleasantness behind them, the voluntary foreclosure abatements quietly ended. This year, the banks began to once again review unpaid home loans. It takes a while for the creaky, wheezy, inadequate machinery of processing defaulted mortgages to rumble back to life. So it has — and we should expect to see signs of increasing foreclosures and distressed sales any day now . . .

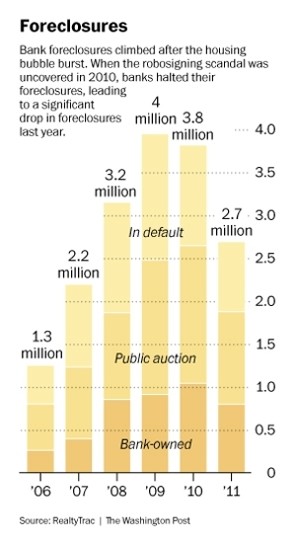

Current foreclosure filings — default notices, scheduled auctions and bank repossessions — increased in May by 9 percent, according to the RealtyTrac monthly foreclosure report.

This was right on cue. With the abatements over, foreclosure starts are creeping up again. As the foreclosure machinery ramps up, the negative ramifications they bring will expand. More distressed sales, lower prices and increasingly tough comparable appraisals are likely over the next 12 months..”

The Post’s graphics department did a nice job with the RealtyTrac data:

>

Source:

Foreclosure machinery creaks back to life

Barry Ritholtz

Washington Post, June 24 2012

http://www.washingtonpost.com/2012/06/23/gJQASAQOyV_story.html

june2412 Gx6-5 (PDF)

What's been said:

Discussions found on the web: